ASX gains but down for the week, every sector rallies, Kogan tanks, Origin up on energy prices

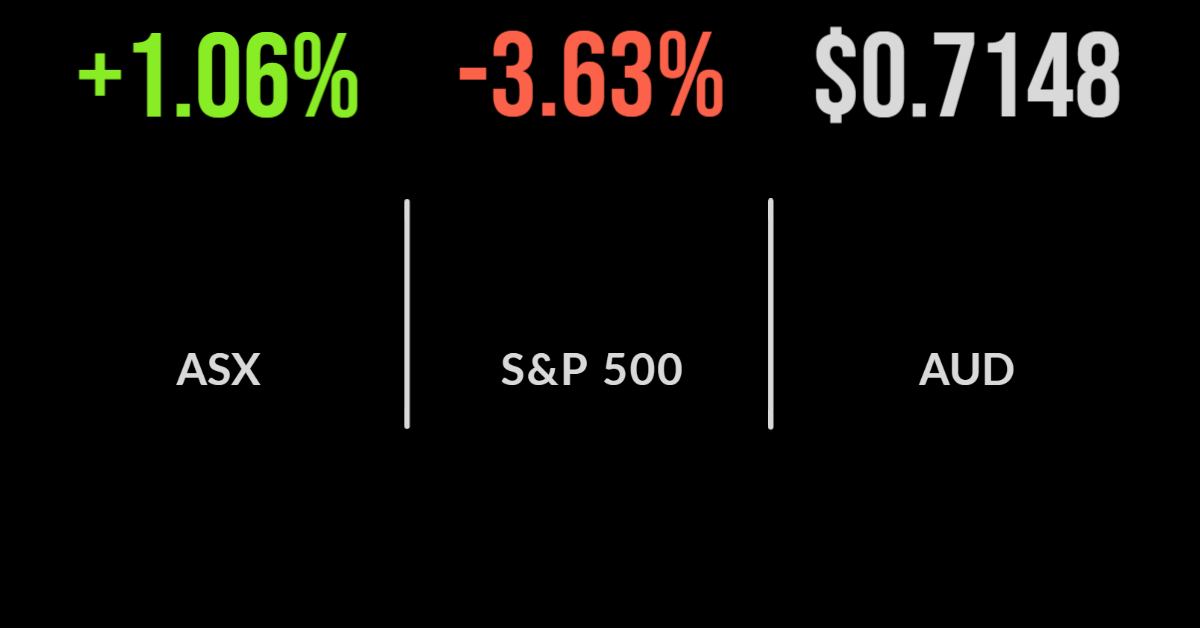

The domestic market continues to outperform our global peers, with the S&P/ASX200 gaining 1.1 per cent on Friday, but still finishing the week 0.5 per cent lower.

Every sector was higher, led by technology and communications which gained 2.2 and 1.9 per cent, and nine of the market’s 11 sectors gained more than 1 per cent.

Earnings remain the primary driver with Origin Energy (ASX: ORG) adding 1.9 per cent after management confirmed that revenue from the APLNG production asset had doubled for the year to date to $6.5 billion, with both volumes and prices increasing.

Shares in Kogan (ASX: KGN) were smashed by another weak update, with the company reporting an 11 per cent fall in gross profit as sales fell by 3.8 per cent to just $262 million; shares fell by more than 13 per cent and are now down over 50 per cent for the year.

The challenging environment once again hit Ramsay’s (ASX: RHC) profit ahead of an impending takeover, with management announcing a 38 per cent fall in profit for the year today, as elective surgery restrictions around the world continued to bite.

The result was more mixed across the week with utilities and real estate the standouts, up 1.3 and 0.8, as investors sought shelter from the surging volatility, while tech, materials and energy all dropped by more than 1 per cent.

Retailer City Chic (ASX: CCX) topped the market adding 12.8 per cent, with EML Payments (ASX: EML) and Life360 (ASX: 360) down 42 and 24 per cent each.

S&P500 caps one of worst four-month streaks in history, Apple down by profit up, Amazon falls

The week ended the same way it began in global markets with all three US benchmarks moving sharply lower as economic growth, inflation and corporate results continue to bite.

The Dow Jones outperformed with energy companies slightly better off, down 2.8 per cent, with the S&P500 and Nasdaq down 3.6 and 4.2 per cent respectively.

Every sector was lower, with consumer discretionary and property among the biggest detractors, down 5.9 and 4.9 per cent on interest rate concerns.

The day’s trading capped the 6th worst four-month start to a year for the S&P500, down 11.5 per cent, which was actually worse than the 9.9 per cent in 2020 as the pandemic began.

Shares in Amazon (NYSE: AMZN) detracted, falling 14 per cent, after the company reported a rare loss, the first in four years, despite the labour and product shortages reversing.

Apple (NYSE: AAPL) remains the standout, reporting record sales and profit in the second quarter of US$97 billion and US$25 billion respectively, as the group’s dominant position allowed them to overcome chip shortages amid surging demand for new iPhone models.

This represented 9 per cent growth globally but 19 per cent in the US, with the dividend, increased 5 per cent as well.

Over the week the Dow dropped 2.5 per cent, the S&P500 3.3 and the Nasdaq 3.9, while for the month the results were falls of 4.9, 8.8 and 13.3 per cent.

China saving the world, quality matters more than ever, inflation conundrum remains

Whilst the Chinese COVID-zero policy is being derided globally, it may well be one of the saving graces amid the incredible surge in prices that is occurring around the world.

With an outsized driver of inflation being energy prices and shortages, exacerbated by the Ukraine-Russia war, China’s lockdowns are crimping demand for the very same inputs that are in demand, placing much needed downward pressure, in the short-term at least.

Nearly every investor talks about seeking ‘quality’ in any company that they own; however, this qualitative term is clearly in the eye of the beholder, which is being shown by the massive divergence in investment performance in 2022.

What has become clear though, is that traditional versions of quality matter, that is, companies that are delivering real cash flow, dividends and growing revenue to their shareholders will be rewarded, or at the very least not punished as much as the others.

Investors are clearly no longer willing to bet on growth rates continuing into the future and for the time being are focused on protection.

There is a natural tendency to see value in companies that have fallen say 60 per cent, like Robinhood, Spotify or Shopify, but the current market has once again reiterated that even a company that is down 60 per cent can halve again, reiterating the importance of diversification.

It’s been a busy few weeks for Mark Zuckerberg, founder of Facebook, now Meta Platforms, having seen the largest loss of wealth in a single day and then the largest gain, of US$11 billion this week.