Advisor rev-up as Fidelity wins top Morningstar award

Fidelity International took out the major ‘fund manager of the year’ award at Morningstar’s annual event last Friday evening (February 28). Nearly 200 people, many of them advisors, also heard Jamie Wickham’s upbeat view on the advice industry.

Wickham, the managing director of Morningstar for Australia and New Zealand, said, while introducing the proceedings, that investor advocacy was ingrained in Morningstar’s DNA, in its research and its software. But many investors needed help and advisors were critical in that process.

“Demand for advice is not going away,” he said. “There is a lot of short-term pain for advisors and licensees and that shouldn’t be under-estimated, but the good ones will not only survive, they will thrive.”

In December last, Morningstar purchased the software business of Adviser Logic, an Australian company. This would enable the firm to “throw everything we can to put in their kit bags” for advisors, he said.

He also said that there was no question ESG concerns and processes were becoming more embedded in the wealth and advice sectors. Coincidentally, Morningstar also last week published a report on gender diversity in the industry and its lack of progress over the past 20 years (see separate report this edition).

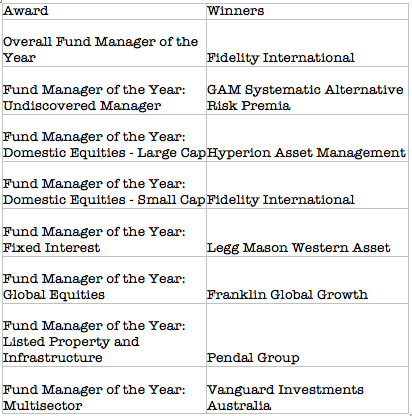

The annual Morningstar awards comprise of only eight categories, unlike most other industry awards by research houses and publishing companies, which tend to have more categories. From a commercial perspective, the more awards categories you have the more revenue you get from the event. The other awards winners were:

Aman Ramrakha, Morninstar’s head of research for Australasia, said that fixed income was still a very important part of a portfolio, notwithstanding record-low interest rates. “I hope you all know that,” he said. “While markets are challenging, we are here to add value over long periods of time.” Western Asset Management, which has had a successful presence in Australia for many years, took out the fixed interest category for its ‘Legg Mason Western Asset’ global bond fund. Legg Mason is a multi-affiliate manager. One of its affiliates is Western Asset, run by Anthony Kirkham for Australia and NZ.

Another interesting award winner was GAM, which won the ‘undiscovered manager’ award for its systematic alternative risk premia strategy, which has proven popular with institutional investors and is now starting to attract the attention of the advisory market segment.

Accepting the award, Alex Zaika, the Australia country head, said that the strategy’s famous founder, Lars Jaeger, was “very surprised” to be told he was nominated for such an award. “Lars wrote the book on risk premia years ago,” Zaika said. Which he did. The Swiss former scientist has written several books, published in both German and English, the most relevant one being: ‘Alternative Beta Strategies and Hedge Fund Replication’.

This Morningstar award was all the more significant because of the troubles which GAM has had with its main bond fund, an absolute return bond fund which blew up and cost the public company’s CEO his job. What it shows is that Morningstar believes the risk premia strategy run by Lars, is sufficiently quarantined from the now-resolved corporate issues of the parent company such that it can be recommended to investors. It’s a good fund and Lars, who lives in Zurich, is actually the guy who ‘wrote the book’.

– G.B.