-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

It turns out not everybody wants flash new overseas offices. And while funds aren’t sweating the constraints of Your Future, Your Super when it comes to private markets, some assets are just better handled in the public ones – illiquidity premium be damned.

Last year’s savage selloff hit ESG strategies hardest, but it hasn’t hit the appetite from big institutions. Their tastes have just become more discerning, with more stringent criteria for external manager selection.

The custodian is exploring use cases for machine learning and generative artificial intelligence to give its clients help in parsing – and visualising – the vast quantities of granular data now available to them.

Super funds want to put their $300 billion of annual inflows to work in new renewable energy infrastructure. But policy settings, Your Future Your Super and intensifying competition for local assets could all have unforeseen consequences.

The newly launched Scarcity Partners wants to help take emerging asset managers to the next level. With stormy weather still forecast for markets, it’s a great time to buy.

Private credit and unlisted infrastructure are on the offshore shopping list, but some funds feel illiquid assets aren’t worth the stress (testing). And YFYS isn’t just driving asset allocation decisions – it might start influencing product development too.

The asset consultant will modify its team composition in response to shifting client demand and build out its younger ranks as it executes on its new five-year plan.

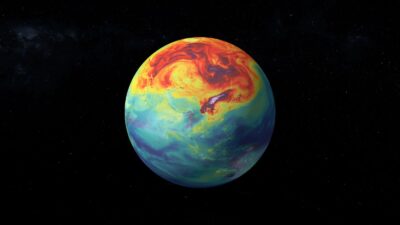

The use of climate-related investment practices is seeing a sharp fall among the global institutional investor set, while more than half of them are worried about achieving the best returns while delivering emissions reductions targets.

BNP Paribas’ securities services division has had a big win after being brought in to keep the preferred candidate honest on price during the tender process for MLC.

Teams from Pzena and Invesco scored highly against the Northern Trust-backed Essentia Analytics’ Behavioural Alpha Benchmark, a system designed to differentiate between luck and true investment nous.

Following a significant technology and systems uplift, Rest feels it’s ready to do global equities in-house. That doesn’t necessarily mean its roster of external managers will lose out.

Environmental, social and governance (ESG) funds should forget fiduciary duty, dump ratings and adopt extreme exclusions in a radical revamp of the investment overlay proposed in a US academic paper.