Dalio backs China’s halt on Ant IPO

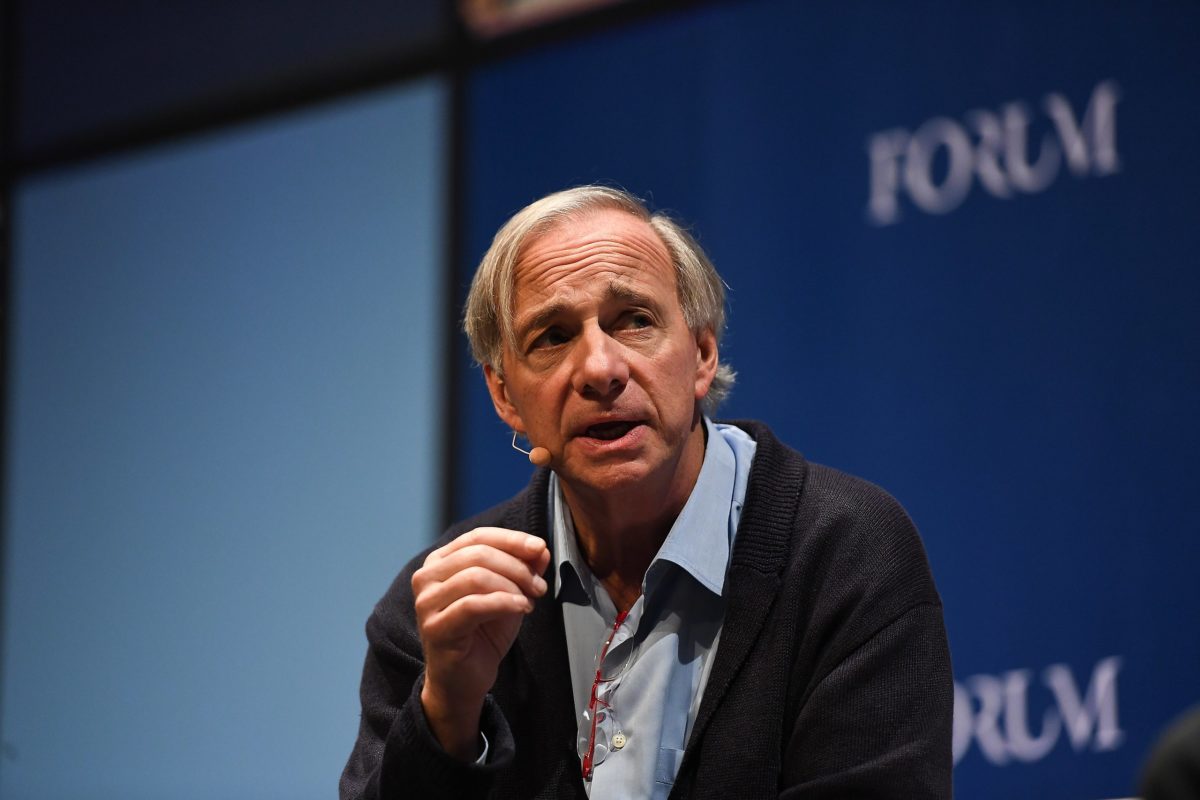

The investing world was disappointed to see the indefinite cancellation of the Ant Group float, if only because they missed seeing whether a Chinese company could take the mantle for the world’s biggest IPO for the second time. Ray Dalio was not among them.

The founder of Bridgewater and one of the world’s most famous investors opened a virtual gathering organised by the National Committee on US-China Relations last week (November 11). It was not so much his fame as a hedge fund manager that made the speech noteworthy. It was the fact that Dalio has been investing in China for about 30 years and sung the praises of its entrepreneurs for much of the time.

He maintained his bullish stance on China during the webinar but was, perhaps surprisingly, supportive of Beijing’s decision to cancel the float just two days before its proposed $US37 billion listing on November 5. Many people have blamed Jack Ma for bringing it on himself.

Ma, the founder of parent company Alibaba, has long been a thorn in the sides of the state-owned banks, which is pretty much all of them. Back in 2008, Ma said at a business forum: “I have heard many banks saying they will lend more to small and medium-sized enterprises. I have been hearing this for five years but how many banks are actually doing this? If the banks don’t change, we will change the banks.”

But 12 years later and having set a previous world IPO record with Alibaba in 2014 (eclipsed by Saudi Arabia’s Aramco in December last year), the threat sounds a lot more serious to the incumbent Chinese banks. According to Week in China e-magazine, investors only had to look back one week to get the gist of the issue for the Chinese authorities.

The publication said: Jack Ma, Alibaba’s founder and a major shareholder in Ant, was giving a keynote speech in the presence of some of the nation’s most senior financial figures, such as Zhou Xiaochuan and Yi Gang, the former and current governors of the Chinese central bank. The gathering this year was themed around ‘Crisis, Reform and Opening-Up’ and Ma’s speech was supposed to be a curtain-raiser to the world’s largest ever IPO as Ant geared up for a dual listing in Shanghai and Hong Kong. He was in combative form.

“Chinese banks nowadays still operate with a ‘pawn shop’ mentality,” he explained. “Good innovations should be not afraid of supervision. But they are afraid of being supervised by yesterday’s regulations.” In particular Ma took aim at the tendency of the state-owned banking heavyweights to demand collateral before giving out loans. Loan requests from those who cannot meet their criteria – typically unbanked individuals and smaller businesses – are part of the growth engine of Ant Group’s business model, which draws on newer capabilities in AI and Big Data to identify credit risks. But Ma was effectively calling for a revamp in the regulatory regime, adding that the Basel Accords – “a club for the elderly”, he scoffed – and claiming that the internationally agreed banking rules should not always apply in China.”

According to US-based Chief Investment Officer newsletter, Dalio said diversifying into China was worth the risk. “The Chinese are doing things to build confidence,” he is quoted as saying. “They can undermine it, but I think that the diversification outweighs the risks.”

Dalio defended the regulators’ decision to halt the Ant IPO and propose further requirements on the Alibaba subsidiary. Many institutional investors are expecting the offering to come back to the market next year, possibly with some state ownership. “I’ve had a lot of dealings with Chinese financial regulators and I could say that, generally speaking-not generally speaking, almost always speaking-I found them to be reasonable, caring, and highly informed people, who are now in an environment which is changing at an extremely fast pace,” Dalio said.

“Ant is a whole new concept, innovative concept, in terms of banking, and could almost replace or threaten the banking system in China. And it hasn’t yet been properly established in terms of regulatory review,” Dalio said. “I think it was progressing too fast, and it had to be clear as to who the authority was.”

Bridgewater, which has about US$140 billion under management, has a Chinese fund under its All Weather brand and two offices on the mainland – in Beijing and Shanghai.

– G.B.