-

Sort By

-

Newest

-

Newest

-

Oldest

-

All Categories

-

All Categories

-

Appointments

-

Custody

-

ESG

-

Funds Management

-

Super

As funds get bigger and bigger – and the Your Future Your Super (YFYS) performance test bites – they’re rethinking everything from alpha generation to their intrinsic investment philosophies. While the increasing size of super funds will benefit them in unlisted markets – where big funds can increasingly play on the same field as global…

According to Pzena Investment Management, the value cycle is now truly under way – and shows no signs of slowing. New York-based Pzena Investment Management began to track the value rotation in late 2020, with its analysis research showing that deep value stocks have outperformed by around 37.4 per cent since. But the question…

Factor-specialist Northern Trust Asset Management (NTAM) has established a quantitative investment team targeting the Asia-Pacific region. Australia-based, Scott Bennett, will head the new NTAM APAC quant unit across the dual locations of Melbourne and Hong Kong. Bennett joined NTAM in 2018 as head of quant research for Australia and NZ. Before moving to NTAM, Bennett…

As merger activity continues apace, State Street – armed with its “unique” front-to-back solution – intends to take a dominant position as custodian of choice for the biggest end of town. The super industry and its custodians are now exiting a period of relative stability. The number of funds has more than halved in the…

Schroders has launched likely the first dedicated fund managed directly to the Your Future, Your Super (YFYS) benchmark for alternative investments. The Global Active Allocation Fund, which has secured a foundation investment mandate from a large super fund, is a multi-asset portfolio with the objective of outperforming the YFYS benchmark applying to alternative investments and…

Rumoured talks between NAB Asset Servicing (NAS) and HSBC have re-opened the possibility that Australia’s last homegrown custody business will finally close its doors. The latest rumour circulating through Australia’s tight-knit asset servicing industry is that HSBC is pitching to negotiate the potential transfer of NAS’ 30 largest clients to its business, while NAS would…

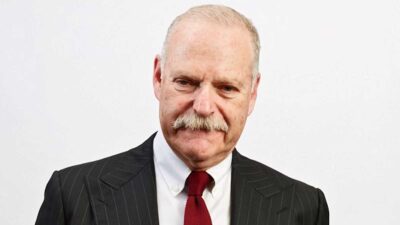

Before Jack Diamond, a super industry and funds management stalwart, was diagnosed with cancer his friend Josh Funder had come up with the idea of sponsoring an award for innovation in finance. It is called the ‘Diamond Award’. For Funder, the founder and chief executive of Household Capital, an innovative firm itself which lends to…

HSBC has recruited a State Street custody veteran as part of a long-planned expansion of its own business. Sinclair Scholfield has been appointed head of sales and client management for HSBC’s Securities Services business in Australia and New Zealand. Scholfield spent the last 18 years at State Street, where he was most recently head of…

A mere 13 funds were dispatched by the first round of the Your Future Your Super (YFYS) performance test. Chant West believes the damage could be worse in the choice sector. Later this year, APRA’s performance test will be brought to bear against the choice sector after a dry run on the smaller universe of…

AustralianSuper will build its financial penalty war chest from its administration reserve instead of new member fees, but has left the door open to future admin fee hikes. AustralianSuper has changed its Trust Deed to include a right for its trustee to be paid a limited “Trustee Risk Reserve Fee” (TRRF) in light of the…

Carbon analytics fintech Emmi has appointed a chief operations officer as it onboards a slew of new super fund and consulting clients. Rebecca Bannan, who was previously Emmi’s head of strategy and operations, will step into the role of chief operations officer. Bannan, a chartered financial analyst, was previously investment director for strategic advisory at…

Mercer has proposed a slew of tax changes to address the super system’s “inherent bias towards high income earners” and reduce the gender pension gap. Under Mercer’s proposed changes, individuals with balances over $5 million would be required to reduce their balance to that amount and those over the age of 75 would be required…