ASX nudges ahead after inflation hit

ASX creeps to gain, Woolies warns of Inflation, CPI data sends bonds lower

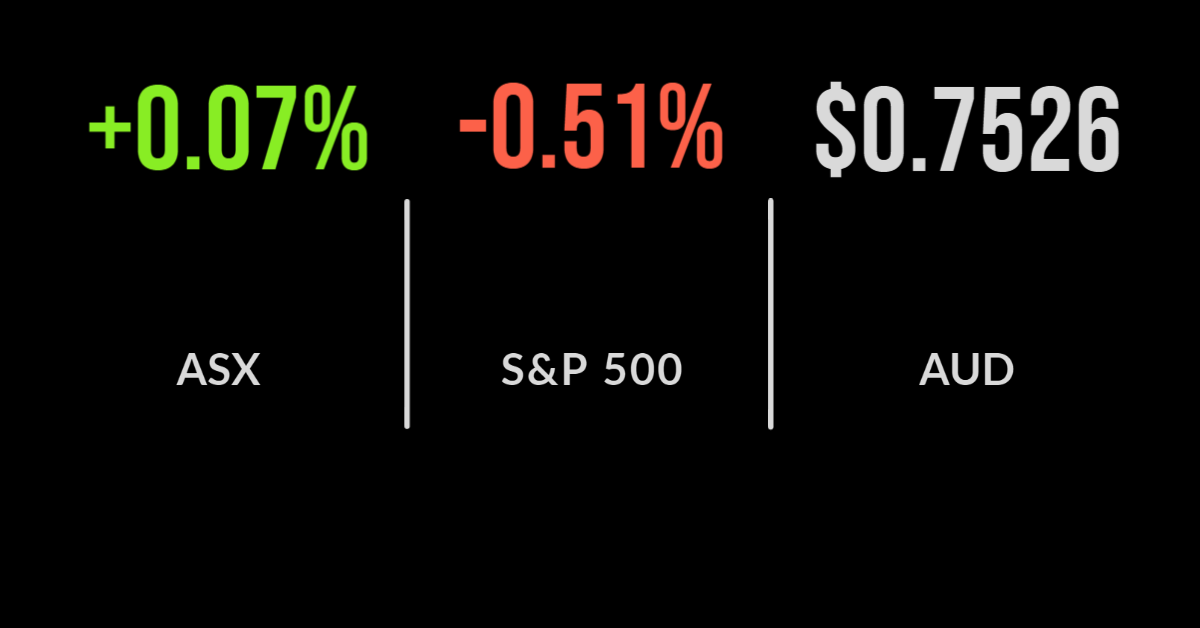

The S&P/ASX200 (ASX: XJO) managed to eke out another small gain on Wednesday, keeping the run of positive days going.

Most weakness came from the staples sector, down 1.9%, after Woolworths (ASX: WOW) delivered a difficult third quarter update.

The mining and utilities sectors were also down over 1% with the defensive communication and healthcare sectors the major beneficiaries; CSL (ASX: CSL) gained another 1%.

Woolies fell 3.2% after management delivered an update following the “most challenging COVID quarter” due to supply chain and staffing disruptions.

Total sales were 7.8% higher than the previous year, with Australian food gaining 3.9 and online sales exceeding 12% of total sales after growing by another half.

The BIG W division was among the hardest hit, sales falling 17% as the majority of stores were closed and some 22,000 works have been forced to Isolate at some point in time.

Shares In ‘carbon free’ lithium explorer Vulcan Resources (ASX: VUL) fell around 10% before entering a trading halt.

Short selling research firm J Capital launched a highly publicised report on the firm which management has quickly rebutted. As usual, these things will take a few weeks to play out on the market.

Tepid inflation, A2 Milk’s hikes forecast

Shares In A2 Milk (ASX: A2M) gave back recent gains, falling 12% after the new CEO announced the target of reaching $1.9 billion in sales in the medium term.

Investors were clearly concerned that margins would fall into the ‘teens’ as the company seeks adjacent category growth in China and an expansion into other emerging markets.

In better news, the company has partnered with The Hershey Company to create a co-branded chocolate milk product.

Australia has joined the rest of the world with inflation jumping 3% In the third quarter compared to 2020 levels, slightly below estimates of 3.1%, with the rate 0.8% for the quarter.

As has been the case overseas, the increase was driven almost solely by higher fuel costs (up 7.1%) and new dwelling purchase costs (up 3.3%), with the underlying inflation rate closer to 2.1%.

Bond yields jumped on the result and some experts are now predicting rate hikes in 2022, despite the RBA reiterating their Intention to hold off until 2024.

Ultimately, any changes in rates will come down to wages and a reduction in underemployment, both of which apart from a few sectors seem a long way off.

Nasdaq outperforms as bond yields slide, Microsoft, Alphabet smash expectations

US markets were mixed on Wednesday, with the Nasdaq finishing flat but the Dow Jones and S&P 500 falling 0.7 and 0.5% respectively after another solid earnings update from the tech giants.

An unexpected division to cancel bond purchases and potentially hike the cash rate by the Canadian central bank sent US bond yields sliding the most in several months, support tech valuations.

But it was all about earnings with both Microsoft (NYSE: MSFT) and Alphabet (NYSE: GOOGL) flexing their muscles once again.

Microsoft reported quarterly revenue exceeding US$40 billion for the first time ever as cloud sales jumped by a third in the quarter alone.

Earnings hit US$20 billion as margins improved and both the Azure cloud and personal computing businesses contributed to the bottom line.

Management was quick to stress the deflationary impact of technology in driving down business costs amid a period of inflation; shares were 4% higher.

Alphabet also beat expectations gaining over 5% after nearly doubling earnings during the quarter after another 41% increase in advertising revenue.

The company has shown its greater resilience compared to Facebook (NYSE: FB) which is being impacted by Apple’s recent privacy changes.