ASX subdued as investors look to Jackson Hole

Flat finish but positive week, Wesfarmer’s big dividend, losers keep losing

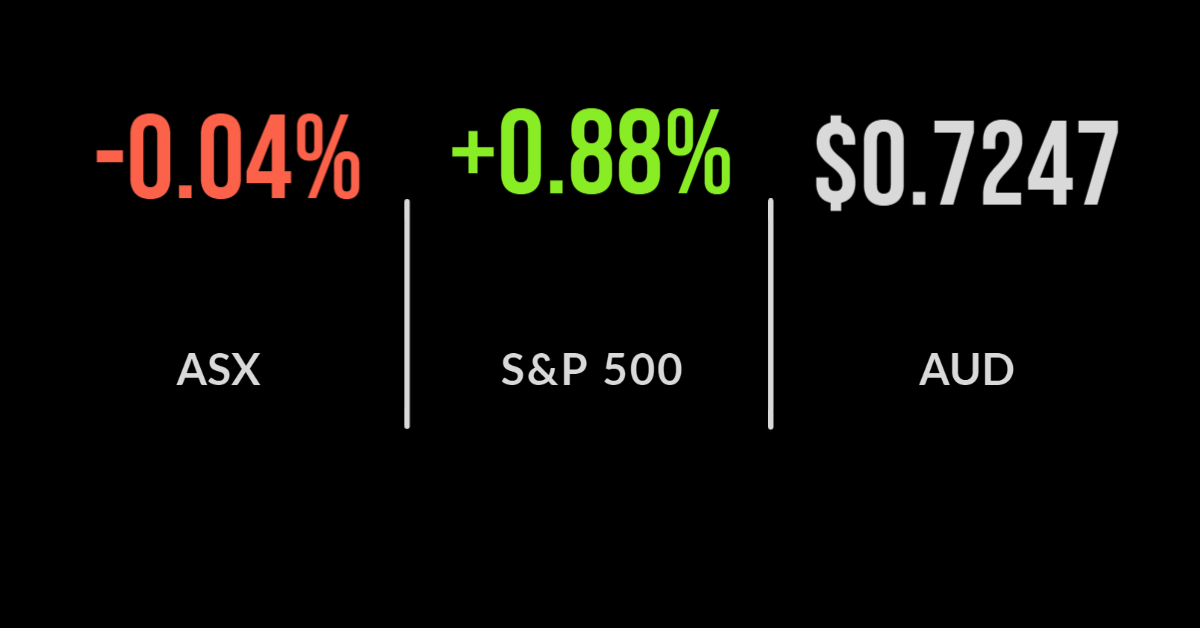

The ASX200 (ASX: XJO) finished just 3 points lower on Friday but managed a 2.2% gain for the week.

The discretionary sector dragged the market lower behind Wesfarmers (ASX: WES) which fell 1.6%, with Appen (ASX: APX) also dragging the IT sector lower (down 1.2%) falling 6.1% as investor desert the popular growth stock.

Investors switched back to industrials and utilities as the reopening outlook remains murky, with Qube (ASX: QUB) and Origin Energy (ASX:ORG) both over 2% higher.

But it was all about Wesfarmers with the diversified conglomerate announcing a 17% increase in its final dividend and a $2 per share capital return following a stunning year from the well-managed company.

Profit increased 16% to $2.42 billion, driven by double digit growth at Bunnings and KMART and a solid return from Officeworks.

Revenue at the former was 12% stronger, not bad for a mature business, with KMART, Target and Catch Group together growing 69% amid an e-commerce boom.

The week was dominated by earnings surprises, primarily negative, with staples and consumer sectors both down, 3 and 1.3% respectively, with both Kogan (ASX: KGN) and Link (ASX:LNK) unable to live up to inflated expectations.

WiseTech Global (ASX: WTC) was the standout, jumping 29.3%, with Qantas (ASX: QAN) jumping 21% after outlining their plans to exit this lockdown mess.

US rallies as Powell holds the line, Affirm the latest BNPL hit, China looks to stimulate again

It was more of the same at Jackson Hole on Thursday, with little in the way of new commentary for markets to digest.

Fed Chair Powell confirmed the possibility that tapering begins this year assuming the economic recovery continues as expected.

As we know from 2020, that is a significant assumption. Markets responded by closing at new records, the Nasdaq adding 1.2% after bond rates contracted slightly.

Every sector finished higher but particularly energy and mining, which sent the Dow Jones and S&P 500 up 0.7 and 0.9% respectively.

It was a similar trend across the week with the Nasdaq continuing its resurgence, up close to 3%, after chip maker NVIDIA (NYSE: NVDA) announced they would be increasing the price of their in-demand products.

The S&P 500 and Dow Jones finished the week up 1.5% and 1% whilst the Russell 2000 Small Cap index had its strongest finish five months.

Consumer spending continued to improve, adding 0.3%, well behind the 1.0% growth in June with additional parenting payments not flowing through.

Inflation remains at a 30 year high, printing at 4.2%, however, it remains clearly driven by shortages and supply chain issues rather than being a sustained increase in prices.

The Chinese government has flagged the recommencement of stimulus in 2021 after being the first to put the handbrake on their economy in 2020, suggesting the second half may be positive for investors in Asia.

Finally, the BNPL frenzy continued with shares in US player Affirm (NASDAQ: AFRM) jumping 35% in after-market trade on rumours they would be the preferred provider to Amazon.

Cash splash, avoiding mistakes the key, comparables bite but do they matter?

With just two days remaining in reporting season there is little doubt the corporate sector is in rude health, with stunning earnings growth and a splashing of cash.

Analysis has shown that as much as 5% of GDP is set to hit shareholder and fund manager bank accounts this week with a record $51 billion in dividends already declared in addition to $15 billion in buybacks.

This comes on top of $34 billion in takeover offers currently in process. On the one hand it’s a boon for patient investors on the other, questions must be asked as to why companies aren’t reinvesting in themselves given the level of disruption in the world today.

With markets high on historical valuation metrics, this week reiterated that avoiding mistakes will be as important as being exposed to the best growth opportunities.

The likes of Kogan, Appen and A2 Milk evidenced what can happen when short-term trends are extrapolated into the future and the fact that no management team is perfect.

Each company has faced significant disruption, failed to make the right decisions and ultimately communicated poorly to shareholders.

Finally, Woolies and Wesfarmers earnings reports both warned of lower comparables in 2022 after 2021 benefited from the weaker lockdown figures.

Whilst no doubt important, on a longer-term view, investing into quality companies, that are well managed and investing into their own businesses remains more attractive than chasing the next hot stock.