Value and ‘the frailties of human psychology’

The value vs growth competition isn’t a competition, according to Schroders. Value will always outperform because it exploits “the one thing that never really changes”: human beings.

Markets have seen a period of very strong value performance since the announcement and rollout of effective Covid-19 vaccines – the so-called “Vaccine Monday” – as markets reappraised the prospects of stocks that were hit hardest during the volatility of early 2020.

“Naturally, these market moves have reinforced the dominant narrative of recent times: that higher interest rates and economic growth expectations are the only things that matter for value performance,” said Liam Nunn, fund manager for the Schroders Global Value Fund.

“But history shows that the link between value returns and interest rates is – if you were being kind – unstable. If you were being brutally honest, it’s pretty much non-existent… Changes in interest rates do not consistently translate into value outperformance or underperformance once you’re looking at a statistically significant of historical data.”

Nunn instead points investors towards the fundamental valuation discrepancies present in global equities, with the gap between fundamental valuation between the most highly rated shares and least highly rated remains at “really extreme levels”. But Nunn believes that alone doesn’t make the case for value: the recent uptick in performance is “barely visible” on 20-year charts, and that while now is a good time to be adding to value exposure, a short-term approach to the investment philosophy will inevitably

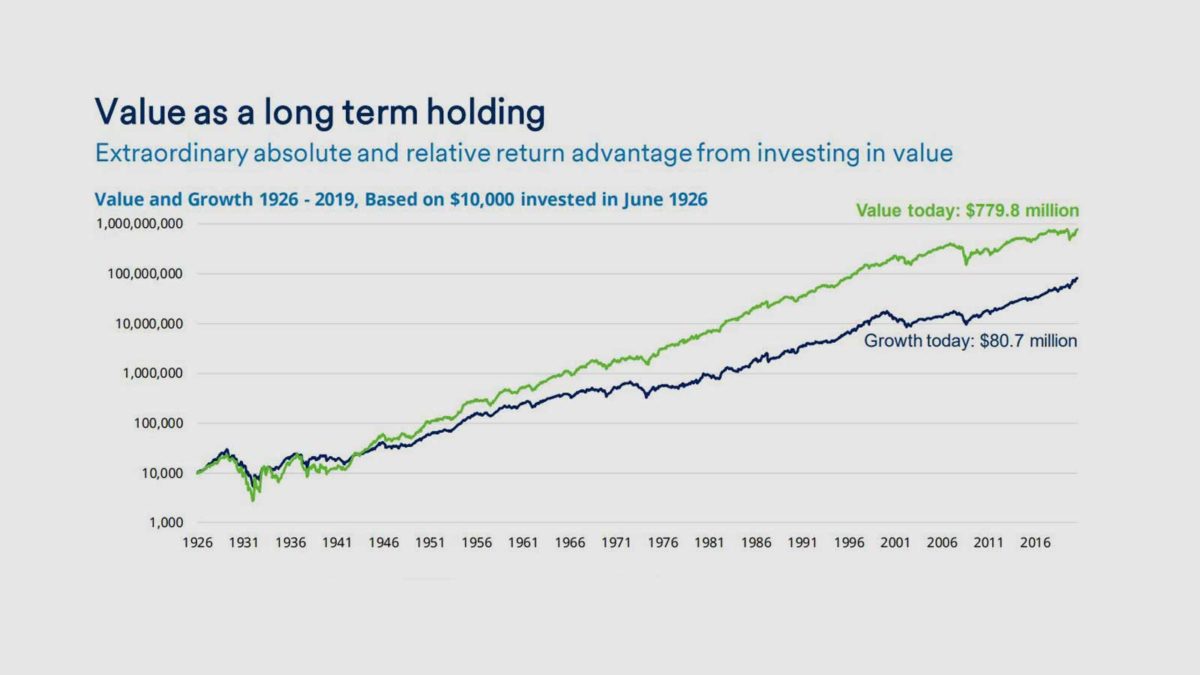

Nunn illustrates the inherent case for value investing by using the example of US$10,000 invested in either a growth portfolio or a value strategy in 1926. Growth would have returned $80 million, while value would have returned a hefty $779.80 million (Nunn didn’t say what was in the simulated portfolios, suggesting some unreliability in the data – what was the Roaring 20s equivalent of Tesla?).

“When people talk about this perennial war of value vs growth in the stock market, from a long-term perspective, it hasn’t really been a contest,” Nunn says. “The last ten years have been more difficult on a relative basis for value, but the long-term track record of its compounding outperformance is incredibly strong.”

Of course, a chart alone isn’t enough to convey the value of value. Nunn looks instead to the father of value investing: American economist and investor Ben Graham, who penned the value perennial “The Intelligent Investor” and whose approach exploited “the one thing that never really changes in stock markets”: human beings.

“(Graham’s) belief in value was based on common sense, intuition, and above all, astute observation of human behaviour,” Nunn said. “Graham stressed that if you want to make money in the stock market consistently, don’t fall into the trap of playing the same game as everyone else. Don’t fall into the trap of speculating on future growth. Spend your time swinging against the short-term sentiment to find the real bargains… Value investing is just contrarian bargain hunting applied to the stock market.”

And what constitutes value one day won’t necessarily constitute it the next. The opportunity set is constantly evolving, with the Schroders value team now holding many of the 1990s equivalent of the FAANGS: Microsoft, Cisco, Oracle etc – “once loved growth juggernauts that fell so hard from grace they ended up being part of a contrarian value portfolio”.

“When the outlook is dark and cloudy, people get fearful and despondent and some companies will just get too cheap. When all we can see is sunshine and lollipops and rainbows on the horizon, people get euphoric and greedy and a lot of companies get too expensive,” Nunn says.

“Value investing is just designed to exploit those consistent patterns of human behaviour. Time and time again, the frailties of human psychology, combined with the irrationality of crowd behaviour, create these pricing inefficiencies that patient investors can exploit. We don’t think that dynamic will ever really change.”