-

Sort By

-

Newest

-

Newest

-

Oldest

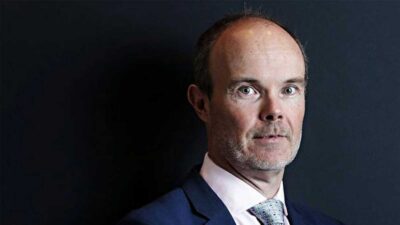

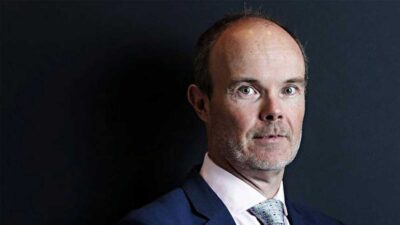

Magellan has abandoned its long-standing Chinese positions and cast a keen eye over financials as it attempts to weather an environment of more persistent inflation. Magellan has remained in the headlines on a near daily basis, with continued uncertainty around the return of CIO and founder Hamish Douglass, who took medical leave in early February….

After a hellish close to 2021 that saw the departure of one of Magellan’s largest institutional clients, the pressure will be on for Hamish Douglass to do what he says he won’t: prioritise the short-term. The closing months of 2021 were likely the harshest of Hamish Douglass’s public career. Criticisms of Magellan’s underperformance since the…

Magellan will continue to spend big on ventures like upstart investment bank Barrenjoey and fintech Finclear as it diversifies away from its cornerstone global equities business. With investors continuing to question the lacklustre performance of Magellan’s global equities strategy, which has been the focus of (occasionally unfair) media attention for going on a year now,…

A key and enduring theme of the work of the Australian Custodial Services Association is the search for ever-greater efficiency in financial markets. Custodians need always be prepared for the next ‘Uber moment’. The latest such moment came in February last year when Magellan Financial Group launched the first quoted managed fund, on behalf of…

Failing to take advantage of the recovery trade looks bad. But with Alibaba, Magellan missed a risk you could see from space. Hamish Douglass, Magellan chairman and chief investment officer, has been much maligned in recent months for something that’s probably his fault but not actually his problem: missing the market rally in late 2020….

Magellan Financial Group’s ‘FuturePay’, launched with a fanfare last week (June 1) after considerable pre-launch publicity, heralds an escalation in a retirement products arms race. Both big super funds and fund managers are scrambling for positions in the race, which is expected to have strong demographically driven growth for years to come. Magellan, arguably the…

Magellan Financial Group has done some back office re-engineering to develop what it claims is the next generation of active exchange traded funds – a “one unit” product that allows investors to transact through off-market applications and through the Australian Securities Exchange. Magellan subsidiary Airlie Funds Management has listed the Airlie Australian Share Fund on…