-

Sort By

-

Newest

-

Newest

-

Oldest

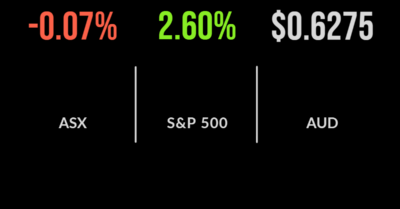

The local market overcame selling pressure ahead of awaited US inflation data to post a small loss of 0.1 per cent. The financials sector was the standout, gaining 1.4 per cent, with the likes of National Australian Bank (ASX:NAB), up 2 per cent, buoyed by the improving profitability of Bank of Queensland which reported yesterday….

The S&P/ASX200 continued to weaken as the guidance flows in from numerous sectors of the economy. The industrials sector was the rare highlight, gaining 0.4 per cent, with the energy and technology sectors finished down 1.6 and 1 per cent respectively. Among the biggest drivers was a continued weakening of the AUD even as the…

The local market opened the week on a negative note, with the threat of US recession sending every sector lower. The rate sensitive sectors were the hardest hit, with utilities falling 3.2 per cent and technology 2.6 per cent behind the likes of Zip Co (ASX:ZIP) which fell 7.4 per cent. Among the biggest losers…

The local sharemarket finished the week on a negative tone, falling 0.8 per cent, but it wasn’t enough offset the exuberance on Tuesday. Only the energy sector managed to post a positive result on Friday, up 1 per cent, behind a rally in Origin (ASX:ORG) and Santos (ASX:STO) which gained 1.2 and 1.9 per cent….

The local market finished just 2 points higher today, all but a rounding error, as gains in the energy and utilities sectors, up 2.2 and 1.1 per cent, offset losses in the consumer and property sectors, which were down 0.8 and 0.7 per cent. The highlights remain from the traditional fossil fuel sectors as Woodside…

The local sharemarket delivered it’s best one day return since the worst of the pandemic, with the S&P/ASX200 gaining 2.6 per cent on Tuesday. The move was driven by a slight shift in narrative and policy by the Reserve Bank of Australia, which decided to increase the cash rate by 25 rather than 50 basis…

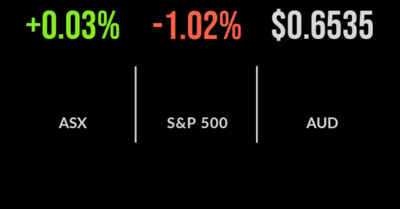

The local sharemarket finished 0.3 per cent lower to begin the new quarter, with strength in the utilities, energy and property sectors not enough to offset broader weakness in the market. The energy sector gained 1 per cent after OPEC+ announced its intention to cut oil production in response to falling prices, just as investors…

The energy sector powered the Australian sharemarket on Thursday, with a 2.8 per cent gain on the back of the apparent sabotage of the Nord Stream sub-sea pipelines linking Europe and Russia. This helped the benchmark S&P/ASX200 index to gain 93 points, or 1.4 per cent to 6,555, while the broader All Ordinaries advanced 100.8 points, or…

Cracks are showing in the old way of doing things. Being able to make money in a sideways market – and do it without equities – will now be the great differentiator.

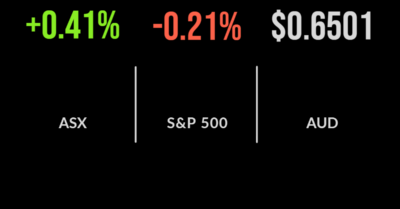

After three consecutive losing days, the Australian sharemarket turned northward again on Tuesday, led by the resources stocks. After being scorched on Monday, the ASX’s coal and lithium stocks rallied on Tuesday as global markets stabilised, as did energy prices, despite rising recession risks. The S&P/ASX 200 Index added 26.8 points, or 0.4 per cent,…