GMO abandons all hope, almost

GMO has released its latest borderline-apocalyptic seven-year forecast for stocks and bonds as it warns clients to “concentrate assets where the bubble ain’t”.

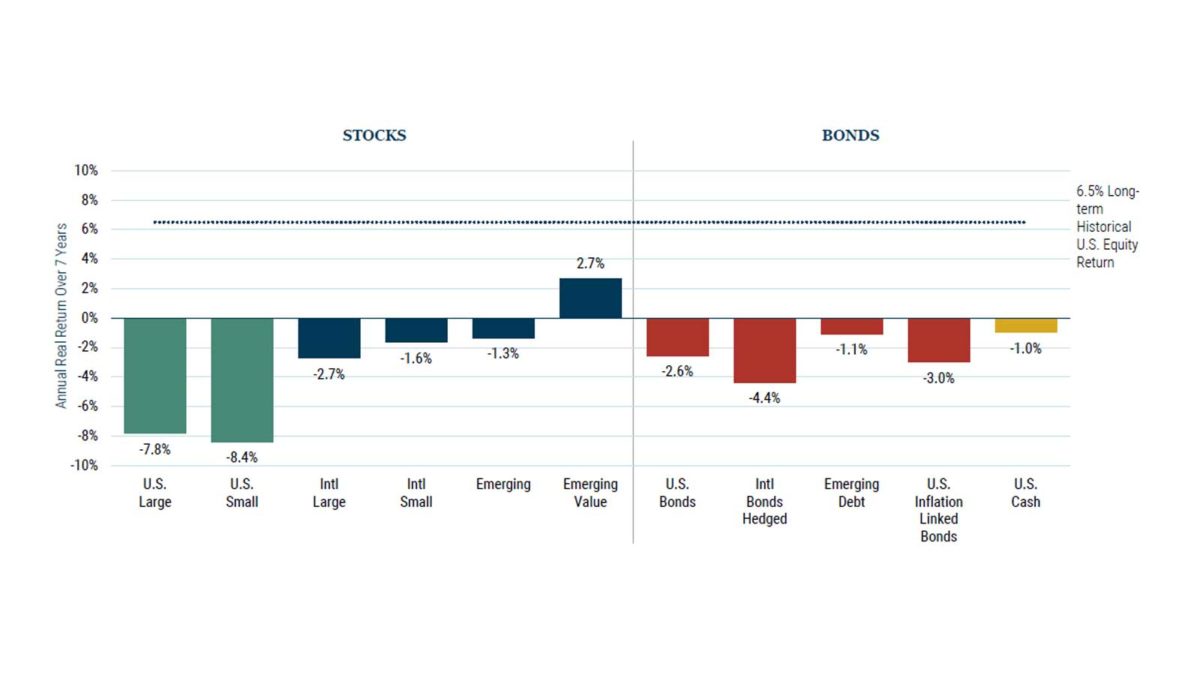

GMO’s extraordinarily bearish forecasts predict a negative annual real return over seven years across the majority of both stocks and bonds, with only emerging markets value stocks getting a positive, if slim, forecast of 2.7 per cent – well below the 6.5 per cent long-term historical US equity return (see chart above).

“It gives us no pleasure to remind clients that U.S. stocks’ valuations, by almost any measure we can come up with – backward or forward looking – are at levels that concern us,” wrote portfolio strategist Peter Chiappinelli.

“Many have wondered aloud whether GMO is not giving enough credit to some of these high growth new-business-model “disruptors.” First, we have all sorts of models that take current optimistic growth forecasts into account. Many are deserving of their current high multiples — we absolutely concede that somewhere in the Global Growth basket sits “the next Amazon.” Unfortunately, they’re all being priced that way, and that is a bridge too far.”

US large and small caps are expected to slide by as much as 7.8 per cent and 8.4 per cent respectively, while international large caps will sink 2.7 per cent.

Nevertheless, Chiappinelli denies that the forecast is all doom and gloom. He wrote: “Emerging Markets Value, which has rallied strongly in the past year, with the MSCI EM Value index up 49 per cent, is still priced to deliver quite decent relative and absolute returns. Japan small value stocks are also quite attractive.

“Further, the valuation spread between global Value and Growth remains at some of the widest levels we have seen in our working careers, and there are all sorts of interesting ways to exploit this dislocation. Importantly, valuation spreads across asset classes more broadly in rates and FX and commodities, represent huge opportunities in non-traditional long/short space.”

The forecast is par for the course for GMO, which has heralded all-time highs in markets as more evidence that they are in what founder Jeremy Grantham calls “the greatest bubble in history”. The best way to deal with that bubble popping is to a) exploit it through equity long/short, b) avoid it through alternatives, or c) “concentrate assets where the bubble ain’t”, that is, Japan small value, cyclicals, and quality.

“We also remind ourselves that during the month of May, the S&P 500’s real earnings yield (the inverse of P:E minus inflation) dipped into negative territory, the lowest in 40 years. Even at the height of tech bubble mania this scary event did not occur,” Chiappinelli wrote.

“Combine that sober statistic with the negative real yields being offered by sovereign bonds, and you may come to see why we are loath to recommend a traditional 60/40 mix. There will come a day when global equities and government bonds are fairly valued and should deliver a ‘normal’ real rate of return. Today, however, is not that day.”