Venture capital deals up in number, down in value

The world’s biggest venture capital managers did more deals last year, but their average value was lower than the year before, a report from GlobalData says. The report indicates a “more cautious approach by the managers”.

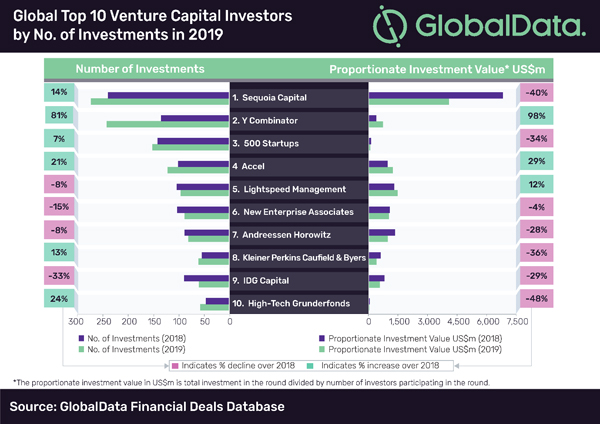

Six of the top 10 global venture capital (VC) investors showcased year-on-year (YoY) growth in the number of investments, whereas seven of them witnessed a YoY decline in the proportionate investment value in 2019, says GlobalData, a UK-listed data and analytics company which covers several sectors including financial services..

The top 10 global VC investors (by number of investments) participated in more than 1,200 funding rounds in 2019 as compared to 1,110 funding rounds in 2018. However, the proportionate investment value of these VC firms declined from US$13.4 billion in 2018 to US$10.5 billion in 2019. The decline could be attributed to the lower proportionate investment value for majority of these VC investors, the report says.

Of the top 10 VC investors, six (Sequoia Capital, Y Combinator, 500 Startups, Accel, Kleiner Perkins Caufield & Byers and High-Tech Grunderfonds) increased their investment volume in 2019. In contrast, seven of them witnessed decline in the proportionate investment value in 2019.

Aurojyoti Bose, financial deals analyst at GlobalData, says in the report: “Despite an upsurge in the investment volume, shrinkage in the investment value indicates a cautious approach of VC investors towards making big investments.”

Interestingly, Sequoia Capital, which registered the highest investment volume and value in 2019, also witnessed decline in its proportionate investment value by 40 per cent compared to the previous year.

The other top VC firms which witnessed declines in the proportionate investment value in 2019 included: 500 Startups, New Enterprise Associates, Andreessen Horowitz, Kleiner Perkins Caufield & Byers, IDG Capital and High-Tech Grunderfonds.

Of these, New Enterprise Associates, Andreessen Horowitz and IDG Capital also witnessed a decline in the number of investments. Manager ‘Y Combinator’ registered the highest growth in the number of investments as well as proportionate investment value in 2019 as compared to 2018.

– G.B.