-

Sort By

-

Newest

-

Newest

-

Oldest

AMP has a long road ahead. But the big challenge isn’t to change the culture – it’s making everybody else care about it. For decades, the AMP logo has sat high above Sydney Harbour, a potent symbol of one of Australia’s oldest companies and an integral part of what many consider entirely peripheral: brand. Now…

When it comes to the question of who’s actually doing the research work, investors know the answer. And they don’t feel like sitting on the sidelines during a crisis. Some trends you can see from space. Inflows into ESG equity funds on the Calastone network between January and November were US$30 billion – 60 per…

Fund managers are subject to behavioural biases like all of us, such as over-confidence, short-termism and memory distortions. Take their predictive abilities. They are not, on average, especially good. In a unique report for clients, Frontier has published what amounts to a longitudinal study based on eight years of conversations, surveys and other communications with…

Member engagement is starting to rise from a very low base. But the industry is still “net nowhere” when it comes to winning their hearts and minds. It’s widely acknowledged that member engagement remains unacceptably low. Try as they might, super funds can’t seem to get members to care about their retirement savings, as evidenced…

The economic aftermath of Covid-19 was never going to be as bad as it seemed at the time. But governments will be hooked on splashing cash. “Economic scarring” was all anybody could talk about in the immediate aftermath of the first wave of Covid-19, and for good reason; it’s well understood that the effects of…

The companies that will survive the tectonic shift to net zero will be the ones that innovate and engage, according to GAM. “What we’re going into is a scenario where those companies that are going to survive and thrive are those that recognise net zero as the North Star and look at their strategy around…

Today’s investors are “riding for a fall”, according to Oaktree Capital founder Howard Marks. Markets could well be in for a repeat of the Nifty Fifty. When Howard Marks was just starting his career in finance in 1969, the preceding 20 years had been “a “mostly unchanging backdrop… in front of which events and cycles…

Strong super returns are about to encounter significant headwinds. And with the government prowling for more money, funds might once again foot the bill. It’s no secret that market conditions have been enormously supportive over the last decade – and that super has been one of the biggest beneficiaries of those conditions, particularly through 2020,…

Active manages have failed to heed changing times – and changing markets. But while Hyperion doesn’t do “concept stocks”, it’s got its eyes on plenty of disruptors. The great elephant in the room for active managers has been their inability to outperform the index long-term. Around 93.4 per cent of international equity managers and 86.3…

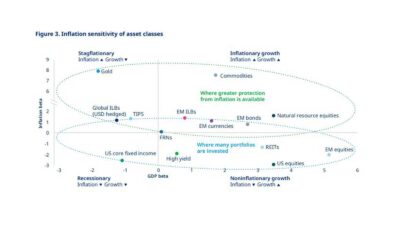

Mercer has urged investors to consider a wider range of inflation scenarios in portfolio design plans as price uncertainty ramps up across the world. In a new paper, the global multi-manager and consultancy firm says investors now face more complicated decisions amid confusing inflation signals. “Adding a less predictable inflation environment now increases complexity for…

The trend towards super consolidation is continuing apace, but there will be fewer mega mergers. It’s now just a matter of mopping up. Mega fund mergers are likely to slow as boards realise the “significant transition planning and integration activity” required to pull them off – but the established mega funds will continue to gobble…

They might be behemoths at home, but Australia’s biggest super funds will be on the backfoot as they scour the globe for investment opportunities. NAB’s biennial FX Hedging survey is not only a good insight into super fund hedging strategies, but the state of the industry itself – particularly its growing interest in markets beyond…