-

Sort By

-

Newest

-

Newest

-

Oldest

After a positive start, the local market turned tail after the Reserve Bank board lifted the cash rate target by 50 basis points to 2.35 per cent, its highest level since December 2014, at its meeting yesterday. The central bank has now raised interest rates for five months in a row, in its most aggressive…

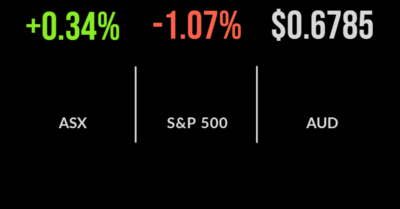

Energy powered the Australian market higher on Monday, with a 4 per cent rise in the S&P/ASX 200 Energy index at the heart of market sentiment, as oil, gas and coal prices rose. The energy action helped the benchmark S&P/ASX 200 advance 23.5 points, or 0.3 per cent, or to 6852.2, while the broader All…

The local sharemarket continued its recent weakness, falling another 2 per cent for the first day of spring. Australia’s largest company, BHP (ASX:BHP) was the biggest detractor falling 7.6 per cent, or $3.09 cents as the stock went ex-dividend. This is a regularly forgotten impact of the payment of dividends, which totalled $2.56 plus franking credits, as…

Income arrives in many shapes and sizes The first half of 2022 has been challenging for investors across all asset classes, and the uncertainties plaguing markets remain-particularly with regard to inflation, interest rates and the possibility of recession. Stephen Dover, Chief Market Strategist, Franklin Templeton Investment Institute says: “As we look toward the second…

ASX higher as dividends rain, three new highs, AMA in trading halt The ASX200 (ASX: XJO) finished the week on a positive note, adding 0.5% with the market finish up the same amount of the five days. On Friday it was all about resources and utilities, with Alumina (ASX: AWC) jumping 6.7% on a booming aluminium price and lithium miner Orocobre (ASX: ORE)…

ASX claws back, energy hit, IT takeover rally spreads The ASX 200 (ASX: XJO) spent most of the day clawing back from early losses, ultimately finishing down just 0.2% despite a weak lead from the US market. The story was similar to yesterday with 8 of the 11 sectors down but technology continuing to drive performance, up…

Market rallies, trifecta of iron ore records, property hit by Victorian Government The ASX 200 (ASX: XJO) delivered another positive day, adding 0.5% as the trifecta of iron ore miners including Fortescue Metals Group Limited (ASX: FMG), Rio Tinto Limited (ASX: RIO), and BHP Group Ltd (ASX: BHP) all hit record highs. This sent the materials sector 1.5% higher, beaten only by the…

Markets drift lower, Rio’s dividend bonanza, inflation spikes The ASX 200 (ASX: XJO) weakened throughout the session, ultimately finishing 0.7% lower on Wednesday. Every sector fell apart from property, which added 0.9%, with the local tech sector once again the hardest hit, down 2.1% as Afterpay Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P) continue to face global competition. Both Vicinity…

ASX finishes flat, materials gain again, Lynas delivers records The ASX 200 (ASX: XJO) gave up another record opening, dropping 0.4% throughout the day to finish flat. Every sector finished lower barring materials and mining, which jumped 1% on the back of a strong update from miner Lynas Rare Earths Ltd (ASX: LYC). Energy dropped 1.4% and property trusts…

Risk on, Altium offer pulled, property rallies, Lendlease selling, and Kogan on track It was ‘risk on’ once again for the ASX 200 (ASX: XJO) with the market up over 1% during the day but ultimately finishing 0.8% higher. The strength was broad-based with just two sectors, industrials and IT finishing lower, as both materials and real…