-

Sort By

-

Newest

-

Newest

-

Oldest

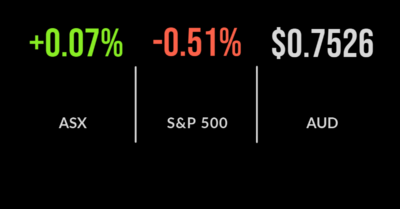

ASX creeps to gain, Woolies warns of Inflation, CPI data sends bonds lower The S&P/ASX200 (ASX: XJO) managed to eke out another small gain on Wednesday, keeping the run of positive days going. Most weakness came from the staples sector, down 1.9%, after Woolworths (ASX: WOW) delivered a difficult third quarter update. The mining and utilities sectors were also down over 1% with…

Tech succumbs to mining, ASX weaker, Tabcorp, Cochlear updates The S&P/ASX200 (ASX: XJO) weakened throughout the day ultimately finishing 0.1% lower with a resurgent technology sector (up 1.6%) unable to overcome a continued sell off in the mining (-1.4%) and energy sector. Annual meeting season is upon us with investor poring through announcements for more guidance into an increasingly uncertain economy. A2 Milk (ASX: A2M) and Zip…

APRA takes action, CBA falls, GQG set to list The S&P/ASX200 (ASX: XJO) delivered another negative day falling 0.6% as concerns of ‘peak growth’ and stagflation continue to grow. Every sector barring technology and energy were lower, with the latter so far the standout story of the second half of 2021. Whitehaven Coal (ASX: WHC) continues to benefit from booming coal…

Sell off continues, bond yields spike, Smartgroup under offer The S&P/ASX200 (ASX: XJO) recovered during the session finishing 1.1% lower after falling as much as 1.5%. The weakness came from a negative global lead with long-term bond yields spurring investors to act on comparatively high equity market valuations. In Australia, the 10-year bond yield has jumped from close to 1.0%…

ASX falls 1.5%, Origin’s Octopus win, energy boom The S&P/ASX200 (ASX: XJO) fell another 1.5% on Tuesday as a spike in bond yields in the US and a lack of clarity on the US debt ceiling put markets into a tailspin. Every sector was lower with healthcare the hardest hit, dragging down over 3% on the back of a 3.8% fall…

Financial, travel push market higher, bidding war for Priceline owner The S&P/ASX200 followed a positive global lead to post a strong opening to the week, finishing 0.6% higher. Most sectors improved outside of the ‘defensives’ with healthcare, down 1%, and consumer staples underperforming. Globally, markets were buoyed by a resurgent oil price as weaker supply collides with strong demand across highly…

ASX falters, oil hits multi-year high, Domain’s record, central banks dominate The S&P/ASX200 (ASX: XJO) finished the week on a negative note, falling 0.4% dragged lower by the real estate sector, which fell 2.1%. The materials sector continued its recent weakness, down 1.3% behind another 1.7% fall in BHP (ASX: BHP) despite the iron ore price finally settling. The real estate sector sold off heavily seemingly on the…

Rally continues despite dividend drag, Premier profit doubles The S&P/ASX200 (ASX: XJO) continued its strong recovery adding another 1% on Thursday after the Federal Reserve committed to continue bond purchases until at least the end of the year. The strength was broad-based with every sector finishing higher, tech, energy and utilities were the highlights with each jumping…

Market fights back, APA bids for AusNet, iron ore stems the flow The S&P/ASX200 (ASX: XJO) looked to be moving into correction territory this morning, opening broadly lower and continuing the weak global trend. The market fell as much as 0.3% before finishing the same amount higher. Concern continues to grow about the outlook for the global economy but…

Correction continues, iron ore futures hit US$90, Ausnet takeover The S&P/ASX200 (ASX: XJO) suffered its worst day since February falling 2.1% on the back of ongoing weakness in the commodity sector. The market hit its lowest point in three months with just ten stocks out of two hundred finishing in the positive, including Boral (ASX: BLD) which added 0.3%….