‘It’s a business about character’: Kudu hunts deals Down Under

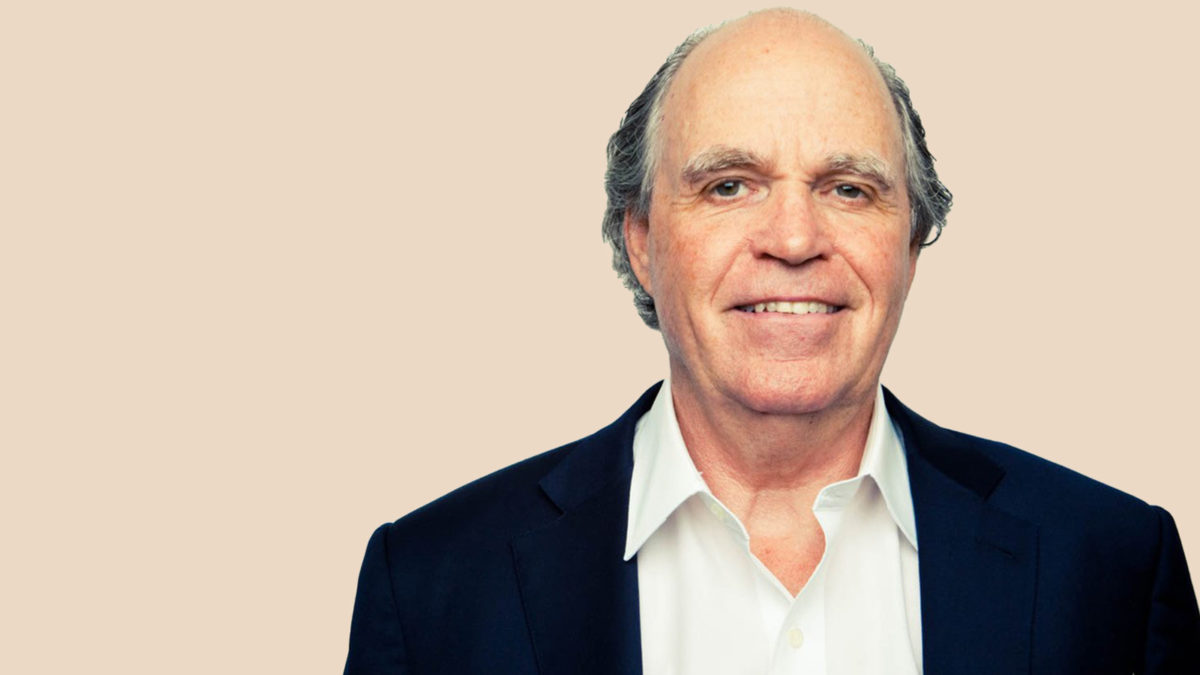

“The asset management business is an absolutely beautiful business, to the mind of anybody involved in it. It’s rock solid; it has high margins; and the people are interesting,” says Charlie Ruffel, managing partner of Kudu Investment Management. “And we love Australia. We love it because there’s a lot of entrepreneurs running investment boutiques, and we’re a real solution for some of these boutiques because we essentially let them run their business the way they want.”

The New York-based firm takes minority stakes in asset managers that have a “capital challenge” and has deployed about $750 million since its inception in 2015. Its portfolio consists of around 21 asset managers with FUM ranging from one to thirty billion, and it previously provided financing to Channel Capital for its management buyout, after which it took a passive stake in the business. Now the team is back Down Under, hunting more deals; they’ve recently cast eyes over at least one wealth management firm.

“(We often look at) a firm that’s done well and wants to grow and expand, maybe in a different geography or in an adjunct asset class, or maybe they want to get rid of somebody who’s a pain in their ass… No-one likes seeders,” Ruffel said. “You take on a seeder when you have no business at all, and they give you money and they exact a large price for giving you money, and five years later you wonder why you’re still paying them that price.”

Kudu’s own capital comes exclusively from two large insurance entities, though it originally raised money from Challenger, which is still managed in a side-pocket. When it shifted to deploying permanent capital it raised money from White Mountains, a New Hampshire insurance holding company, and Mass Mutual.

“It almost killed us to raise it, but we were lucky,” Ruffel says. “It’s hard work raising money – and raising permanent capital is really hard. Most of the capital you raise is from supers or family offices and there’s a life on it; they want to get it back at some stage.”

“Capital raising is all about serendipity; it’s all about timing. If you’re in front of the right people at the right time, you get money. And if you’re not, it doesn’t matter how good your investment proposition is, how good your track record is. It’s brutal raising money.”

Kudu differs from local multi-affiliates like Pinnacle and Fidante in that it doesn’t take on distribution obligations – “distribution promises are easy to make and hard to keep” – though Ruffel believes they’re a good “value add” partner on that front.

“Our ethos is the Hippocratic Oath: do no harm. No promises, no obligations… the real differentiation is our capital. It’s permanent capital; it’s not a fund, it doesn’t have a life on it. When we take a stake in an investment management firm, it’s forever – or until they decide it’s not forever.”

Kudu doesn’t usually discuss its deals – it’s “pretty low-key” – though doesn’t mind its partner companies getting press. Ruffel started his own career as a financial journalist in the good old days when people still read magazines, covering Wall Street for the still-alive Institutional Investor and Euromoney (he later ran a financial information business, before deciding to trade up to banking and private equity).

His partner, Rob Jakacki, was responsible for the Asset Management Finance (AMF) business at Credit Suisse – which took stakes in hedge funds – until the Volcker Rules saw the division wound down in 2014; new investments through the division would have added to Credit Suisse’s risk-weighted assets, necessitating it having more capital on hand. Ruffel and Jakacki have been “swimming in these waters for 20 years.”

“Our business is basically just backing a management team,” Ruffel said. “We want the asset class to be interesting and to have money flowing to it, but at the end of the day it’s just backing a management team. And I think we’re pretty good at identifying good management teams… it’s a business about character.”