ASX gains on energy, coal, Woodside’s Paris ambitions, Tyro’s new CEO

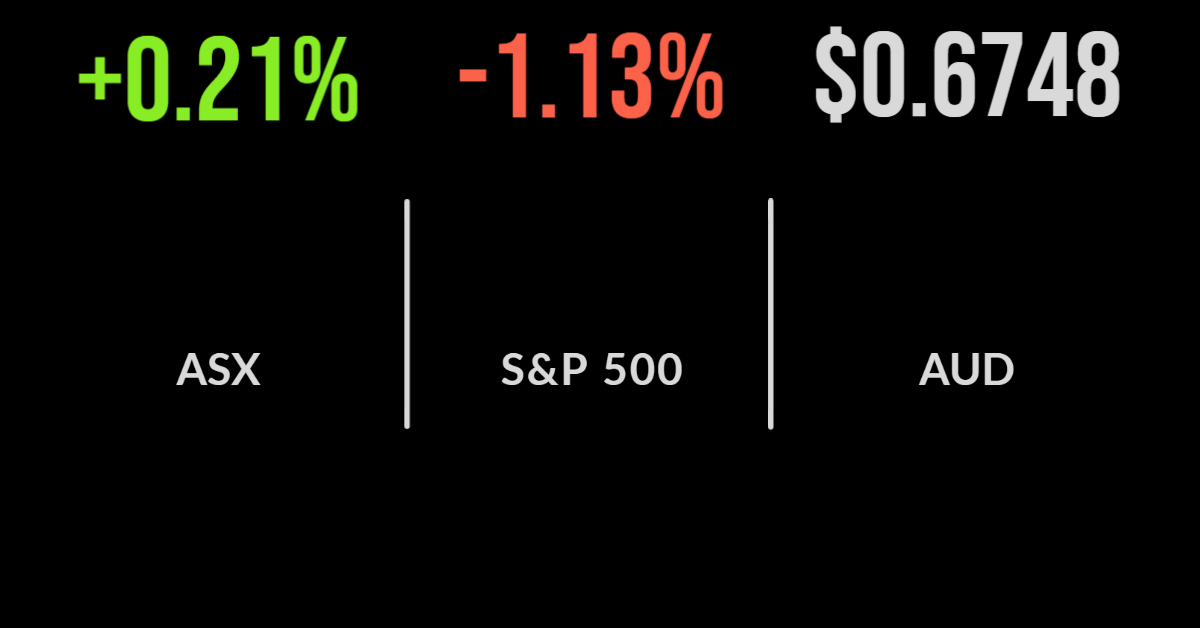

The Australian sharemarket managed to follow the US, posting a gain of 0.2 per cent on Thursday with the energy sector leading the way, up 3.7 per cent.

New Hope (ASX:NHC) and Whitehaven Coal (ASX:WHC) gained 6 and 4.6 per cent respectively on news of the US railroad workers strike which could increase the cost of coal across the global.

Energy stocks also performed strongly with Woodside (ASX:WDS) and Santos (ASX:STO) up 4.3 and 3.5 per cent after Chinese officials flagged the reopening of Chengdu province. This coincided with more details on the US Government’s plan to increase the purchase of strategic oil reserves below US$80 per barrel.

Woodside also released a report which flagged the ability of the US$20 billion Browse LNG project to contribute to the Net Zero goals of the Paris climate accord, a key sticking point with many stakeholders.

After losing its CEO to Star Entertainment, Tyro (ASX:TRY) has announced acquired Medipass CEO Jon Davey will take over the firm; he previously headed digital innovation at the National Australia Bank.

Link deal approved, unemployment increases, Myer dividend increased

Link Administration (ASX:LNK) finished 0.9 per cent lower after the Foreign Investment Review Board (FIRB) approved the takeover by Dye & Durham.

The positive news comes after a significant selloff in Link due to the addition of conditions by the UK financial regulator.

Shares in retailer Myer (ASX:MYR) were flat after the company announced the best result in several years, reporting a 16 per cent increase in profit to $60 million on sales growth of 12.5 per cent to $3 billion.

The result was the reinstatement of a final dividend, taking the annual payment to 4 cents per share, or nearly 8 per cent.

Hedge fund manager Ray Dalio believes inflation will moderate next year before settling closer to 4.5 per cent, with the Federal Reserve expected to accelerate rate hikes as a result.

The New Zealand economy has remained resilient, growing 1.7 per cent, in the face of a series of rate hikes, the annual growth rate reduced to 0.4 per cent.

Unemployment unexpectedly increased in Australia, moving to 3.5 per cent as the hot jobs market saw the participation rate increase.

US market weakens, Adobe sinks, yield curve inversion grows

All three US benchmarks finished in negative territory, led by the technology sector with the Nasdaq falling 1.4 per cent.

The Dow Jones was 0.6 lower and the S&P500 1.1 per cent after the inversion of the yield curve grew steeper ahead of next week’s Federal Reserve meeting.

The central bank is expected to hike interest rates by another 75 basis points following the higher than expected inflation print.

The railroad sector held ground after President Biden confirmed news of a deal that would avoid a mass strike while retail sales were 0.3 per cent higher on car and restaurant spending. Manufacturing sentiment has continued to fall.

Shares in Adobe (NYSE:ADBE) which makes editing and PDF software suffered a more than 16 per cent drop. The company reported a slight fall in quarterly sales with investors wary of any reversal.