-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

With three separate businesses now combined under the Insignia banner, MLC Asset Management CIO Dan Farmer says his focus is no longer on “fixing problems” but on driving returns – and he’s looking to niche asset classes to do it.

Natural catastrophe reinsurance and music royalties have been big winners for PG3, the family office of the founders of Partners Group, which is now bringing its “highly differentiated” uncorrelated strategy to Australian investors.

European private credit manager Park Square Capital is flying into Sydney in search of institutional flows as super funds super-charge their allocations to the asset class.

The two funds are pressing on with their “merger of equals” after hammering out the new entity’s board and leadership structure, promising complementary capabilities across retirement and advice, as well as fee savings for members.

The $350 billion profit-to-member fund will be trying to rustle up some desk space in its London office as it makes a slew of new appointments and prepares to deploy 70 per cent of new inflows into global markets.

Nearly every Australian has super, but its settings don’t work for every Australian, according to the First Nations Foundation, which is advocating for changes around estate planning and the preservation age to make the system fairer.

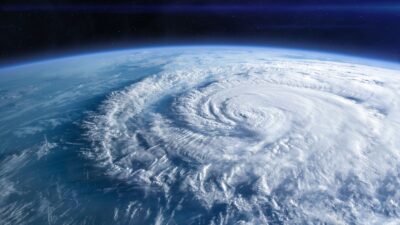

Betting against acts of God is a great way to make money, but institutional allocations to natural catastrophe reinsurance have stayed relatively static even as some managers are generating double-digit uncorrelated returns.

With heightened anxiety around service outages, and CPS230 coming into effect next year, State Street and a slew of other custodians are working with ACSA to enhance their response to the critical operational needs of super fund clients.

Some members are excited for retirement, while others approach it with a “real sense of shame and fear”. Funds are going to have to figure out how to cater to both groups or risk failing them all.

Opening up early access to super for housing would have a negative effect on the balances of even those members that don’t dig into their savings, with funds forced to adopt more conservative investment strategies and hold more liquid assets.

The circa $88 billion industry fund for workers in health and community services reckons that alleviating the affordable housing crisis will boost its other investments by easing the cost of living and inflation.

The chief member officer of the circa $90 billion profit-to-member fund will step down after “nine terrific years” in the role with the fund now commencing its search for a replacement.