-

Sort By

-

Newest

-

Newest

-

Oldest

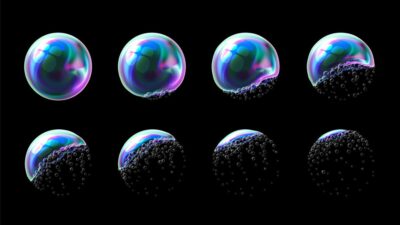

Higher starting valuations usually lead to lower returns, but the most important part of a bubble is “highly skewed psychology” – and investors remain anchored to sanity.

The meltdown of Silicon Valley Bank is “an early step” towards a more rational market environment, according to Howard Marks, but new problems might arise from bank exposure to commercial real estate.

While passive investment strategies are now used to manage the majority of equities, the absence of active managers would only create a “mindless boom and bust.”

The last few months have several famed investors convinced that the bull market is dead and buried. But how it came to life in the first place bears examining.

Fifteen years ago, Thomas Friedman said that globalisation had finally made the world “flat” and that a golden age of prosperity was upon us. A month ago, that stopped being true. Love him or loathe him (and many lean towards the latter), Thomas Friedman occasionally hits the nail on the head. In his 2005 book…

Despite the popularity of that old adage, it’s never as simple as “buy low, sell high”. But if it’s not true, what are investors to do? “Everyone is familiar with the old saw that’s supposed to capture investing’s basic proposition: “buy low, sell high”,” writes Oaktree Capital founder Howard Marks in his latest memo, ‘Selling…

Active manages have failed to heed changing times – and changing markets. But while Hyperion doesn’t do “concept stocks”, it’s got its eyes on plenty of disruptors. The great elephant in the room for active managers has been their inability to outperform the index long-term. Around 93.4 per cent of international equity managers and 86.3…

Howard Marks, one of the investment world’s more celebrated investors, has added his voice to other celebrated investors in decrying continued use of the terms ‘value’ and ‘growth’. The co-founder and co-chair of Oaktree Capital Management, Los Angeles-based, predominantly fixed income and credit strategies, firm addressed the opening session of the CFA Societies Australia conference,…

The next iteration for the private equity sector, long-time best performer among alternatives, is for general partners to combine the operations of their portfolio companies to boost flagging returns. Karim Khairallah, a senior managing director and co-portfolio manager at Oaktree Capital in London, and François Mann Quirici, a founding partner at Nexus Associates, also in London,…