-

Sort By

-

Newest

-

Newest

-

Oldest

Passive investing may have skewed the numbers but the index-hugging wall of money can’t break the maths of markets, a new GMO paper argues.

Veteran investor, Jeremy Grantham, has nominated a falling global property market as lead contender to drive the next deflationary phase of the multi-asset ‘super bubble’.

Renowned fund manager Jeremy Grantham has warned investors to prepare for an “epic” blowout with the recent market resurgence following the script of previous “superbubble” implosions.

The prophets of doom have seen their visions of a downturn realised, but the market is still tremendously expensive when compared with the bursting of previous bubbles.

Jeremy Grantham’s “wild rumpus” appears to have well and truly begun. But it might only be the beginning of a gloomy period for markets.

Jeremy Grantham believes the “superbubble” he’s been warning about for years is now on the brink of collapse – and that the “wild rumpus” can begin at any time. Calling the collapse of a market bubble is anybody’s game. One needs only to know that it exists – something now patently obvious to any investor…

Implausible doesn’t mean impossible. But it remains to be seen whether the “creative destruction” that ARK Invest is banking on can trump the possibility that we’ve been in a bubble all along. They’re what legendary investor/prophet of doom Jeremy Grantham calls “super-crazies” – the wildly overvalued assets that start to appear shortly before the bubble…

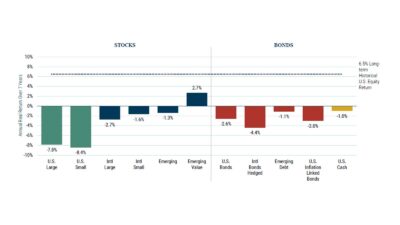

GMO has released its latest borderline-apocalyptic seven-year forecast for stocks and bonds as it warns clients to “concentrate assets where the bubble ain’t”. GMO’s extraordinarily bearish forecasts predict a negative annual real return over seven years across the majority of both stocks and bonds, with only emerging markets value stocks getting a positive, if slim,…

GMO has hit back at critics of its bearish seven-year forecasts, saying “great companies with great narratives can still experience price movements that are too great”. GMO compared asset class forecasts from the seven-year period leading up to March 2000 with forecasts from 2014 onwards, noting that asset prices have both grown around 70 per…