-

Sort By

-

Newest

-

Newest

-

Oldest

In an environment of low interest rates and seemingly overvalued sharemarkets, advisers are naturally flocking to alternative asset classes to eke out returns. Yet not all alternative assets are created the same. The COVID-19 sell off and subsequent recovery has truly seperated the good from the bad. In this webinar, PIMCOs Chris Santore, will shine…

In the wake of the pandemic, investors have continued to pile money into variously labelled ESG/sustainable funds. Are they doing what they say?

TikTok can be described as a social networking app, primarily used by millennials, to share and view amateur video content. The app is Chinese owned. Known as Douyin, owned by ByteDance. As of August 2020, TikTok, had surpassed 1 billion users worldwide in less than four years. How does it work? Users film videos of…

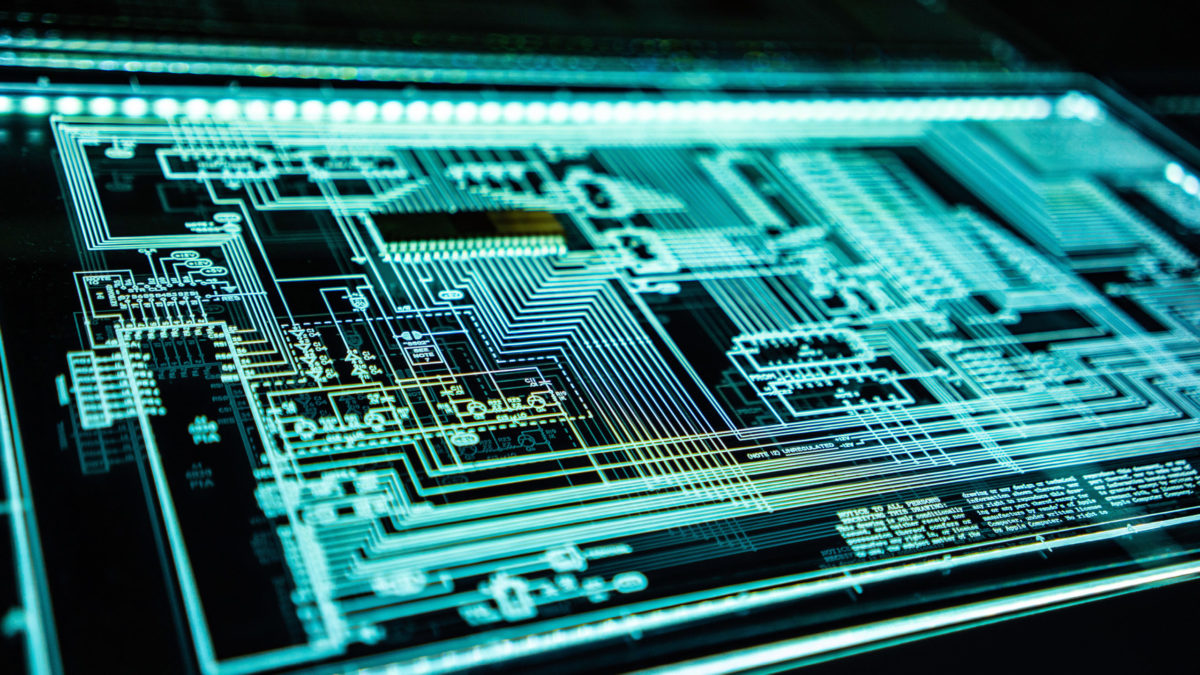

Semiconductors would have to be one of the most pervasive and critical pieces of technology in our daily lives – but they are usually not thought about very much. They certainly don’t seem to get the investment love like they should, or get talked about as much as, say, the FAANG stocks or electric vehicle…

ASX 200 down 0.9%, Federal Reserve boosts US markets, AUD hits a 12 month high The ASX 200 (ASX:XJO) finished 0.9% lower on Friday and down 0.6% for the week; the second straight week of losses. Selling was broad-based but particularly coming from materials, down 1.8%, as Australia upped the trade war ante following PM…

It was a mixed day for the market, the ASX 200 (ASX:XJO) finished 0.2% higher despite trading up as much as 0.8% during the day.

Pandemic tailwind to flow into 2021 for Woolies Woolworths Ltd (ASX:WOW) delivered a weaker than expected result, despite a 6% increase in revenue to $63.6 billion for the financial year. Net profit fell to $1.166 billion with the biggest hit coming from the mothballed Hotels division. Sales revenue improved across the board with Australian and…

Benchmark-beating Stonehorn Global Partners, a specialist Asian equity team of ex-Macquarie personnel, has expanded its Australian team after a $300 million year. The team that gave up managing $4 billion in assets at Macquarie Equities to build their own business in 2019 have delivered exceptional returns in their Stonehorn Asia Equity All-Cap Fund, adding 18.6%,…

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat…

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat…

Since our 2020 Strategic Asset Allocation (SAA) review in June, we have remained modestly underweight the SAA reflecting concern about prospects for the asset class in the current environment. Recently, we reduced this exposure further, as our conviction has built that real estate will underperform the broader equity market over the medium term. Below, we…

The ATO delivered some positive news, approving fractional property investment platform Domacom’s’ application to broaden the use of the $300,000 downsizer contribution.