Kochie rediscovers his roots with ausbiz

The Australian Investment Council, the main body representing private equity managers and investors, has backed David Koch’s new fintech business, ‘ausbiz’, through a media partnership. Although best known as a successful television personality in Australia, ‘Kochie’ is also a serial entrepreneur. Ausbiz aims to connect investors with interesting investment opportunities, particularly in the private markets space.

Joining up again with former colleague Kylie Merritt, Koch, the anchor presenter on Seven Network’s ‘Sunrise’ morning news and entertainment program, has gone back into the fintech world. Since a capital raising late last year, the pair has built a business which is now producing eight hours a day of live broadcast involving stories of private investment opportunities. The business has already employed 14 staff and has about 13,000 investor subscribers. Kylie Merritt said last week (on June 26) that, while the current environment was difficult for all businesses, ausbiz was still subscribing about 100 new investors per day.

Koch, who started his career as a finance journalist at ‘The Australian’ newspaper, worked with Merritt during the dot-com boom at a company he co-founded which looked to sell managed funds over the internet. Like several other companies with the similar ambitions, such as InvestorWeb, it didn’t survive ‘techwreck’ in 2000. Prior to that, he founded ‘Money Management’ magazine in the mid-1980s, with some backing from Fairfax, and has also been a significant investor in the Sydney Kings basketball team.

Merritt and Koch started serious work on ausbiz, building two television studios and raising capital in September and October last year. Surviving the distraction of the summer bush fires (much more than a distraction for people in regional areas), they are now dealing with social distancing due to COVID-19. The company went live with its schedule of broadcasts on March 30. Merritt said ausbiz averages 45 broadcast interviews a day. There are 10 private investors involved in the company. “Basically, we are running a television channel,” she said, “It aims to connect investors with opportunities.” See the Australian Investment Council promotion below.

– G.B.

Streaming live now: ausbiz focuses on private capital

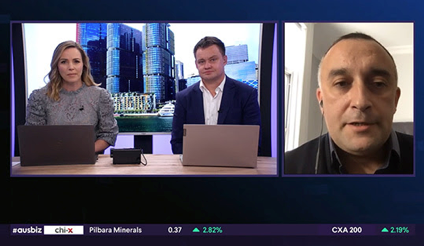

In the midst of the COVID-19 pandemic, finance journalists, Kylie Merritt and David Koch, have launched their own startup, ausbiz − a live streaming service dedicated to business, finance and start-ups.

ausbiz fills a gap in the market by focusing beyond public markets to private capital from pre-seed start-up funding through to private equity investments and exits. The platform is committed to in-depth conversations about private capital, and how it’s driving real change in the Australian and global economies.

Experienced finance journalists, Gemma Acton, Nadine Blayney, David Scutt, Daniel Weiner and Ingrid Willinge can be seen live on ausbiz which is streamed from 8.30am to 4.15pm every day on the ausbiz website or app, or on 7Plus, Iress and Adviser Ratings.![]()

Based at Barangaroo and alongside the live studio, ausbiz has a second studio available for content production such as feature interviews, panel discussions, webcasts and other live streams. The ausbiz team is available to work with businesses in our ecosystem to produce high quality content for your clients, investors, marketing or internal communications. Further details can be found here.

Recently, I was interviewed by Nadine Blayney on The Open discussing the Council’s new Roadmap to Recovery policy statement which identifies the key reform priorities and significant opportunities for Australian businesses in the years ahead.

The Australian Investment Council is partnering with ausbiz which has a purpose to connect investors with opportunities and is looking for great stories from the private capital investment community as well as the businesses they invest in.

I encourage you to take a look at the platform and if you have an interesting story to share, please contact the ausbiz team at [email protected]. Kylie Merritt is always happy to discuss content or commercial opportunities; [email protected].

Best regards,

Yasser El-Ansary

Chief Executive

Australian Investment Council