-

Sort By

-

Newest

-

Newest

-

Oldest

The Magnificent Seven are likely riding into bubble territory but investors might yet avoid a bloody showdown, according to a new analysis by Dutch quantitative manager, Robeco.

While inflation, rates and the US dollar are peaking, we’re not quite there yet. Dutch quant house Robeco is tipping better returns for investors in 2023 but only after markets tumble further over the coming months.

Portfolios built along factor lines may be better-placed to withstand the grinding effects of high inflation, a recent study probing almost 150 years of market returns has found.

Dutch asset management giant, Robeco, tips a mainly positive, if subdued, outlook for equities over the next five years but with a high degree of uncertainty ahead in a decade it dubs the ‘Roasting Twenties’. In its new five-year forecast returns paper, Robeco says “we expect risk-taking to be rewarded in the next five years,…

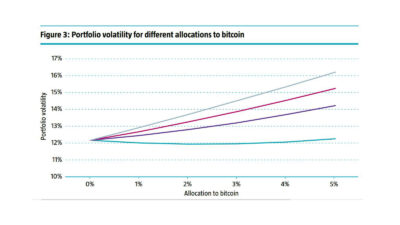

Bitcoin’s volatility means that institutional investors have historically steered well clear. But the times are a-changing, and even skeptics believe the cryptocurrency will have its day. Cryptocurrency is clearly here to stay. While most investors watch its massive price swings with bemused detachment, a few have begun to think seriously about the role they can…

September has historically been a bad month for markets, and it could be about to get worse. But then again, talk is cheap. Everybody in equity markets knows that September is the cruellest month, to paraphrase Elliot.Nobody really understands why it happens (theories range from tax-related selling to seasonal behavioural biases) but it happens. The…

While the consensus view of credit markets is that investors should be long, at least one credit manager, Maurice Meijers of Robeco Asset Management, takes the other side. In the global equity and fixed income manager’s quarterly outlook delivered last week (April 22), Meijers, the chief executive of the firm’s Singapore business and a fixed…