ASX jumps as Woodside delivers bumper profit, building approvals tank, as energy prices surge

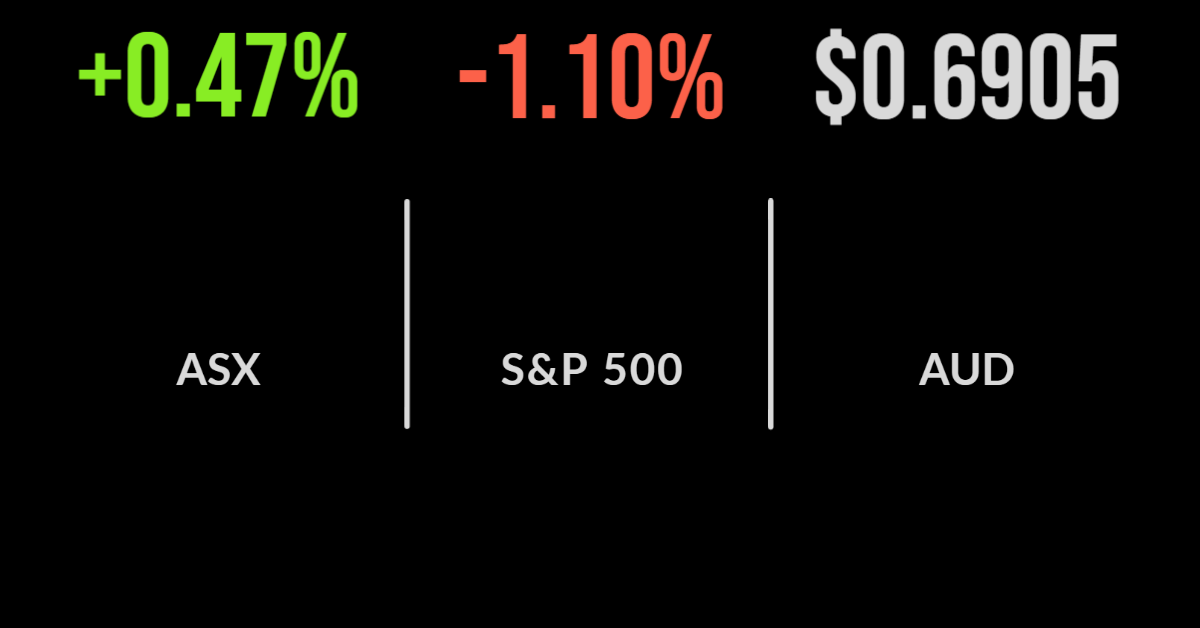

The local market managed to overcome another weak global lead, gaining 0.5 per cent on Tuesday, with the energy sector a key support.

Gaining 1.4 per cent on the back of a strong inaugural report by Woodside Energy (ASX:WDS) the sector was second only to technology, which gained 1.8 per cent.

Renewed conflict in Libya was central to the oil price once again moving over USD$100 per barrel.

Woodside’s interim profit was influenced by the merger of BHP’s (ASX: BHP) oil and gas assets, with revenue more than doubling and profit up fivefold to USD$1.6 billion.

The result was a stronger than expected dividend, which sent shares more than 1.5 per cent higher.

Construction remains a real challenge for the economy as the Homebuilder stimulus rolls off, as building approvals fell 17.2 per cent in July with the materials sector the only detractor.

Online luxury retailer Cettire (ASX:CTT) which was popular during the pandemic fell another 17.7 per cent taking the 2022 loss to 80 per cent, despite management suggesting profitable revenue growth was expected in 2023.

WiseTech talks acquisitions, Healius profit doubles, Hello World loss narrows

Logistics software company WiseTech Global added 3.8 per cent after management responded to speculation that they were considering the acquisition of US-based Envase Technologies.

Medical imaging and testing provider Healius (ASX:HLS) shares gained 3.5 per cent after reporting a doubling of profit to $309 million on the back of a continued scaling of company operations.

Revenues jumped 22 per cent, supporting an 84 per cent increase in earnings, with talk of a partnership for the early detection of Alzheimer’s and ‘substantial’ imaging contract in NSW.

The dividend was increased by another 10 per cent. The commodity sector was the only real weakness, but both Mineral Resources (ASX:MIN) and Lake (ASX:LKE) gained over 5 per cent after weaker results earlier this week.

Hello World’s (ASX:HLO) stronger than expected report supported the entire travel sector, gaining 5 per cent and sending Webjet over 4 per cent higher.

This came after management confirmed a narrowing of the loss to $28 million for the financial year and a 60 per cent jump in revenue.

Selloff hits 4 per cent, Twitter deal officially off, job advertisements continue to rise

The Federal Reserve-led ‘rebalance’ has continued amid a slowdown in volume as the US summer break nears an end.

All three US benchmarks fell by more than 1 per cent, with the Nasdaq continuing to be hit hardest, down 1.5 per cent.

The Dow Jones and S&P500 both fell 1.2 per cent with weakness in Twitter (NYSE:TWTR) a key contributor.

The social media company fell by 1.7 per cent after Elon Musk formally informed the group of the termination of his merger deal citing ‘misconduct’ highlighted by a whistle-blower.

Economic data remains strong, which day traders are clearly seeing as a negative as it will result in higher interest rates, this time it was job openings jumping by 11.2 million suggesting the corporate world is in rude health.

This is clear dispersion between sectors with Snap Inc (NYSE:SNAP) dropping 2.6 per cent after announcing a 20 per cent cut to its workforce.

Consumer confidence has also jumped from 95 to 103 points following an earnings season that was more than 50 per cent better than expected.

Editors note: This article originally said WiseTech Global had confirmed acquisition interests. This was incorrect and we have adjusted the article accordingly.