Lithium stocks tank on price concerns, market finishes higher, Origin pulls earnings

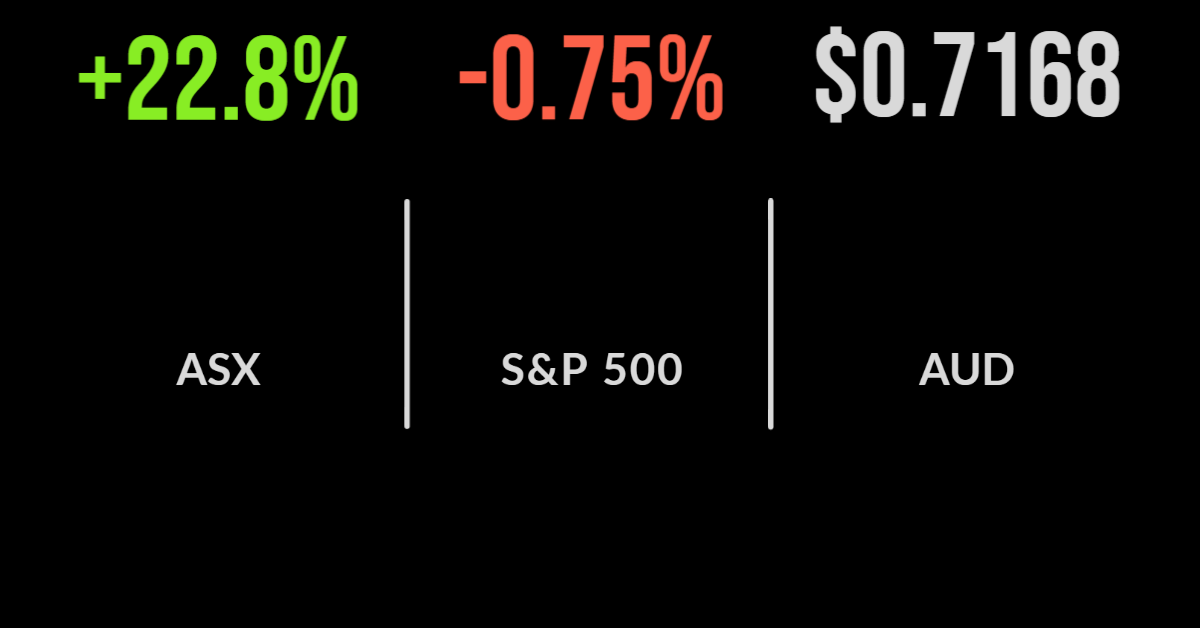

The local market managed to eke out a positive return on Wednesday, gaining 0.3 per cent on the first trading day of June.

Another rally in the iron ore price, which supported the likes of Fortescue (ASX:FMG) and BHP (ASX:BHP), the latter up 2.3 per cent, wasn’t enough to dig the materials sector out of the hole, as it finished down 0.3 per cent.

The biggest driver was ‘carnage’ in the lithium sector that saw Pilbara (ASX:PLS) finish 22 per cent lower, Liontown (ASX:LTR) down 19 and Allkem (ASX:AKL) down 15 per cent.

The massive selloff came after Goldman Sachs suggested the price was set for a sharp correction and the Argentinian Government set an export price below current market due to concerns over ‘irregularities’ in shipments. It offers another insight into the challenge of investing into emerging and current trends and the risk that short-term events get extrapolated into the future.

There was positive news for the domestic economy, which saw growth of 0.8 per cent in the March quarter and 3.3 per cent for the year, not really reflecting the ‘hot’ environment that has central banks so concerned.

Origin pulls guidance, wheat prices fall, take Graincorp lower

Origin Energy (ASX:ORG) reversed a strong recent run, falling 13.7 per cent after flagging increasing costs in their production assets. The group has highlighted the growing risk of an energy crisis like that which is occurring in the UK and sending wholesale energy prices to record levels.

The issue, of course, is increasing costs of production and caps of pricing. The group announced that earnings from their APLNG production facility remain strong and will offset a decline in energy market earnings due to the ‘extreme volatility’ but reduced guidance to $310 to $460 million, a much larger range.

They also highlighted the challenge on the electricity system of coal power outages and the pressure this is placing on gas facilities. Wheat prices have also fallen on hopes that the Russian crop will not be overly impacted and that Ukraine will be allowed to export in 2022, which sent shares in Graincorp (ASX:GNC) 1.6 per cent lower.

All three benchmarks slip as yields jump, Salesforce.com upgrades, jobs fall

All three major US benchmarks lost ground on Wednesday, led by the Nasdaq which fell 0.7 per cent as bond yields jumped on commentary that the Fed may increase rates by another 0.50 per cent in September.

The S&P500 and Dow Jones fell 0.8 and 0.5 per cent respectively as the local manufacturing index showed a strong reading of 56.1.

In a surprise move Facebook (NYSE:FB) Chief Operating Officer Sheryl Sandberg announced she would be leaving after 14 years at the helm and multiple controversies. Shares fell close to 2 per cent on the news.

The now standalone Victoria’s Secret (NYSE:VSCO) jumped nearly 9 per cent after reporting a strong profit and seeing quarterly sales hit US$1.5 billion.

Amazon (NYSE:AMZN) also capped a strong seven day streak with another 1 per cent gain as the big tech companies recover. Job openings fell to 11.4 million as signs of the slowing market increased.