-

Sort By

-

Newest

-

Newest

-

Oldest

Private debt is starting to attract a broader range of investors, including high net-worth individuals and smaller funds who are searching for yield combined with capital preservation. The attraction, alongside traditional supporters among the big super funds, has also been helped by increasing concerns about inflationary expectations – whether this will be transitory – and…

Funds should allow retiree members to request they select a retirement product on their behalf, and create “safety net provisions” for those who don’t, according to new research. New research by David Bell, executive director of the Conexus Institute, Geoff Warren, associate professor at the Australian National University, argues that relying solely on retirees to…

Big sovereign and public sector funds globally have skewed their investments to their domestic markets since the outbreak of covid-19, according to a report by Global SWF. However, the two Australasian sovereign funds, Future Fund and New Zealand Superannuation Fund, have stayed the course with their investment strategies, according to spokespeople for those organisations. The…

The portfolio that drives excess returns over the next decade ‘will likely look a lot different’ than that of the 2009-2019 period as the world enters a new era of outsize economic policy. Private equity giant KKR believes that markets are accepting “the visible hand” of government intervention across areas as diverse as inequality, monopolistic…

Fund managers show a keen willingness to embrace data science and systems such as centralised data platforms for decision making when it comes to formal surveys. But the reality is still something different. According to a survey of 300 global asset management firms sponsored by the asset servicing arm of Northern Trust, nearly half (48…

The value vs growth competition isn’t a competition, according to Schroders. Value will always outperform because it exploits “the one thing that never really changes”: human beings. Markets have seen a period of very strong value performance since the announcement and rollout of effective Covid-19 vaccines – the so-called “Vaccine Monday” – as markets reappraised…

In the beginning was the word and the word was ‘ethical’. Now we have lots of words: ‘responsible’, ‘sustainable’, ‘stewardship’, ‘environmental’, ‘social’ and ‘governance’. And perhaps a new word: ‘singularity’. The Singularity Group is a Zurich-based global investment boutique and research firm which uses quantitative techniques to seek out companies which have sustainable innovation as…

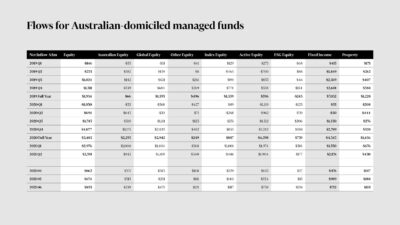

The recovery of inflows into equity and other growth-orientated managed funds which started towards the end of last year has faltered, with the second-consecutive quarter of slower growth. According to the latest figures from Calastone, the global funds data network, net inflows for both Australian equities and Australian-domiciled global equities funds were, together, down about…

New studies from two big-name consulting firms show the global funds industry struggled to increase profit margins in 2020 despite reporting bumper growth in assets under management (AUM). Reports from both EY and the Boston Consulting Group (BCG) found double-digit expansion in global funds management AUM during 2020. The BCG study says AUM increased year-on-year…

A key and enduring theme of the work of the Australian Custodial Services Association is the search for ever-greater efficiency in financial markets. Custodians need always be prepared for the next ‘Uber moment’. The latest such moment came in February last year when Magellan Financial Group launched the first quoted managed fund, on behalf of…

The flow of money into ‘dedicated sustainable investing’ will accelerate over the next four years, with global assets hitting US$13 trillion (A$17.8 trillion) by 2050. But there are steep hurdles for fund managers hoping to take part. According to a study by Casey Quirk, a US-based Deloitte business, the four-fold predicted increase from the US$2.8…

Failing to take advantage of the recovery trade looks bad. But with Alibaba, Magellan missed a risk you could see from space. Hamish Douglass, Magellan chairman and chief investment officer, has been much maligned in recent months for something that’s probably his fault but not actually his problem: missing the market rally in late 2020….