Small caps boasting a ‘moat’ can enjoy long-term outperformance

While volatility and small caps can often go hand in hand, so too do small caps and long-term outperformance. Despite often bearing the brunt of choppy markets – as we’ve seen in this latest period – small caps are also where some of the most compelling long-term opportunities frequently emerge.

Part of our approach to identifying value in the sector is distinguishing those companies capable of thriving through the cycle. This means doubling down on the fundamental research effort, prioritising companies with durable margins, stable earnings profiles, a history of compounding growth and, critically, defensible competitive advantages, or what we call “moats”.

For the past three years, small caps have underperformed large caps to a point where valuations are starting to look attractive again. Put another way, small caps are likely to be more prosperous today than they have been for some time, with the sector trading at a five per cent P/E discount to large caps, despite historically trading at a 10 per cent premium on the same metric.

But discounts or premia alone can be very blunt measures of value. There are 1,500-odd listed small caps in Australia (85 per cent of all ASX-listed companies) and recognising quality and quality markers can be challenging in such a crowded space. Having an edge in what remains an inefficient part of the market is critical.

Quality – with a margin of safety

In any market, but especially in the current one where macro headwinds and higher-than-average volatility abounds, quality matters. Our approach to defining quality is as a set of tangible, investible metrics that we know will act as decent shock absorbers through different economic cycles: revenue growth, gross margins, return on equity and balance sheet strength.

The earnings outcomes for small caps can vary widely but we know that, traditionally, high-margin businesses are better positioned to absorb shock. In the small-cap universe, this ability becomes a critical margin of safety. The greater the margin strength, the more flexibility a company has to retain pricing power and defend market share in tougher times.

Earnings stability leading to compound growth

By concentrating on companies that offer the potential for sustainable earnings growth, even in challenging times, investors can gain exposure to earnings growth that is not only strong but resilient through the cycle. Future sustainable cash flow is key.

The pathway to growth is more stable and predictable for investors preferencing companies that have this control over their revenue drivers.

Premier Investments (ASX:PMV) fits our definition of a quality small-cap business with strong, compounding earnings. The company owns a portfolio of high-performing retail brands, including Peter Alexander and Smiggle, which have delivered consistent growth over the long term and are both being exported via a global rollout. During the five years to 2024, PMV saw EPS growing almost 20 per cent a year, with strong margin expansion driving a significant increase in ROE to almost 15 per cent in 2024.

Following the recent demerger of its apparel brands into Myer, investors are left with a compelling mix of high-quality assets – including a stake of 36.5 million shares in Breville (worth more than $1 billion at a headline level at the time of writing), select property holdings and a strong net cash balance sheet.

Adjusting for these holdings, the remaining two apparel brands are operating in a difficult environment but are still generating strong, mid-20 per cent EBIT margins with an implied valuation of about 15 times earnings. To us, this represents attractive valuation for two high-quality brands in apparel.

Unique or scarce assets:

Quality can also be found through identifying companies with superior financial metrics or by identifying quality scare assets that cannot be replicated.

A good example of this in action is gold miner Gold Road (ASX:GOR) that owns 50 per cent of the Gruyere mine in Western Australia via a joint venture with Gold Fields (ASX:GFI). The Gruyere open-pit mine is a tier-one, low-cost and long-life asset located in a stable and secure jurisdiction. Gruyere is a six-million-ounce plus resource, making it one of the largest Australian gold mines.

In our view this type of asset does not usually sit with mid-tier producers for long. Trading on high, single-digit free cash flow yield and with upside optionality from its exploration program, we believe Gold Road’s quality assets will either be recognised by the listed or unlisted market or competitors.

The recent opportunistic bid from its joint venture partner Gold Fields at a 28 per cent premium to Gold Road’s share price supports our view of the underlying intrinsic value of this quality asset. A deal can still be consummated, but we believe the price needs to be higher to fully reflect the quality of this asset.

Seek out companies with a moat:

Of all the factors considered in small caps portfolio construction, the concept of a moat – a company’s ability to defend its economic territory – is often overlooked, but we view it as one of the most important indicators of future success.

For example, diversified industrial group MAAS Group (ASX:MGH) is a founder-led business with privileged assets ($1.4 billion tangible asset base) through ownership of quarries that supply construction materials for the multi-year build-out of renewable energy and the electrification infrastructure.

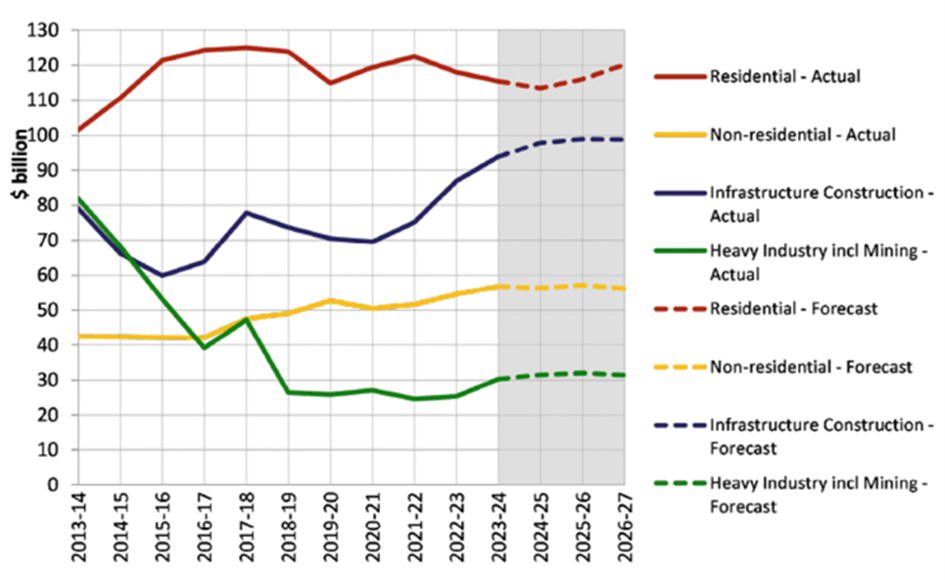

According to the Australian Construction Industry Forum, construction spend in residential and infrastructure (the two segments where MAAS is exposed) should underpin market growth (see chart), offsetting flat spending in heavy industry and non-residential, providing MAAS with strong tailwinds in the future.

Chart: Australian building and construction work done ($bn, 2021-22 prices)

The market’s short-term fixation has seen MAAS unduly punished for missing 2025 earnings expectations due to several infrastructure projects being delayed. For longer-term investors, the earnings have been delayed (not lost) and we expect those with a longer-term investment horizon will be rewarded. The company is trading on 11-times 2026 earnings, a material discount to its historical trading range and its peers.

For investors seeking a moat of their own in turbulent markets, small caps can offer a compelling pathway to long-term growth – provided there’s a disciplined framework in place.

When you apply a lens focused on quality, earnings consistency, compounding potential and defensible moats, small caps can reveal themselves not as speculative plays but as resilient businesses with structural advantages. Volatility may be stereotyped as part and parcel with small caps. But those willing to look for the right indicators can achieve stability and outperformance.