China’s drive for technological supremacy faces major roadblocks

Technology has long been a battleground for superpowers. In 1969, the CIA concluded that the technological gap between the Soviet Union and the West was vast and widening. If the former maintained a centrally planned regime, it would never catch up.

Much has changed since then and the geopolitical landscape has shifted profoundly, yet the race for technological leadership among economic powers is more intense than ever, with the US facing a new rival, China – a formidable competitor.

Current discourse on China’s technological capabilities often falls into two extreme positions – sceptics and alarmists, with the former dismissing China’s innovation capacity, perceiving it as merely imitative, while the latter portray China as overwhelmingly dominant across the technological spectrum.

Neither perspective captures the complexities of China’s technological ascent. Sceptics often adopt a narrow definition of innovation, equating it solely with originality in design. However, innovation can take many forms, including process innovation, which is an important feature of China’s innovation landscape.

However, one should not simply extrapolate from China’s past successes. Progress in technology hinges on a nation’s ability to develop and diffuse innovations. Successful diffusion translates into productivity gains, a vital source of long-term growth in an era marked by an ageing population and high public debt.

Yet, China’s innovation strategy has increasingly centralised, with the government favouring specific sectors and cracking down on e-commerce platforms, gaming and healthcare over the past three years. The anti-corruption campaign in the financial sector has also stifled capital allocation, forcing promising private companies to exit the market.

Global examples, including those from China, demonstrate that a dynamic private sector and decentralised approaches are essential for new technologies to proliferate and become widely accessible, ultimately fostering progress. Proper incentives for commercialisation must be established.

Amid low consumer confidence, persistent deflationary pressures and increased scrutiny from abroad, the environment for Chinese companies and institutions to innovate has deteriorated. Considering these challenges, China is entering a phase in which the pace of its technological advancement is likely to moderate.

That said, China has been successful in transferring technology achievements into economic gains – especially when compared with the former Soviet Union.

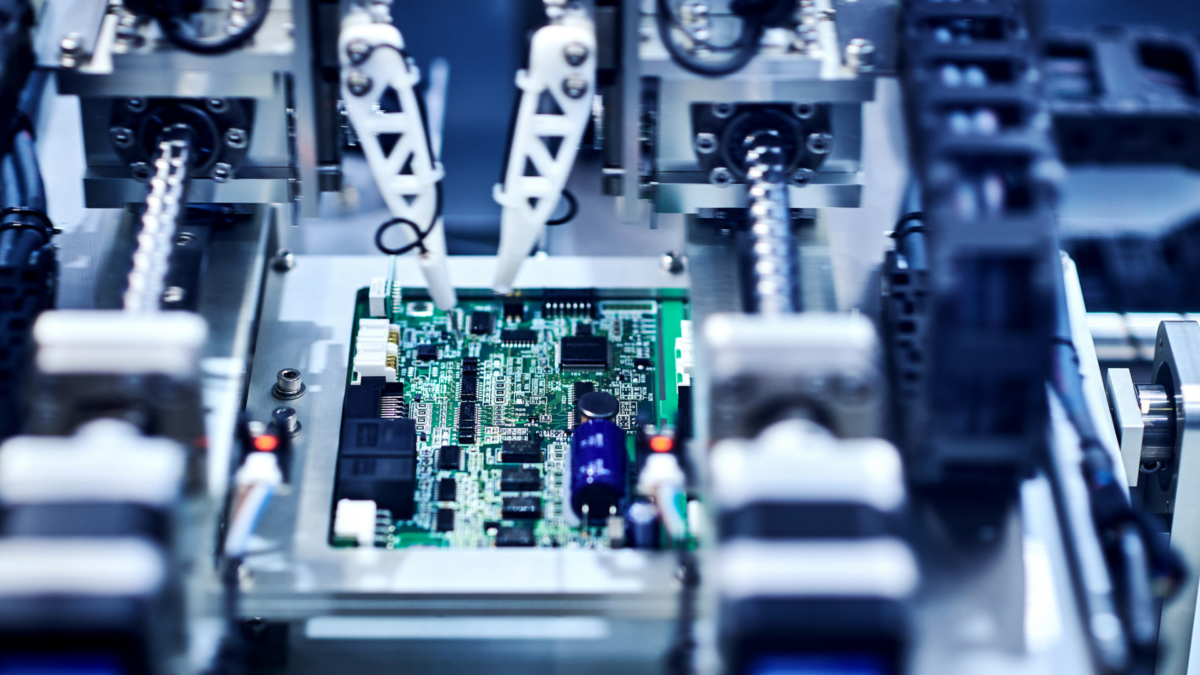

For example, China’s EV and semiconductor sectors have seen rapid growth and global competitiveness. China’s rise in technology has been significantly propelled by its dynamic private sector that thrives in a manner that often contrasts with the country’s centralised political image.

A prime example is Shenzhen that has evolved from a fishing village into a bustling metropolis of migrants. Although the city has a relatively low percentage of highly educated workers compared with other major Chinese cities, it boasts the highest concentration of R&D personnel and is home to a few tech giants that contribute substantially to China’s information and communications technology progress.

This phenomenon highlights the effectiveness of a decentralised innovation ecosystem where local governments allow for greater flexibility and demonstrates how localised, business-friendly policies and a liberal labour market can foster technological advancement, even without top-notch talents. The success of Shenzhen also challenges the notion that China’s centralised political system will inevitably lead to stagnation.

While China’s private sector has been a key driver of its technological ascent, challenges remain:

Deflation: Persistent deflationary pressures pose challenges for profitability and technology adoption across companies and institutions.

Domestic regulatory uncertainty: China’s unpredictable regulatory environment poses another significant challenge. For example, companies in the technology, media and telecom sector, once seen as leaders of Chinese innovation, have faced significant regulatory hurdles since 2021.

Geopolitical tensions: China’s relationship with the West, particularly the US, is becoming increasingly strained. The Biden administration renewed the China-US scientific research agreement with heightened restrictions, and the Trump administration has expanded the toolkit with the America First trade and investment policy frameworks. Further restrictions on bilateral trade, talent and capital exchanges are likely.

The race for technological leadership between China and the West is far from over. The US and its allies still hold significant advantages in capital markets and innovation ecosystems, while Chinese regulators crack down on the financial sector. For China to sustain its technological rise, it must prioritise end-demand innovation.

While top-down, state-driven approaches have been effective in certain areas, they may not be sufficient to maintain long-term growth. If China’s policies continue to stifle these market forces, its technological rise may plateau.

Ultimately, the key to long-term technological leadership lies in a nation’s ability to commercialise and spread its innovations. As the Soviet Union’s experience shows, technological discovery alone is insufficient for sustained growth.

This is an edited version of a research paper prepared by the Amundi Investment Institute – China in the race for technological leadership.