-

Sort By

-

Newest

-

Newest

-

Oldest

Chicago-based V-Square Quantitative Management has expanded its separately-managed account platform with the launch of its Global Equity ESG Materiality and Carbon Transition Indexed Strategy.

While Australia’s biggest asset owners are “extremely sophisticated” on ESG, the shackles of the idiosyncratic Your Future Your Super (YFYS) benchmarks are still holding them back on portfolio decarbonisation.

The conventional view of emerging markets is that they represent a growth strategy and are prone to short-term fluctuations. A focus on the majority of stocks which pay dividends challenges that view.

Passive funds have built momentum on the win-win premise of low-cost market benchmarked products but a new study confirms the undoubted winners of the seemingly unstoppable trend: indexers.

Value investors have staged their long-prophesied comeback during the highly volatile start to the year. But questions remain about whether this performance will be prolonged.

The emissions intensity of the ASX has some investors with a home country bias looking for an exclusionary approach. But decarbonising Aussie equities isn’t as simple as ditching them.

Investors and their fund managers have dumped Russian holdings in recent weeks amid worsening horror at the invasion of Ukraine. But active managers could lessen the blow for investors through new opportunities on the other side of a Russian trade. For Ninety One’s emerging markets team, Russia is an “ugly sideshow” to the main investment…

The increasingly expansionary MSCI Group is to buy Real Capital Analytics (RCA), a property research firm. The Australian operation is earmarked for strong growth. MSCI announced last week (August 3) that it would pay US$950 million (A$1.3 billion) for RCA, which was founded in the US a little over 20 years ago, in 2000, by…

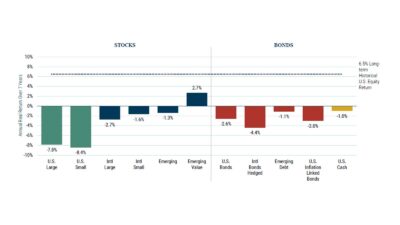

GMO has released its latest borderline-apocalyptic seven-year forecast for stocks and bonds as it warns clients to “concentrate assets where the bubble ain’t”. GMO’s extraordinarily bearish forecasts predict a negative annual real return over seven years across the majority of both stocks and bonds, with only emerging markets value stocks getting a positive, if slim,…

Joseph Lai, the top-performing Asia equities manager who resigned from Platinum Asset Management on December 29 last year, is set to join Fidante’s new boutique, Ox Capital. He will reportedly link up with another long-term emerging markets specialist, Doug Huey. The two had worked together at Platinum, where Huey was an investment analyst, prior to…