-

Sort By

-

Newest

-

Newest

-

Oldest

The technology sector all but sunk the local market today with the S&P/ASX200 sinking 1.8 per cent on the back of an 8.2 per cent fall in the sector. Every other sector was lower, with energy and real estate down more than 2 per cent and financials outperforming by falling just 0.8 per cent. Just…

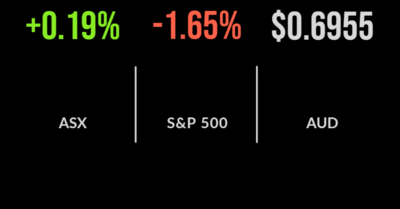

The domestic market managed to eke out a small gain, recovering from as much as 1 per cent down to send the S&P/ASX200 0.2 per cent higher on Wednesday. Positive signs from Asia, including a broadly expected jump in Chinese inflation contributed to the settling of nerves with the materials sector recovering 0.9 per cent….

The local sharemarket followed global markets lower, with the S&P/ASX200 opening as much as 2.5 per cent lower. The day’s trade was a story of the weight of numbers, with every sector barring communication finishing lower, but more companies gaining than falling. The size and scale of weakness in energy and commodities, down 2.1 and…

There are few signs that the global selloff is slowing down, with a weak US lead on Friday contributing to another 1.2 per cent fall on the S&P/ASX200. The threat of higher interest rates and inflation are now been compounded by news that the Chinese government had extended lockdowns in key capital cities potentially adding…

The local market closely followed the global lead with the S&P/ASX200 experiencing its worst session since Russia invaded Ukraine. All 11 sectors of the market were lower with technology and real estate the hardest hit, down 4.5 and 3.4 per cent for the day, whilst consumer staples naturally outperformed, falling just 0.2 per cent behind…

The first day of a new interest-rate environment was a slight downer for the Australian share market, with the benchmark S&P/ASX 200 easing 11.5 points, or 0.2 per cent, to 7304.7 points. The gauge has lost 1.8 per cent this week, to be down 1.9 per cent since the start of the year. The S&P/All…

The first interest rate hike in Australia in 11-and-a-half years took centre stage on the Australian markets yesterday. The Reserve Bank of Australia (RBA) lifted the cash rate by 25 basis points, or 0.25 percentage points, taking it to 0.35 per cent, and signalled that more rate rises were ahead, as the central bank seeks…

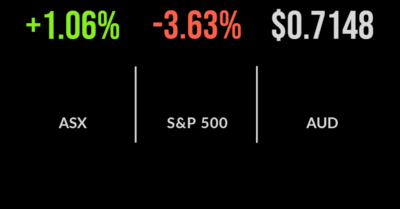

The domestic market continues to outperform our global peers, with the S&P/ASX200 gaining 1.1 per cent on Friday, but still finishing the week 0.5 per cent lower. Every sector was higher, led by technology and communications which gained 2.2 and 1.9 per cent, and nine of the market’s 11 sectors gained more than 1 per…

The local sharemarket followed a weak global lead, falling 0.8 per cent on Wednesday but with the fear spreading to broader sectors of the market. In the opposite to yesterday’s trade, energy and utilities outperformed gaining 1 and 0.6 per cent respectively, with the materials sector also benefitting from a breather on Chinese selling. Whitehaven…

News that Beijing was set to follow Shanghai into massive lockdowns to avert the threat of Omicron sent global share markets into a shockwave in this shortened week. The S&P/ASX200 fell another 2.1 per cent with every sector lower, led by the materials and energy sectors which fell 5.1 and 4 per cent respectively. The…