ASX drops 0.6% as banks and BHP drag

Market retreats, A2 Milk surges, BlueScope, JB Hi-Fi report

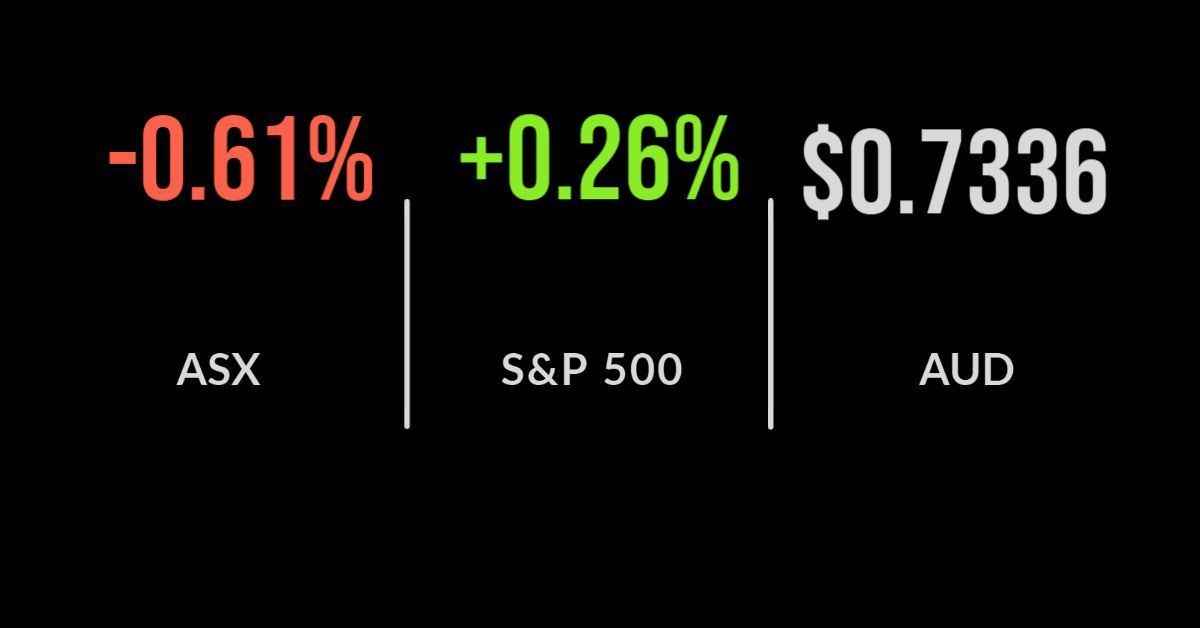

The ASX200 (ASX: XJO) started the week on a negative note, falling 0.6% as COVID-19 cases surge in Australia, lockdowns expand to four states and Victoria was plunged into another curfew.

Around half the sectors were lower with the popular cyclical ‘value’ stocks like energy and financials hardest hit down 3.4% and 1.3% respectively.

Quality remains in focus with Wesfarmers (ASX: WES) jumping 0.3%. A2 Milk (ASX: A2M) was a surprise winner jumping 12.1% amid rumours that global giant Nestle may be considering acquiring the group.

Sydney Airport (ASX: SYD) was 0.7% lower after rejecting the unsolicited bid by a group of industry super funds. Bendigo Bank (ASX: BEN) was a major detractor, the second-tier bank falling 9.9% despite reporting a 50% increase in profit to $457 million.

Investors were clearly concerned about a 3% increase in costs rather than their banking business which is lending at a rate of close to three times that of the broader market.

Management declared a 26.5 cent dividend, down on 2020’s 31 cents per share. BHP (ASX: BHP) also fell 1.4% amid rumours that Woodside (ASX:WPL) may be interesting in their $20 billion oil and gas operations.

Lend Lease (ASX: LLC) profit collapse, JB Hi-Fi sales slow, BlueScope hikes dividend

Popular recovery play Lend Lease (ASX: LLC) continues to disappoint investors with the stock falling 7.6% on a profit downgrade.

New management flagged a ‘challenging year to come’ announcing that this year’s $377 million profit will fall to $230 to $290 million in 2022 despite the sale of their troubled engineering unit.

Despite expectations of the opposite, their One Sydney Harbour and Elephant Park developments will take a $100 million hit as weaker sales combine with lower prices.

Construction revenue fell 14% and management no longer expect to sell 4,000 properties per year, but likely half that meaning they will be held longer on their balance sheet; a difficult one to watch.

Pandemic winner JB Hi-Fi (ASX: JBH) delivered it’s eight consecutive year of record profit growth up 67% to $506 million, however many are expecting this run to end in 2022.

Sales were up 12% during the year as people upgraded their home office but same store sales growth has falling 15% in July and August with 55% of stores not closed and not considered essential.

The dividend was 19% higher with shares adding 2.5% on the news. Sticking with dividends, BlueScope Steel (ASX: BSL) has been riding the wave of iron ore prices announcing a 25-cent ordinary dividend and a special dividend of 19 cents after reporting a $1.19 billion profit. Shares were just 0.6% higher.

More records despite case spike, Afghanistan capitulation, Apple surges, Tesla falls

US markets continued to new records on Monday with the Dow Jones and S&P 500 both finishing 0.3% higher.

A key driver was Apple (NYSE: AAPL) which added 1.4% as investors once again flocked to quality and defensive earnings as cases of the Delta variant surged to 130k in the US. This came at the same time as China’s latest economic data showed a worsening slowdown in the economy with the average growth in retail sales over the last two years falling to just 3.6%.

Industrial production remains strong at 5.6%, however, when combined with the weaker US consumer last week it is clear the economic recovery is slowing.

US markets have now doubled since their pandemic low. Tesla (NYSE:TSLA) was the biggest detractor to the Nasdaq which fell 4.3%, after the US government announced an investigation into their Autopilot system.