Rate hold, but reassessment time

Australian shares advanced for a seventh consecutive trading day on Tuesday after the Reserve Bank held interest rates steady, as the central bank assesses whether its ten-month hiking program is getting on top of inflation.

The RBA left the cash rate at 3.6 per cent, but Governor Philip Lowe warned some further rate rises may be needed to ensure inflation returns to target. Governor Lowe said the decision to hold interest rates steady this month will give the RBA board “more time to assess the state of the economy and the outlook, in an environment of considerable uncertainty.”

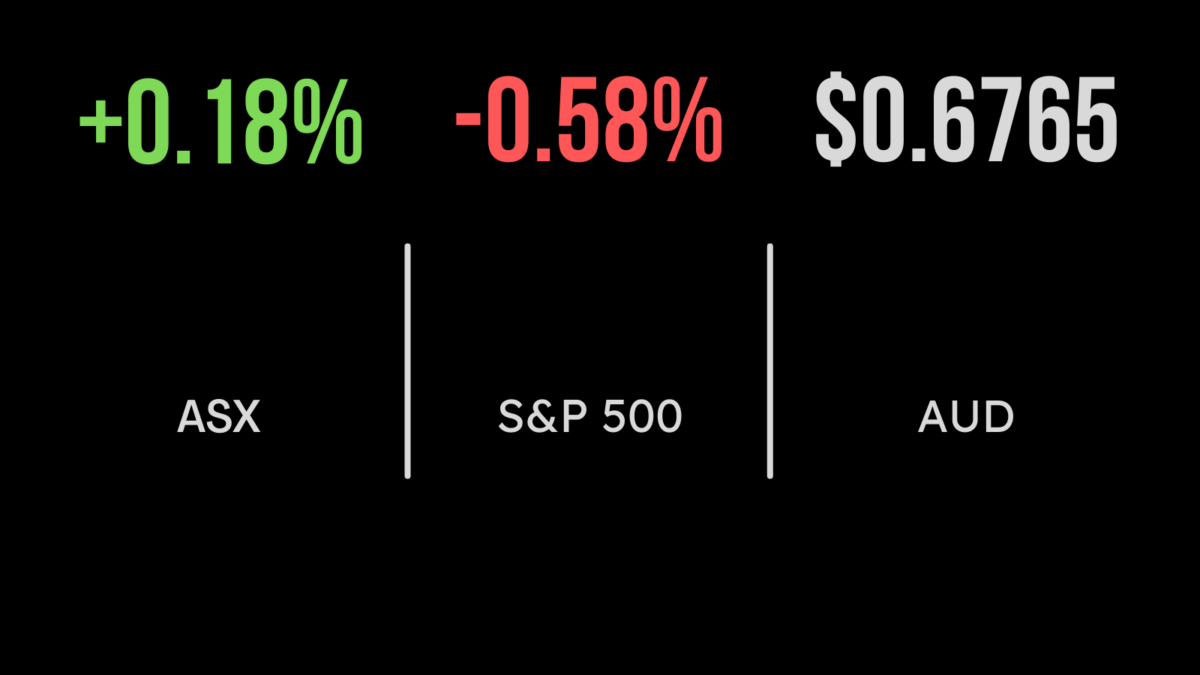

The S&P/ASX 200 closed 0.2 per cent, or 13 points, higher at 7236 on Tuesday, reversing a loss of about 0.1 per cent heading into the RBA’s decision. The broader All Ords also added 0.2 per cent to 7431.5.

The energy sector led the sharemarket higher as oil prices extended their advance after OPEC+, the Organisation of the Petroleum Exporting Countries (OPEC) and Russia, announced a surprise output cut on Monday.

Woodside Energy rose 18 cents, or 0.5 per cent, to $34.41; Beach Energy lifted 4.5 cents, or 3.1 per cent, to $1.51; Santos added 13 cents, or 1.8 per cent, to $7.20; and Brazilian-based producer Karoon Energy advanced 5 cents, or 2.2 per cent, to $2.33.

Among the big miners, BHP surrendered $1.03, or 2.2 per cent, to $45.94; Rio Tinto eased $1.06, or 0.9 per cent, to $117.74; and Fortescue Metals retreated 15 cents, or 0.7 per cent, to $21.88.

In coal, Whitehaven Coal surged 39 cents, or 5.7 per cent, to $7.28 and New Hope Corporation added 27 cents, or 4.7 per cent, to $6.06, but the bigger pair were put in the shade by Australian and South African producer Terracom, which jumped 6 cents, or 9.5 per cent, to 70 cents. Coronado Global Resources added 3 cents to $1.67.

Lithium stocks are under pressure after lithium carbonate prices in China fell 5.3 per cent on Monday to $US32,773.78 a tonne, meaning prices have more than halved from their peak in 2022.

Producer Pilbara Minerals slid 11 cents, or 2.9 per cent, to $3.69, while fellow lithium producer Allkem lost 34 cents, also 2.9 per cent, to $11.43. Of the project developers, US-based Piedmont Lithium shed 5 cents, or 5.6 per cent; Core Lithium retreated 4 cents, or 4.7 per cent, to 80 cents; Lake Resources declined 2 cents, or 4.2 per cent, to 46 cents; and Sayona Mining gave up 1 cent, or 4.9 per cent, to 20 cents.

In the big bank world, National Australia Bank appreciated 16 cents, or 0.6 per cent, to $28.07 and ANZ firmed 5 cents, or 0.2 per cent, to $23.27; but Commonwealth Bank lost 29 cents, or 0.3 per cent, to $98.98, and Westpac eased 9 cents, or 0.4 per cent, to $21.80. Investment bank Macquarie Group gained $2.49, or 1.4 per cent, to $179.46.

US jobs market starting to slow

In the US, the major indices turned downward as investors mulled a spike in oil prices and what that could mean for the global economy. The 30-stock Dow Jones Industrial Average slid 198.8 points, or 0.6 per cent, to close at 33,402.38. The broader S&P 500 eased 23.9 points, also 0.6 per cent, to 4,100.6, while the tech-heavy Nasdaq Composite index retreated 63.1 points, or 0.5 per cent, to close at 12,126.33.

The market losses followed the latest US job openings report, which showed that in February, the number of available positions dropped below 10 million for the first time in nearly two years, indicating that the labour market is starting to slow.

European stock markets closed slightly lower as oil stocks gave up some gains.

On the bond market, the 10-year US Treasury yield was unchanged at the close, at 3.339 per cent, while the more policy-sensitive 2-year yield was also flat at session’s end, at 3.821 per cent.

On the commodities front, Brent crude oil firmed 1 cent to US$84.94 a barrel, while US West Texas Intermediate added 29 cents, or 0.4 per cent, to US81 a barrel. Gold surged US$35.79, or 1.8 per cent, to US$2,020.71 an ounce.

The Australian dollar is buying 67.55 US cents this morning, down slightly on the 67.6 US cents local close yesterday.