ASX unchanged as miners and financial firms wrestle

No records today, Suncorp smashes expectations, Transurban’s problem tunnel

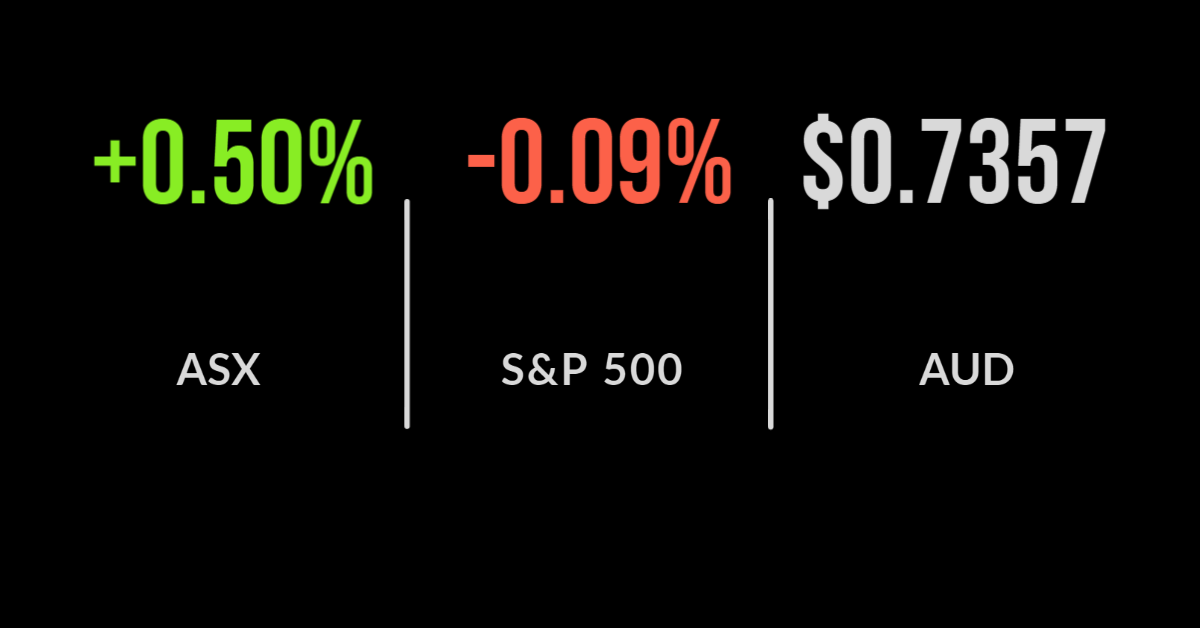

It was a flat day for the market despite a strong positive start, with the S&P/ASX 200 (ASX: XJO) giving up its initial 0.5% gain slowly throughout the afternoon.

The majority of sectors were lower, or more broadly flat, with the financials sector the only real positive contributor jumping 1.3% after Suncorp Group’s (ASX: SUN) stellar result.

The materials and energy sectors continue to feel the brunt of the sell-off with precious metals falling after strong employment figures in the US, Northern Star Resources Ltd (ASX: NST) was down 3.7%.

All eyes were on banking and insurance group Suncorp, which jumped 7.8% after reporting a 13% increase in net profit to $1.03 billion despite just a 4% increase in revenue.

Cash earnings before write-downs and bad debts surged 42% with the banking division delivering an outsized gain of 69% due to the continuing boom in residential property markets.

The result was a dividend that smashed expectations, 40 cents per share, up from just 10 cents in 2020, along with an 8 cent special dividend.

The result lifted the rest of the banking sector with Westpac Banking Corp (ASX: WBC) adding 1% after announcing the sale of its Australian life insurance business to TAL for $900 million. The deal comes with a 20-year contract to continue distributing the products to clients.

West Gate holding back Transurban, Aurizon weak result, Magellan AUM jumps

Transurban Group’s (ASX: TCL) recovery from the pandemic has taken a hit from its troubled West Gate Tunnel project, with the group reporting a 9% fall in cash from continuing operations to $2.89 billion.

This resulted in a loss of $287 million, which was reversed by the recent sale of its US assets to a number of pension funds for $3.73 billion, reiterating the importance of looking beyond the headline figures.

Sydney and Brisbane traffic had returned towards normal levels, but both the US and Melbourne assets remained heavily impacted as lockdowns extended.

The bad news, however, was a $3.3 billion blowout on a $6.7 billion initial budget with the Victorian Government threatening legal action if a commercial agreement for completion isn’t put in place; shares fell 2% on the news.

Coal-focused rail group Aurizon Holdings Ltd (ASX: AZJ) also released FY21 results, reporting a 1% increase in profit to $533 million despite a 1.5% fall in revenue.

The group increased its dividend to 14.4 cents per share, slightly ahead of 2020 levels. Aurizon shares added 1.7% on the result.

Magellan Financial Group Ltd (ASX: MFG) continues to dominate its traditional rivals with assets under management jumping $4 billion in July, some 20% of Platinum’s (ASX: PTM) total assets under management.

Elsewhere, Charter Hall’s Long WALE REIT (ASX: CLW) saw earnings increase 30% on 2020 levels following acquisitions that saw its net tangible assets grow 17% to $5.22 per share. CLW shares finished 2.8% higher.

US markets mixed, gold in flash crash, oil prices fall

US stock markets broke their positive run with the Dow Jones and S&P 500 falling 0.3% and 0.9%, respectively, as commodity markets continue to digest the impacts of the Delta variant.

Both the energy and real estate sectors were among the hardest hit as the Chinese Government’s policy of seeking to eliminate COVID-19 has sent growth expectations for the economy lower following the latest Wuhan outbreak.

Gold bullion was also hit as another Federal Reserve official warned that the tapering of bond purchases lies ahead in the coming months. It hit its lowest point since March, yet little has changed on the difficult outlook for the global economy.

The UN International Panel on Climate Change also released their latest report, suggesting that it is ‘unequivocal’ that humans have had an impact on the climate and predicting that weather disruptions will continue to increase in regularity.

The Nasdaq was the standout, adding 0.2%, as shares in Moderna Inc (NASDAQ: MRNA) surged over 17% following the approval for use of its COVID-19 vaccine here in Australia.