-

Sort By

-

Newest

-

Newest

-

Oldest

BlackRock has a message for investors trying to navigate the confusion that has sundered markets in recent weeks: get used to it. Rising inflation was enough to give markets the jitters; tack on a war – and the prospect of an even bigger one, should the situation in Ukraine devolve further – and all the…

Hyperion believes that the sell-off in growth stocks in recent months has become indiscriminate, with the market failing to differentiate between trend setters and trend followers. The last few years has seen the ascendancy of high growth tech stocks in US and global markets, to the extent that many bears now believe it’s a bubble…

As China’s domestic market liberalises and regulatory upheaval eases, quant strategies stand to gain that will gain from the massive inefficiencies in its “opaque landscape.” While many bottom-up investors tout the domestic consumption story as the main reason for getting involved in China A-Shares, its huge, retail-dominated market also makes it perfect for a “nimble,…

As the amount of capital available to them soars and equity markets grow more volatile, companies increasingly don’t want to go public – and don’t need to. The number of publicly-listed companies on US exchanges has roughly halved from 8000 to 4000 in the last 20 years, according to Liberty Street Advisors. And while part…

Commodities and active cross-asset ‘trend-based’ strategies should provide the most effective bulwark against entrenched high inflation if history holds true, an award-winning study has found. Based on almost 100 years of market data from the US, UK and Japan, the paper, titled ‘The best strategies for inflationary times‘, picked up the 2022 Bernstein Fabozzi/Jacobs Levy Awards as…

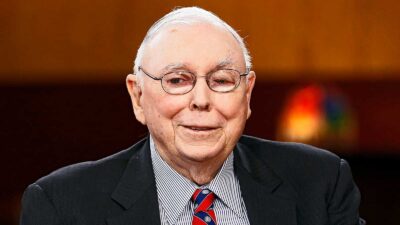

The near-centenarian investor believes that institutions like BlackRock and Vanguard will wield outsize power in the market, and that our latest period of “wretched excess” will end with a bang. As passive investing becomes the go-to for a new wave of dumb money, Wall Street’s masters of the universe have been replaced with the emperors…

The last two years have seen an “anomaly” in equity markets where stocks with no dividends were king. But those who “kept the faith” might finally be rewarded. The concept of duration, while intrinsic to fixed income, doesn’t get much of an innings in equities. But John Tobin, managing director and portfolio manager at Epoch…

Investors are focusing too heavily on the transition to renewables and aren’t seeing the catastrophic implications of a short fall in oil supply, according to Pzena Investment Management. In recent times, a number of institutional investors have made waves by announcing sweeping divestments from fossil fuels like oil and thermal coal. But investors are pricing…

Asset owners haven’t been challenged with a sustained crisis in nearly 20 years, and it’s possible they’ll get one just as they make the jump into markets they’re unfamiliar with. Governance will be key. As inflation climbs and market volatility increases, Rich Nuzum, president of Mercer’s investments and retirements business, says that asset owners need…

AMP Capital has a new name and new suitors as it approaches a demerger in June. But AMP CEO Alexis George is playing her cards close to the chest. After a short stint as “PrivateMarketsCo”, AMP Capital will become Collimate Capital in an effort to provide a clean slate in the aftermath of the Boe…

Magellan’s funds are unlikely to survive the departure unscathed, but commentators seem to believe the business will be better for the long-term. There seemed to be little sign that Hamish Douglass was in distress last week. He happily talked his book at a Morningstar conference as a horde of retail investors grew increasingly frustrated on…

Renowned US hedge fund Bridgewater Associates is tipping a messy market transition as inflation and interest rate changes wash through the global financial system this year. Bridgewater, founded by Ray Dalio (photo at top), warns that while extraordinary COVID-era global monetary stimulus measures have finally kick-started the real economy, investors remain overly optimistic about the…