Market weaker on healthcare, ASX adds female CEO, Wesfarmers warning

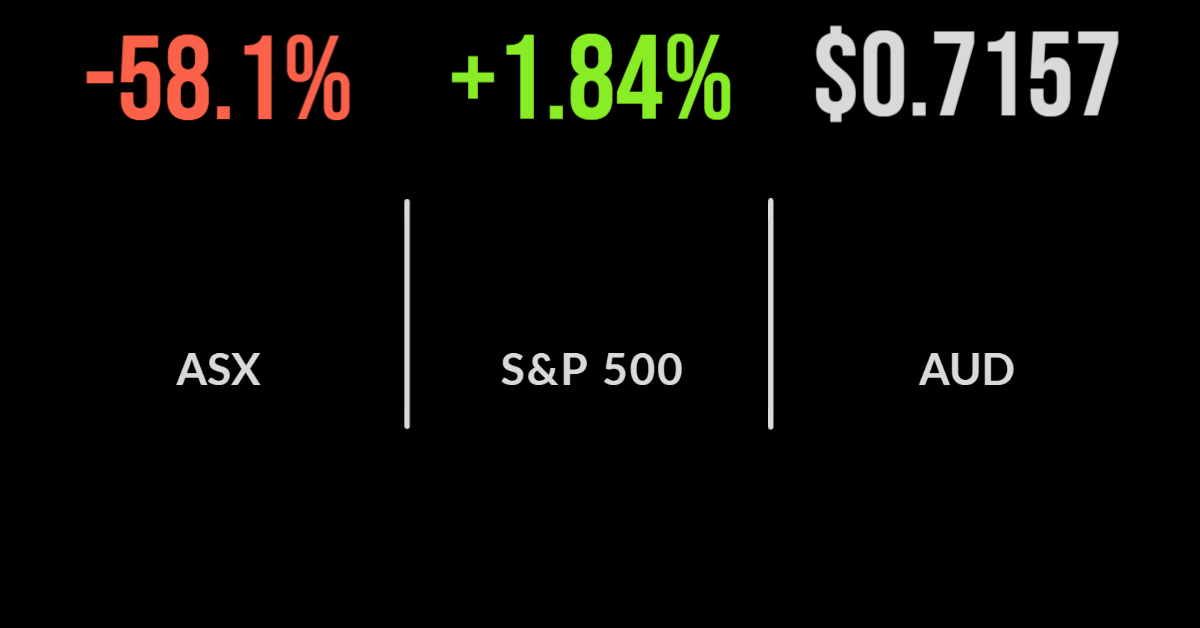

The local market continued on a negative trend to open the month of June with the S&P/ASX 200 falling 0.8 per cent on the back of a broad-based selloff.

The biggest detractor was the healthcare and technology sectors, falling 1.8 and 2.5 per cent respectively as US Federal Reserve members continue to predict aggressive rate hikes. Cochlear (ASX:COH) and CSL (ASX:CSL) were both down 1.8 per cent.

Woodside Energy (ASX:WDS) the new merged entity of Woodside Petroleum and BHP’s (ASX:BHP) oil and gas assets had its best day in over two years, gaining 5.2 per cent after completing the merger.

The oil and gas price continues to benefit from a growing energy crisis in both the UK and now Australia, with the energy sector gaining 3.1 per cent. Origin Energy (ASX:ORG) reversed yesterday’s weakness, gaining 2.7 per cent after investment bank Barrenjoey increased their price target following updated earnings guidance.

Both companies have been central to the 52nd straight month of Australian trade surpluses, with this month hitting $10.7 billion.

Forecasters folly, Wesfarmers flags potential weakness, REA looking to grow

The trade data was much stronger than the $9.3 billion forecast by experts, who subsequently blamed a 27 per cent jump in travel services in April. Shares in REA Group (ASX:REA) couldn’t overcome the broader technology selloff, falling 3.3 per cent, despite flagging the potential for acquisitions as the company considered new verticals including home insurance.

The ASX (ASX:ASX) has anointed their first female CEO, with Helen Lofthouse getting the top job at a difficult time for the company.

Lofthouse is being promoted from head of markets and will be forced to deal with the struggling blockchain conversion.

Wesfarmers (ASX:WES) were 0.6 per cent lower, with management flagging weakness in the newly acquired API healthcare and pharmaceuticals business due to supply chain issues.

They have also highlighted inflation and commodity prices as a potential hit to production and expect heightened inventory and potentially weaker margins in the short-term. Bubs (ASX:HUB) shares remain strong, gaining 6 per cent, after confirming their first shipment to the US will occur on June 9.

US markets rally despite Microsoft guidance cut, jobless claims fall, HP dips

It was another positive move for global markets overnight, which should bode well for the end of the week session in Australia, as the Nasdaq gained 2.7 per cent. The S&P 500 and Dow were up 1.8 and 1.3 per cent respectively after a rally in Microsoft (NYSE:MSFT) spurred the market.

The 0.8 per cent gain came despite a cut to their fourth quarter guidance with revenue expected to be around $1 billion or 2 per cent lower on the back of strength in the USD.

It was the opposite story for Hewlett Packard (NYSE:HPE) which fell more than 5 per cent after reporting a US$250 million quarterly profit but flagged a US$126 million hit on their Russian operations.

Revenue was solid, but margins shrank, with both computing and storage sales flat or marginally lower on 2021 levels as spending on hardware slows.

In a sign that high prices are causing demand destruction the demand for new car sales hit ‘recessionary’ levels, falling to 13 million in May.

First time jobless claims fell 11k to 200k, while labour productivity remains sharply negative