-

Sort By

-

Newest

-

Newest

-

Oldest

Rising iron ore prices helped mining heavyweights BHP Group, Rio Tinto, Fortescue Metals and Mineral Resources on Thursday, and in turn that helped to push the major indices higher. The benchmark S&P/ASX200 index finished Thursday up 3.8 points at 7,255.4, while the broader All Ordinaries gained 3.9 points to 7,460. Iron ore has risen 15 per cent since the start of 2023, on optimism…

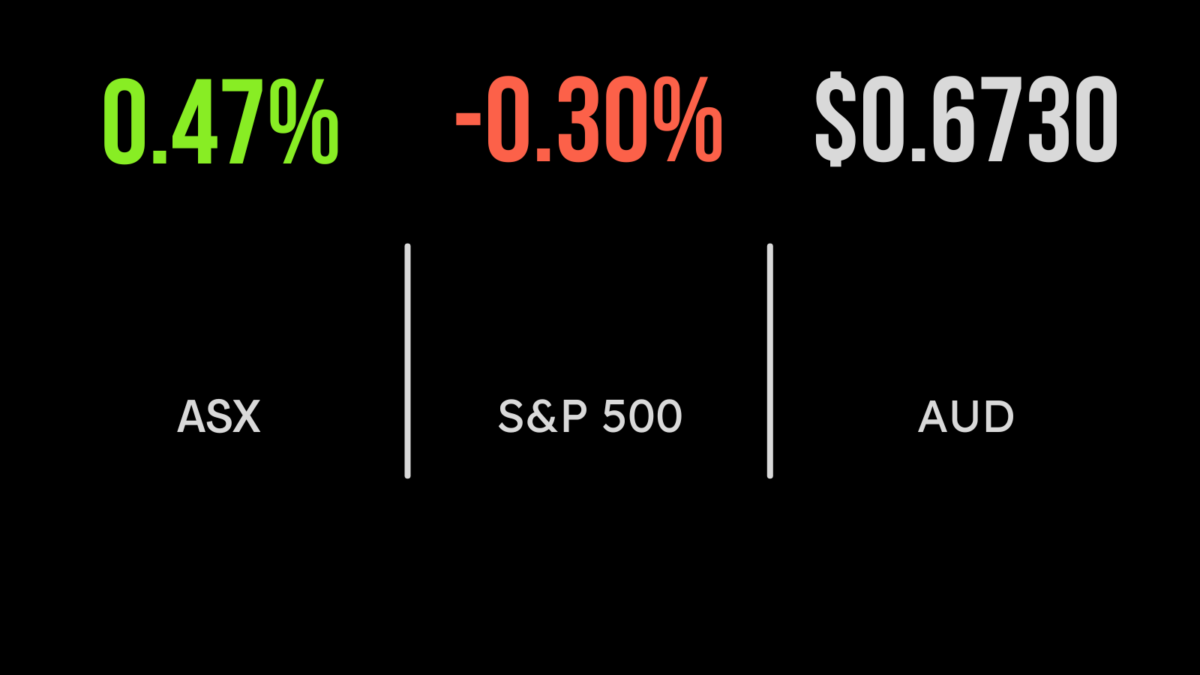

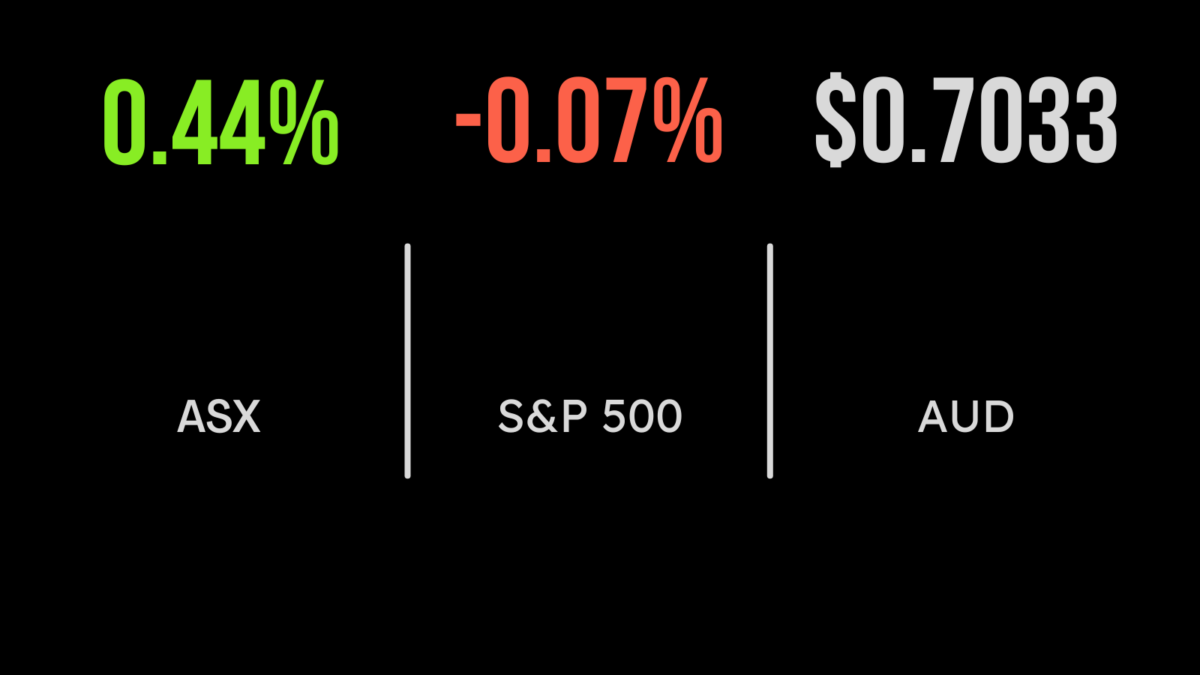

Optimism for mining stocks battled a downturn in the big banks in deciding the direction for the Australian share market on Wednesday, with the banks prevailing just enough to see the benchmark S&P/ASX 200 close 6.8 points, or 0.1 per cent, lower at 7251.6, while the broader All Ordinaries Index retreated 1.9 points to 7456.1. The bullishness for the miners…

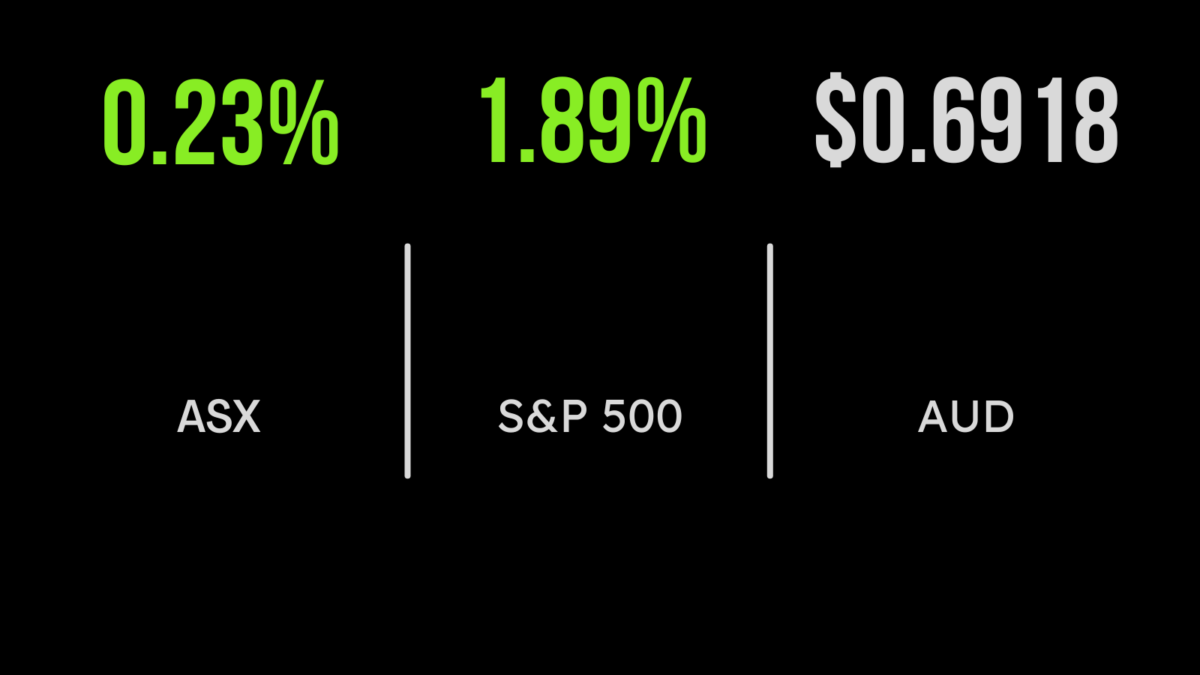

Australian retail sales rebounded in January as household spending defied inflation and higher borrowing costs, strengthening the case for the Reserve Bank to keep raising interest rates, and run a “higher for longer” rates scenario, taking its cue from its central bank peers in the US and Europe. Retail sales rose 1.9 per cent in January after…

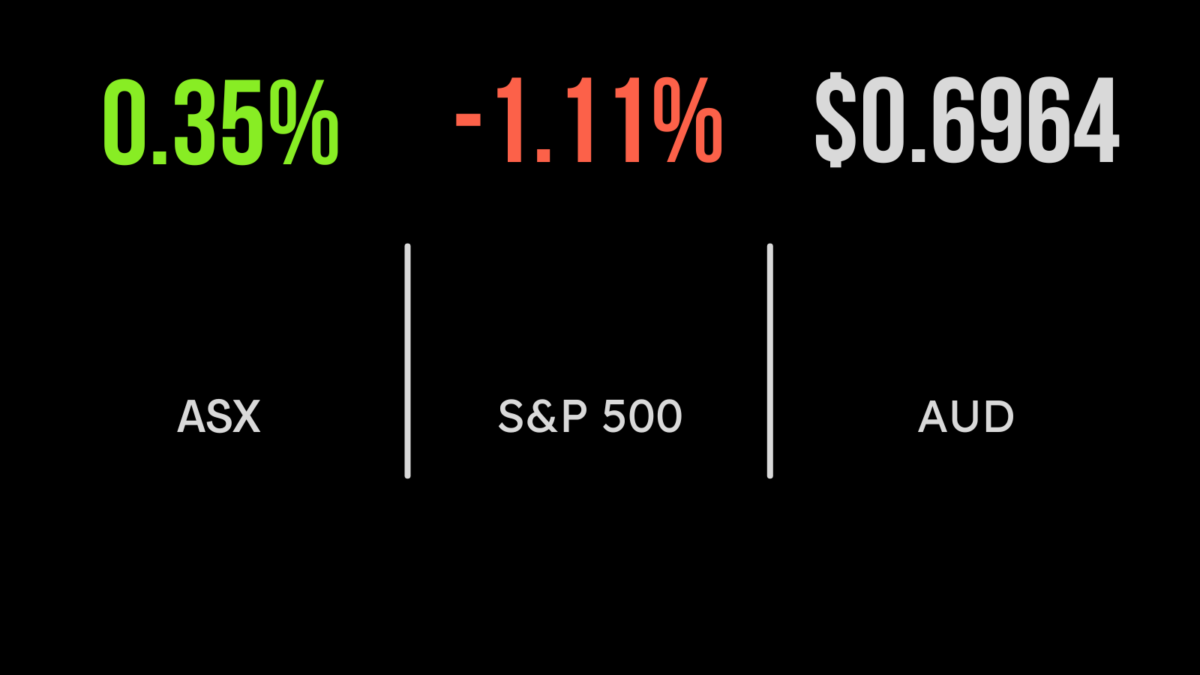

The benchmark S&P/ASX 200 Index fell 39.8 points, or 0.5 per cent on Thursday to 7490.3; while the broader All Ordinaries index dropped 44.7 points, or 0.6 per cent, to 7695.8. Energy was in the spotlight, with the Mike Cannon-Brookes-backed AGL Energy plunging 82 cents, or 10 per cent, to $7.12 after the company downgraded full-year earnings guidance, cut its dividend and reported…

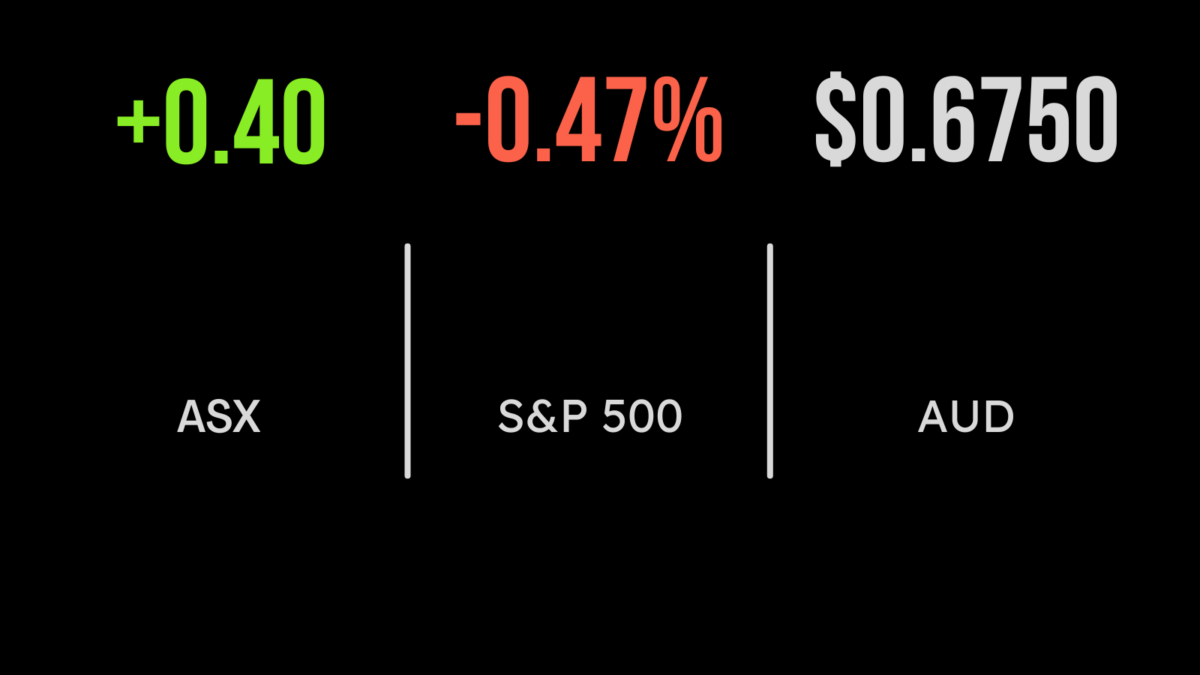

The benchmark S&P/ASX200 index on Wednesday advanced 26 points, or 0.4 per cent, to 7,530.1, while the broader All Ordinaries closed 27.4 points to the good, also 0.4 per cent, at 7,740.5. Goldminer Newcrest added another 65 cents, or 2.6 per cent, to $25.60, taking its gain to almost 14.5 per cent since it received a $24.5 billion takeover offer from US…

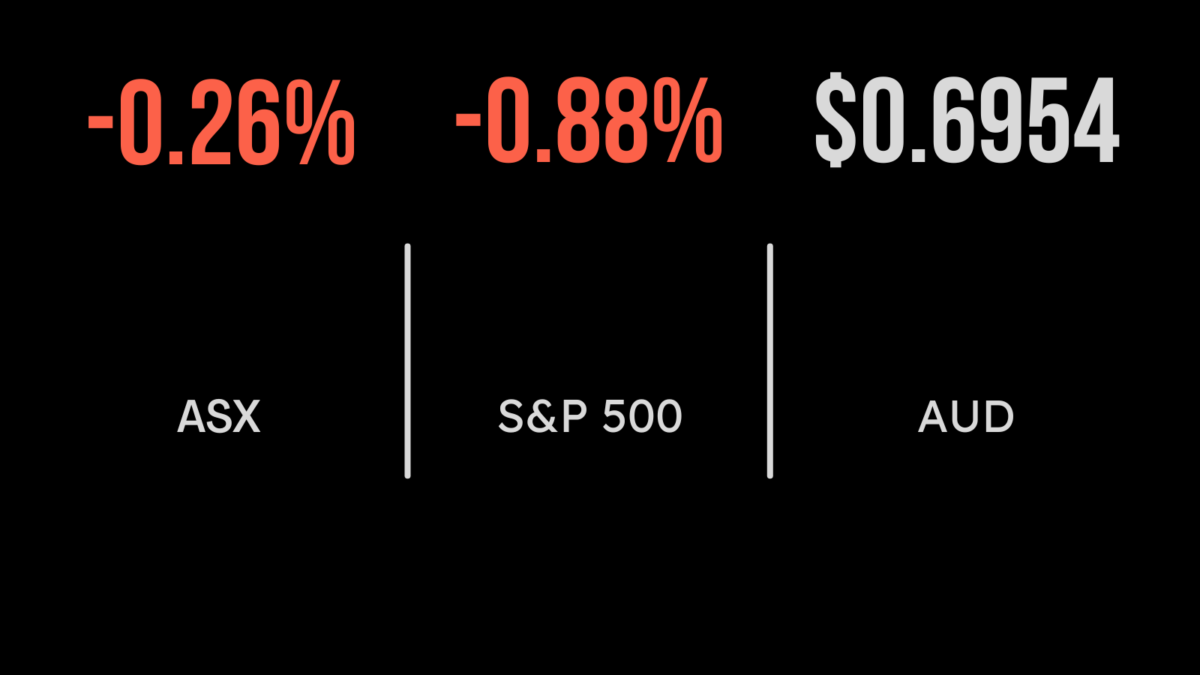

Australian shares ended a five-day winning streak on Wednesday, and the Aussie dollar rose, after the markets learned that inflation in Australia had risen to its highest point since 1990, at an annual rate of 7.8 per cent in the December quarter, beating economist forecasts of 7.6 per cent. Even the Reserve Bank’s preferred measure of “trimmed mean…

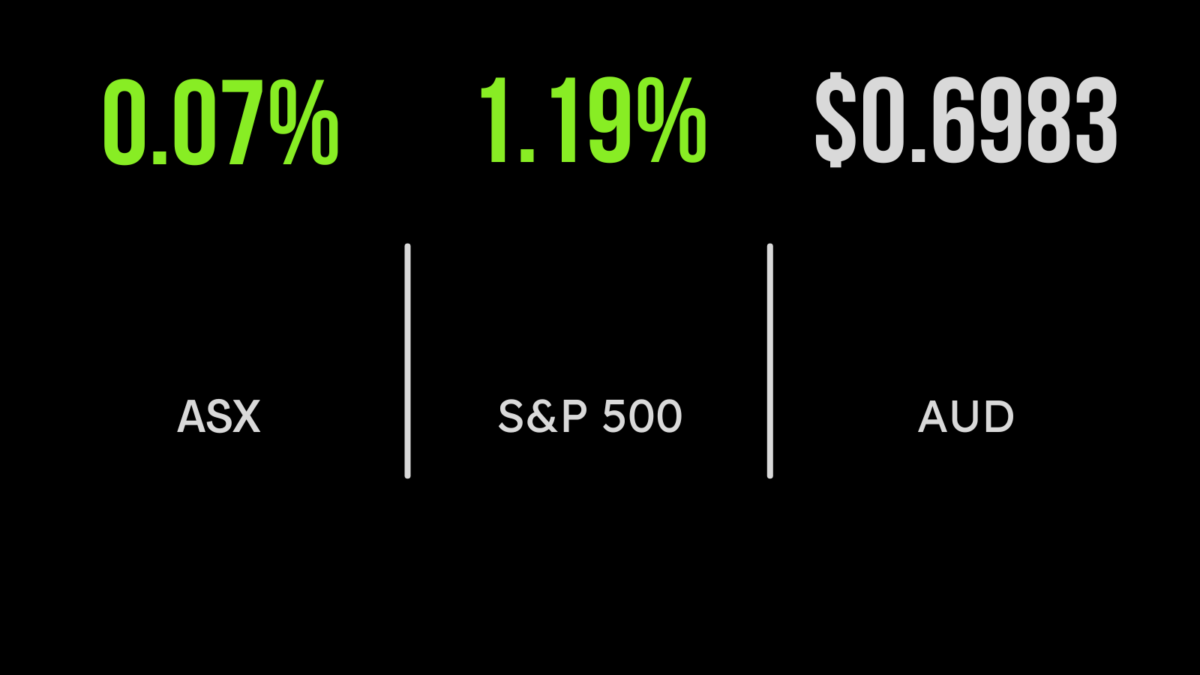

Upgrades in expectations for lithium price growth helped to lift the Australian sharemarket on Tuesday, driving a strong day for miners. Broker UBS lifted its lithium price forecast as much as 50 per cent, and the lithium players saw plenty of green. Pilbara Minerals gained 25 cents, or 5.2 per cent, to $5.08, while fellow producer Allkem was up…

The S&P/ASX 200 continued its strong early-2023 form on Monday, advancing 5.1 points, or 0.1 per cent, to a fresh nine-month high of 7457.3 points. The broader All Ordinaries index added 7.9 points to 7,674.2. It has been quite some time since the buy now, pay later (BNPL) stocks were on a tear, but the former darlings turned the clock…

The local market managed to finish what appeared a mixed week on a positive note, gaining 0.2 per cent. Powered by the energy and materials sectors, up 1.4 and 0.9, on news of higher iron ore and oil prices, the S&P/ASX200 managed a 1.7 per cent gain for the week. Whitehaven Coal (ASX: WHC) was…

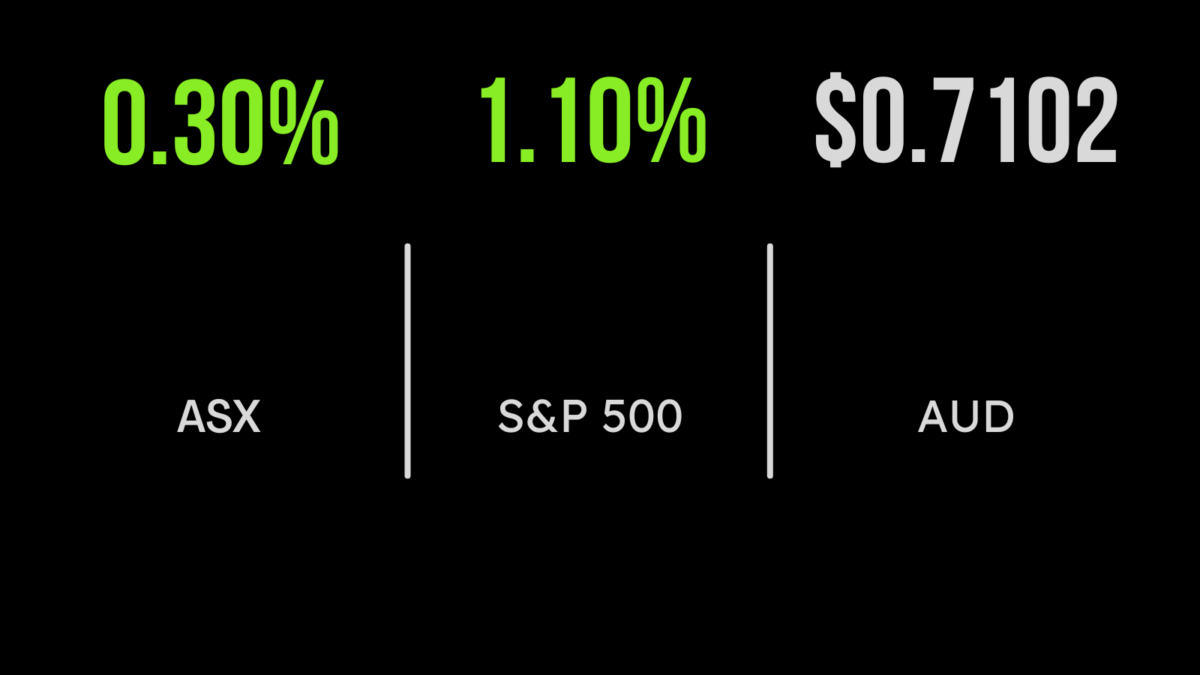

The local share market advanced to a fresh eight-month high on Thursday after weaker-than-expected jobs data showed the Australian economy slowing, raising expectations for less aggressive rate hikes from the Reserve Bank. The benchmark S&P/ASX200 index closed on Thursday up 41.9 points, or 0.6 per cent, to 7,435.3, its best level since April 22. The broader All Ordinaries gained 38.9 points,…