Market retreats, Origin write-downs hit profit, Medibank hit by returns

The Australian share market has experienced a similar reporting season trend to global markets with the trend being towards much better than expected results and far less volatility than predicted.

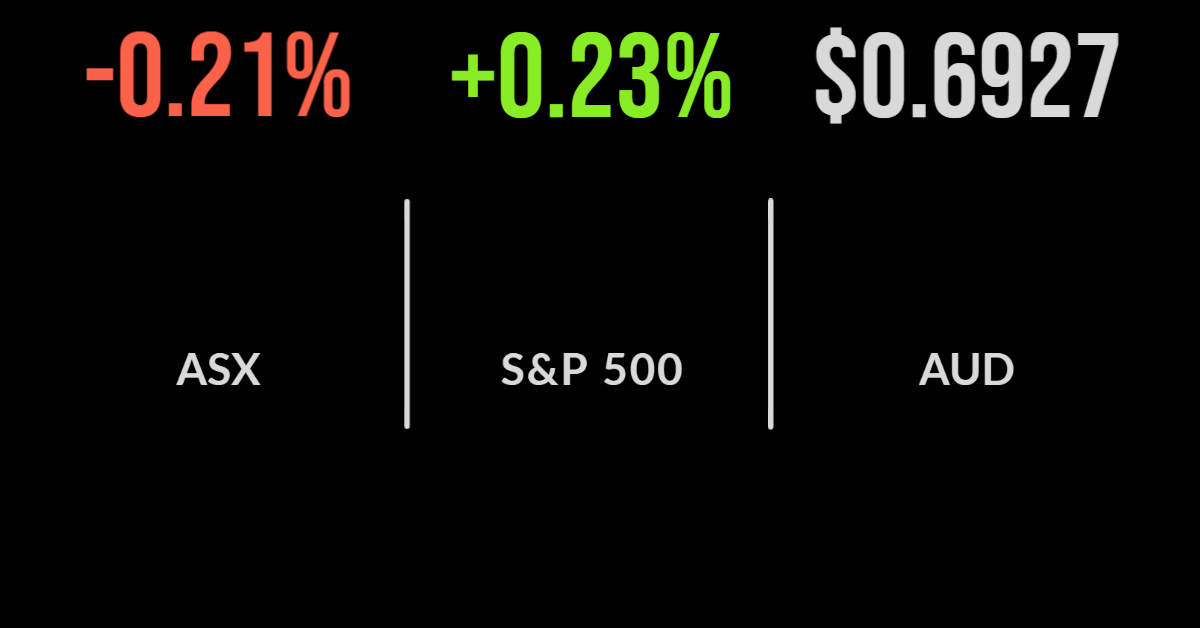

The S&P/ASX200 fell 0.2 per cent with energy and healthcare both gaining more than 1 per cent, but technology and utilities reversing once again.

On the utilities side, it was all about Origin (ASX: ORG) with the diversified energy group announcing a 30 per cent increase in underlying profit, but a statutory loss of $1.4 billion as assets continued to be revalued.

The APLNG project delivered a record $1.5 billion distribution, however, delivery of coal to their power plants remains a real risk.

The dividend was doubled but the share price finished more than 2 per cent lower after dipping significantly during the session.

Shares in Medibank (ASX: MPL) finished slightly higher despite the company reporting an 11 per cent fall in profit.

The reversal was due to the poor performance of the group’s investment portfolio which detracted $25 million.

Transurban returns to profit

Toll road operator Transurban (ASX: TCL) fell another 3.4 per cent after reporting a 12 per cent increase in the dividend and a return to profitability.

After losing $287 million last year due to lockdowns in Australia the group delivered a $16 million profit on revenue of $3.4 billion but remains challenged by increasing interest rates.

Vitamin maker Blackmore’s (ASX: BKL) continues to stagnate following a strong few years with the stock falling by more than 10 per cent after reporting a slowing in profit growth.

The company reported another 12 per cent increase in revenue but just a 7 per cent improvement in profit to $30 million with exports to China slowing.

Amcor (ASX: AMC) experienced a similar journey to Brambles with management reporting a 13 per cent increase in revenue, with the majority coming from price increases to customers and profit margins remaining under pressure.

Profit increased 6 per cent and the company confirmed the sale of three Russian factories as they seek to clean up their global operations.

Former Amcor business line Orora (ASX: ORA) was at the other end of the spectrum delivering a 36 per cent increase in profit on a 15 per cent increase in revenue, with the US business showing much more positive than in Asia and Australia; shares were slightly lower.

Market gains as rates near ‘neutral’, Cisco delivers, Kohl’s profit hit

All three benchmarks managed to finish in positive territory, reversing what was looking like a rare two-day losing streak in the current environment.

The Dow Jones gained 0.1 per cent, the S&P500 0.2 and the Nasdaq the same, with Cisco (NYSE: CSCO) a major highlight after the company reported stronger than expected revenue growth and forecast this strength to continue.

The networking and service provider gained 5.8 per cent but remains some way below 2022 highs.

The sentiment has now switched towards positivity with Fed Chair Jerome Powell hinting that he believed the ‘neutral’ rate of interest had been reached.

This is seen as the level of interest rates that are neither contractionary or expansionary for the economy, but for which there is no fixed rule. Jobless claims also fell slightly by 2,000 in the week prior.

Bed Bath & Beyond (NYSE: BBBY) shares were 20 per cent lower after meme stock shareholder Ryan Cohen, who owns a significant stake in AMC, indicated his intention to sell into the recent 80 per cent share rally.

Department store Kohl’s (NYSE: KSS) fell 8 per cent after reporting a profit that missed expectations, despite a beat on the revenue side, which fell 8 per cent.

There is a clear divergence in the consistency of spending depending on the store and customer base in the US.