Market retreats, healthcare, currency boost, Metcash upgrades

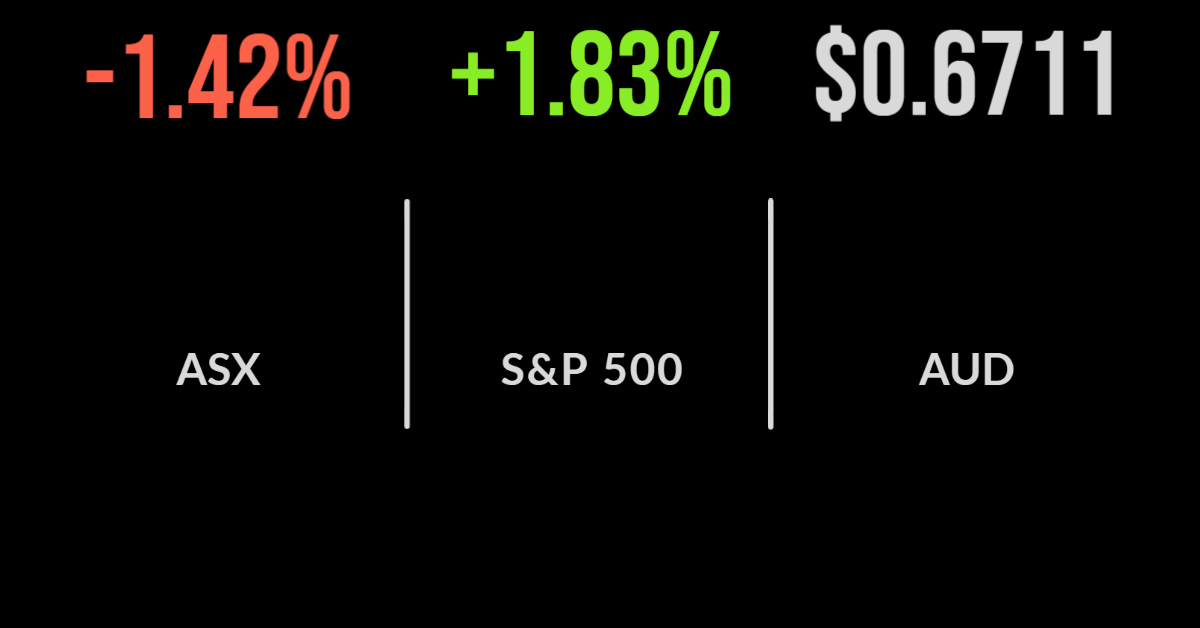

The Reserve Bank of Australia’s aggressive pursuit of a neutral interest rate policy setting has offered a challenging backdrop to the sharemarket this week, with the S&P/ASX200 falling 1.4 per cent on Wednesday. It wasn’t rates alone, however, with the oil price falling to levels not seen since January 2022 as concern grows about the demand side of the market amid synchronised contractionary monetary policy. The result was the energy, utilities and materials sectors pushing the market lower, down 3, 2.2 and 1.9 per cent respectively with New Hope Coal (ASX:NHC) and Viva Energy (ASX:VEA) down 5.2 and 6.6 per cent. On the positive side were overseas operating companies Virgin Money UK (ASX:VUK) and ResMed (ASX:RMD) which gained more than 4 per cent each as the Australian dollar continued to devalue against the US. In fact, the currency has now reached just 68 cents to the US dollar alongside many other developed economies. Shares in United Malt (ASX:UMG) gained 1.5 per cent after management confirmed a ‘positive’ crop outlook for all jurisdictions and announced they will not need to raise capital.

IGA powers ahead, GDP shows resilient economy, Bitcoin fall continues

Shares in Metcash (ASX:MTS) finished 1 per cent higher, overcoming the weak sentiment after the company reported strong momentum in their neighbourhood network of grocery stores. They confirmed that sales across the business were 8.9 per cent higher in the year to August, while reporting strong progress for the financial year to date, which finishes in April. Food sales were 4.3 per cent higher, but hardware and liquor sales were the standouts. hardware, which includes Total Tools and Mitre 10, gained 19.5 per cent for the year to date, with liquid also gaining 11.5 per cent. The group highlighted the growing trend of localised shopping that has come out of the pandemic. The Australian economy grew at 0.9 per cent in the June quarter, data that is now two months out of date and not particularly relevant given the significant increases in interest rates. But once again, exports and household spending powered the economy ahead, with net exports adding 1 per cent and consumption another 1.1 per cent. Most spending went towards cafes and restaurants while coal and oil remain key contributors. The economy expanded at a rate of 3.6 per cent for the year.

Market jumps despite Fed commentary, Twitter up, trade deficit shrinks

Global sharemarkets look set to reverse the end of summer selloff with the Nasdaq leading the way on Thursday, gaining 1.9 per cent on the back of a reasonably positive statement from the Fed. The S&P500 gained 1.7 and the Dow 1.5 per cent despite the central bank confirming they may hike rates by 75 basis points at the next meeting. The key here is that with this level of increase already priced into the market, the actual event occurring will have little impact on trading. The US trade deficit unexpectedly fell by 12.6 per cent in July suggesting the consumer remains strong and that they may avoid a recession while the Bank of Canada increased its cash rate by 75 basis points to 3.25 per cent. Target (NYSE:TGT) cancelled their retirement policy to allow the current CEO to extend his stay, while Twitter (NYSE:TWTR) shares gained 5.2 per cent after a court allowed the recent whistleblower’s evidence to be included in Musk’s counterclaim