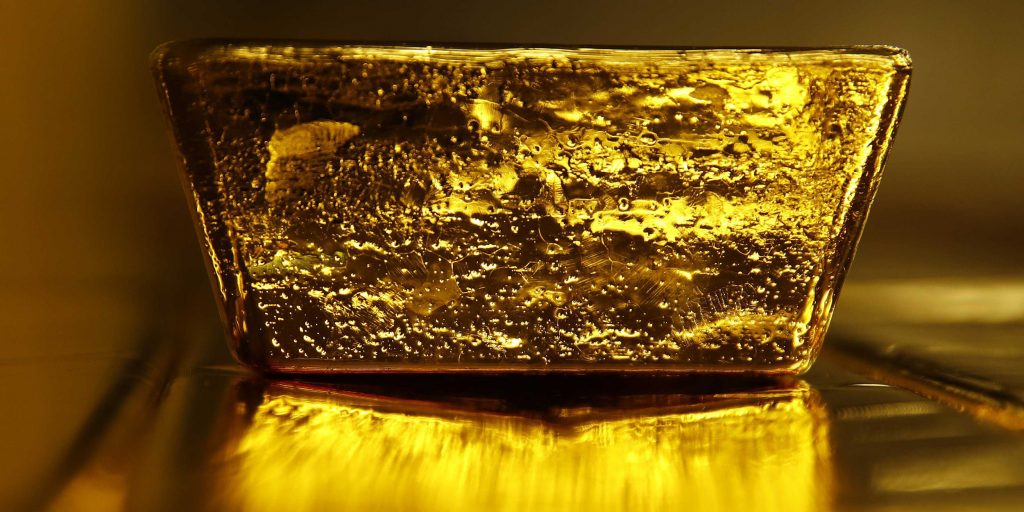

Gold to hit US$3,000 on virus fears

The gold price is soaring, all thanks to a world gripped by fear, or is it hope? Worried investors, from endowments to ‘mums and dads,’ are buying up the ‘safe-haven’ asset on concerns over the economic fallout caused by the COVID-19 pandemic that shows no sign of stopping. And as a result, gold demand has risen, pushing the price past the psychological US$2,000 an ounce barrier for the first time in history. Here are a few points on the recent gold price rise, and why it could hit USD$3,000:

- Investors moving out of equities into gold. The common notion is that this rise is due to fear and panic; that investors sell out of equities in exchange for gold, to park money in a safe-haven asset. While this is partly true, the recent surge in the gold price is more a sign that investors have no where else to put their money. Gold doesn’t require inflation; in fact, it performs better during deflationary environments like the one we are seeing today.

- Negative real interest rates rather than fear. The real (after-inflation) return that bond investors can expect to receive has dipped into the negative, as global rates near 0%. While there is little evidence that inflation is a problem today, negative real interest rates are a clear and present danger to investors: this means that bond investors are expected to lose money in real terms over the next decade. This is what is driving record rallies in assets that are not linked to negative rates, such as gold. With negative interest rates, there is nothing lost in holding gold rather than bonds, as you aren’t getting income either way. And so, gold becomes more appealing than cash and becomes an important hedge against more volatility.

- Gold falls in an economic recovery. As gold rose in times of uncertainty, the opposite is also true. In an economic recovery, uncertainty and fear are replaced with economic certainty and consumer confidence. The gold price falls. In fact, a strong economy is the worst-case scenario for the precious metals. Clearly, the economic fallout from COVID-19 is still to play out. An economic recovery, together with a vaccine, is some time off.

- Central banks buying up gold. With bonds fetching negative real yields, gold’s lack of income suddenly does not look all that bad. Since the GFC, central banks have been net buyers of gold, buying not only for return but also to diversify away from US$-denominated assets. If institutions/pensions funds start to lift their asset allocation to gold (from 0% presently) as central banks have done, it could boost the gold price further.

- Pension funds increasing allocations. With cash and bonds generating no return, pension funds and insurance companies have turned to gold to generate returns in a yield-starved investing landscape. This could be the most powerful tailwind for the metal, as professional investors run out of alternatives assets that don’t reduce liquidity.

- Supply constraints due to COVID – It has been a double-whammy effect for the gold price. One side has demand rising steadily and on the other side supply has dropped off, as gold mines across the globe suspend operations to contain COVID-19 outbreaks.

Will gold continue to rise towards US$3,000? Gold is up 35% in 2020 and recently broke the US$2,000 psychological level (although it slipped back below that last night.) With demand rising and supply falling, the drivers supporting its rise have some time yet to fully play out. During times of extreme fear, rational thinking goes out the door and investors flee towards safety. But this time, negative real interest rates are driving investors, rather than fear. For that reason, the $3,000 price level is not out of the question, and some brokers are even making a case for US$4,000 an ounce. Macquarie wrote a recent note saying, “We believe this is the overshoot move that we have been looking for and, while momentum could carry prices further, it raises the risk of a sharp correction.”

Despite delivering the strongest returns for all asset classes over 12 months and the last few years, commentators continue to peddle the old mantra that gold can be confiscated by governments. More recently, attention has been drawn to the fact that gold actually fell in value during the latest correction. While this is correct, government bonds also fell, with the market for these low-risk assets requiring central bank support to avoid a complete shutdown. Gold has one thing going for it, it will always be liquid.

Here are three ways to gain exposure to gold through the share market:

- ETF Securities Physical Gold ETF (ASX:GOLD) – Investors can take a position through GOLD, which is an exchange-traded fund (ETF) designed to track the international price of gold in Australian dollars. It is a relatively simple, low-cost way to gain exposure to the current gold run. GOLD trades like a regular share and is bought and sold through a stock broking account. An investment in GOLD represents ownership of 1/100th of a troy ounce of gold. Importantly, this ETF is supported by real bullion bars held in the London vaults of JP Morgan.

- Newcrest Mining (ASX:NCM) – NCM is not only Australia’s largest gold miner but one of the world’s largest. The $27.4 billion company owns and operates mines across Australia, Indonesia, Papua New Guinea and the Ivory Coast, and also produces silver and copper. At its June quarter production report the company delivered a strong finish to the financial year by achieving FY20 production guidance. Group production for the June quarter was up 7%, to 573,175 ounces, taking FY20 production to 2.17 million ounces, a 12.7% decline on FY19 (partially explained by the sale of the Gosowong mine in Indonesia, and COVID operations suspension at other mines). The company is cashed-up, having recently raised $1.2 billion, and performing well. Out of the selection of ASX-listed gold miners and explorers, Newcrest is a relatively ‘safe’ bet.

- Regis Resources (ASX:RRL) – Capitalised at $2.7 billion, RRL is a mid-tier Australian producer, mining gold in the Eastern Goldfields region of Western Australia. In the June quarter, Regis produced 87,260 ounces of gold, giving a full year gold production of 352,042 ounces, down 3.1% from the 363,418 ounces produced in FY19. The company achieved record cash flow from operations of $109 million in the June quarter. Guidance for FY21 foresees an increase in production to 355,000 ounces-380,000 ounces at an all-in sustaining cost (AISC)an ounce of A$1,230-$1,300 an ounce – not bad with gold presently at A$2,750 an ounce! Compared to Newcrest, Regis is more a traders’ stock, having a riskier profile. Shares are up 102% from its March lows of $2.91, and at $5.38, RRL is just below FN Arena’s collation of analysts’ consensus target price, at $5.55.

From its COVID-19 low to today’s price, gold has rallied a good 35%. With no vaccine in sight, the economic fallout could drag out for some time. Should that be the case, there is a strong case for the current momentum supporting the gold price to continue in its upward trajectory, and possibly, through the magical $3,000 mark. And that is where the opportunity lies; not in questioning gold’s real value, but in riding this momentum that COVID-19 has created.