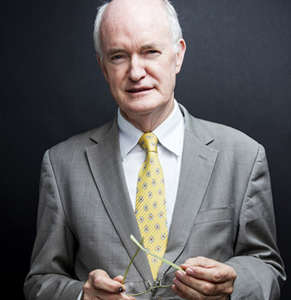

… Noonan throws a parting punch as he retires from Media

Gerard Noonan retired from his role as chair of Media Super last week (September 30) after nearly 30 years at the fund and its predecessor, Just Super. It was his last major non-executive director’s role in the super industry of the many important one’s he’s had. He will stay around for a few more months helping where required on the proposed merger with Cbus.

He became the chair of Just in 1991, even while he still had a full-time job as editor of the ‘Australian Financial Review’. The Cbus merger is his third for the journalists’ fund. The first, in 1994, was with the interestingly named JEST, which was an even smaller fund catering for actors and entertainers, followed by a more complicated merger with Print Super in 2008. When he joined Just it had $6 million under management. As he leaves it has $6 billion. By this time next year, it will be part of a fund with more than $60 billion.

The new chair is Susan Heaney, who is part of a privately run printing company on the Queensland Gold Coast. She has been on the 10-person board since 2013. The board consists of six printing-related directors and four from journalism and the varied arts industries.

He said: “Industry funds like Media Super have provided the best performing superannuation offerings to millions of Australians – lean, low cost and earning our members on average more than 7 per cent every single year over the past three decades. Beat that if you can.”

Noonan, always a self-confessed ‘Bolshie’, is a champion for the industry fund movement. He took the opportunity with his retirement announcement to have one last swing at the Coalition Government. He said: “Minister Jane Hume pretends that she’s ambivalent – but the record shows that Australian conservative governments have opposed, from the start, the compulsory super contributions. Always did. They’ve resented the fact that it’s been the not-for-profit sector – the industry funds with employer and union board governance – that has easily outperformed the so-called professionals in the retail funds and the banks.

“I was a young journo (and union activist) when we were first pushing for super for workers in the late 1970s and early 1980s and I covered scores of stories for the Fin Review showing the Liberal-National party opposing any attempt to get it up and running. It needed Bob Hawke and Paul Keating to support the campaign to get super started, then it was legislated in 1992. Remember, that was immediately after the severe 1991 recession, so it’s laughable what Senator Hume and the Government are saying ‘now is not the time’…”

Graeme Russell, another longstanding super industry person, also retired this year from his role as chief executive of Media Super, replaced by former COO Tony Griffin as acting chief executive ahead of the merger, which is likely to be completed next February. Russell had been a trustee director of Just for 19 years and a trustee director of Media for two years before his seven-year stint as Media’s chief executive.

Noonan’s only remaining directorship is at ‘The New Daily’, an industry fund-owned daily newsletter which has about 500,000 subscribers. He has gradually been easing himself out of important roles such as chair of AIST and president of ACSI, as well as well as being a member of Innovation Australia, an advisory body to the Federal Government.

Before becoming news editor and then editor of the ‘Financial Review’, Noonan was the paper’s Melbourne-based industrial relations correspondent, dealing with both trade unions and industry bodies. In a change of pace, and after previously being sacked by Fairfax, he became ‘higher education editor’ of the Sydney Morning Herald. In 2008 he won a Walkley Award, the highest award for journalists across the media, for his outstanding contribution to journalism

His departure from the ‘Financial Review’ is worth a story in itself. Noonan was sacked by Conrad Black’s “dogsbody”, Michael Hoy, who had an ill-defined role as Fairfax ‘editorial director’. This followed a stand-up slanging match with Conrad Black in Black’s office a week earlier, when Black called him a “foaming-mouthed red-ragging communist” and Noonan called Black an “absentee landlord who had no idea what was in the Fairfax papers because he lived in London and spent his time toady-ing to Maggie Thatcher”. The row was over the publication of a report in the ‘Financial Review’ concerning Black’s media interests. Black, a Canadian who controlled the Telegraph Group in the UK, had taken a stake in Fairfax Media, the paper’s publisher, and became deputy chair.

The report referred to some upstreaming of profits and dividends from the Telegraph to Black’s private company Hollinger International. What became an important element in the story was the apparently innocuous statement that at least some of these were in turn upstreamed to a company called ‘Radler Corporation’. In 2007, Black was jailed in the US for fraud. The prosecution was able to use evidence against him from one David Radler, who did a plea bargain with the prosecutor after also being charged with fraud.

Perhaps in the hope of a quieter life, Noonan (age 69) has already started taking music lessons on a double bass and has for some time run a small vineyard at Sofala, west of Sydney, which has 800-1,000 vines growing shiraz grapes.

– G.B.