-

Sort By

-

Newest

-

Newest

-

Oldest

The local sharemarket delivered it’s best one day return since the worst of the pandemic, with the S&P/ASX200 gaining 2.6 per cent on Tuesday. The move was driven by a slight shift in narrative and policy by the Reserve Bank of Australia, which decided to increase the cash rate by 25 rather than 50 basis…

The local sharemarket finished 0.3 per cent lower to begin the new quarter, with strength in the utilities, energy and property sectors not enough to offset broader weakness in the market. The energy sector gained 1 per cent after OPEC+ announced its intention to cut oil production in response to falling prices, just as investors…

The energy sector powered the Australian sharemarket on Thursday, with a 2.8 per cent gain on the back of the apparent sabotage of the Nord Stream sub-sea pipelines linking Europe and Russia. This helped the benchmark S&P/ASX200 index to gain 93 points, or 1.4 per cent to 6,555, while the broader All Ordinaries advanced 100.8 points, or…

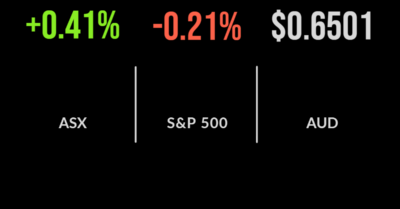

After three consecutive losing days, the Australian sharemarket turned northward again on Tuesday, led by the resources stocks. After being scorched on Monday, the ASX’s coal and lithium stocks rallied on Tuesday as global markets stabilised, as did energy prices, despite rising recession risks. The S&P/ASX 200 Index added 26.8 points, or 0.4 per cent,…

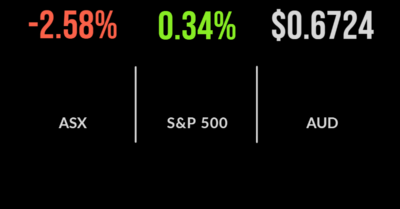

With the worst losses in two years for the ASX’s mining and energy sectors, there was no way that the Australian share market’s major indices were gaining ground yesterday, and so it unfolded. The mining sub-index slid 5.3 per cent, its worst day since a 6.8 per cent fall on May 1, 2020, while the…

The benchmark S&P/ASX 200 index rose 86.5 points, or 1.3 per cent, on Tuesday to 6,806.4 points, while the broader All Ordinaries gauge added 81.4 points, or 1.2 per cent, to 7,030. Nine of the ASX’s 11 sectors gained ground, with real estate and healthcare the only ones to retreat. The mining sector was the…

Utilities and tech shares dragged the S&P/ASX 200 lower on Monday, as the benchmark lost 19.2 points, or 0.3 per cent, to 6,719.9 points, its lowest closing level in two months. Real estate was the only sub-index to post a gain, led by heavyweight real estate investment trust (REIT) GPT, which gained 9 cents, or…

It was a sea of red on the S&P/ASX200, with the market closing down 1.5 per cent on Friday, resulting in a 2.1 per cent loss for the week. A reversal in the energy sector, triggered by a resolution of potential railroad strikes sent the energy sector down 3 per cent, with Whitehaven Coal (ASX:WHC)…

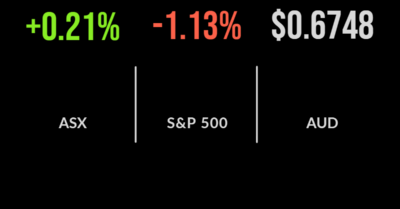

The Australian sharemarket managed to follow the US, posting a gain of 0.2 per cent on Thursday with the energy sector leading the way, up 3.7 per cent. New Hope (ASX:NHC) and Whitehaven Coal (ASX:WHC) gained 6 and 4.6 per cent respectively on news of the US railroad workers strike which could increase the cost…

The local market fared better than global shares on Wednesday, falling 2.6 per cent in comparison to the 5 per cent drop in the Nasdaq. There was red across the board, led by the property and retail sectors, with the likes of Charter Hall (ASX:CHC) and Wesfarmers (ASX:WES) dropping more than 4 per cent on…