From Goldilocks to gold: Mercer sets scenes for inflation

Mercer has urged investors to consider a wider range of inflation scenarios in portfolio design plans as price uncertainty ramps up across the world.

In a new paper, the global multi-manager and consultancy firm says investors now face more complicated decisions amid confusing inflation signals.

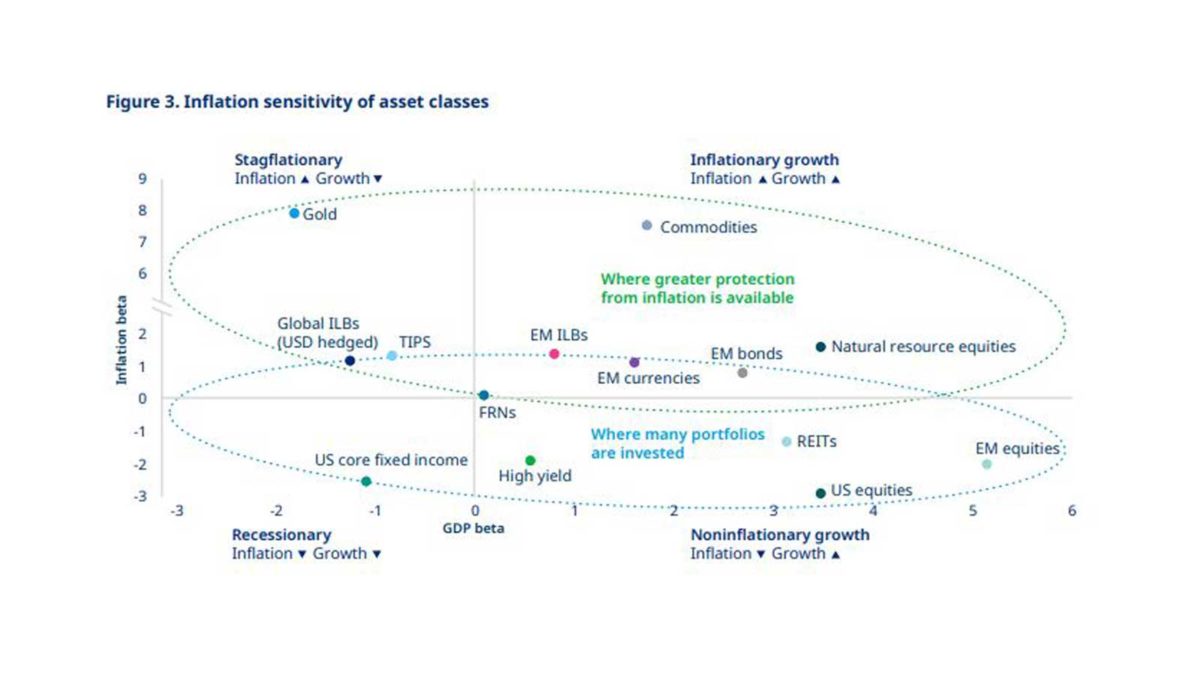

“Adding a less predictable inflation environment now increases complexity for portfolio construction, as the asset allocator needs to think about inflation sensitivity (“inflation beta”), not just growth sensitivity (“GDP beta”),” the Mercer study says. “Although some portfolios will employ inflation protection through investing in Treasury Inflation-Protected Securities (TIPS) or index-linked gilts, which also come with limitations, few portfolios appear comprehensively hedged against inflation risks.”

Despite leaning to the more optimistic side of the argument, Mercer makes the case for a structural shift to higher inflation ahead as demographic and labour supply pressures tilt the scales away from the price-constrained trends of the previous four decades.

“What fuels our concerns over higher inflation risk and wider tail outcomes is not so much this short-term spike in inflation seen in 2021 as it is the weakening of long-term secular, disinflationary forces in the background,” the paper says.

Mercer lays out six potential inflation scenarios ranging from the ‘Goldilocks’ outcome – where strong growth and productivity gains conspire to keep prices down – to the worst-case ‘pandemic stagflation’ caused by resurgent COVID, slow growth and supply-chain-led price increases.

Each scenario would have materially different effects on various asset classes. Under the Goldilocks outcome, for instance, almost all assets rise while only commodities and gold offer much hope of return if stagflation arrives.

The report says Mercer currently favours the ‘balanced growth’ scenario – moderate growth and inflation – but investors should not discount other possibilities.

“For the first time in a generation, investors need to seriously consider inflation,” the paper says. “… The range of scenarios for inflation in the future has increased, and scenario analysis can provide insight into the risks to portfolios.”

And investors will have to consider a wide set of asset classes to provide portfolio inflation-protection, Mercer says.

“Even inflation-linked bonds, which may appear as the most intuitive solution given their contractual link to inflation, do not perform well in any of the short-term scenarios. This is because, in the near term, they are more exposed to changes in real rates than to changes in inflation expectations,” the report says. “Over the longer term, the inflation linkage strengthens, but in many markets, investors are locking in negative real rates by investing in inflation-linked bonds. We see inflation-linked bonds as part of the toolkit, but more tools are needed.”

Investors assessing current portfolio inflation risks should weigh up several factors, Mercer says, including:

- holdings of existing inflation-sensitive assets;

- the time horizon over which inflation-linked assets are expected to provide protection;

- identifying what scenario would leave the portfolio most vulnerable;

- the types of desired inflation-protection – such as general consumer price index or more targeted metrics (healthcare, for example);

- liquidity budgets;

- governance rules; and,

- environmental, social and governance (ESG) considerations.

The study highlights a potential conflict between inflation-protection strategies and ESG targets with higher commodities exposures, for instance, butting against portfolio decarbonisation targets.

Coining a new acronym for the already crowded ESG dictionary of jargon, Mercer says: “Investors also need to balance positioning portfolios for higher inflation risk in the medium term while maintaining their long-term focus on decarbonizing portfolios – we refer to decarbonization-at-the-right-price (DARP).”

For history buffs, too, the report lays out a time-line dating back to 1209 that shows inflation regimes have moved in long cycles in the past.

While investors might choose to ignore historical trends (and, there is “indeed merit in not extrapolating naively”), Mercer says the longer view adds valuable perspective.

“Just because we have been fortunate enough to live through a multi-decade disinflationary cycle until now does not mean we have reached the end of history,” the paper says.