Opposition’s first-home buyer policy ‘not a super idea’

It was only one line in Opposition leader Peter Dutton’s (pictured) Budget reply speech, but it ensured that allowing younger Australians to dip into their superannuation savings to buy property will be a frontline issue at the election.

Dutton recommitted an incoming Coalition government to allow eligible first-home buyers to access up to $50,000 of their super for a home deposit “because it is better to get into a house sooner”.

The Coalition, which took this policy to the 2022 federal election, clearly aims to make home ownership an election issue. To quote Dutton from an earlier speech, the goal is to “restore the dream of home ownership”.

It’s a commitment that will encounter fierce resistance from the superannuation industry with the Super Members Council (SMC) – the peak body for the profit-to-member super funds – leading the charge.

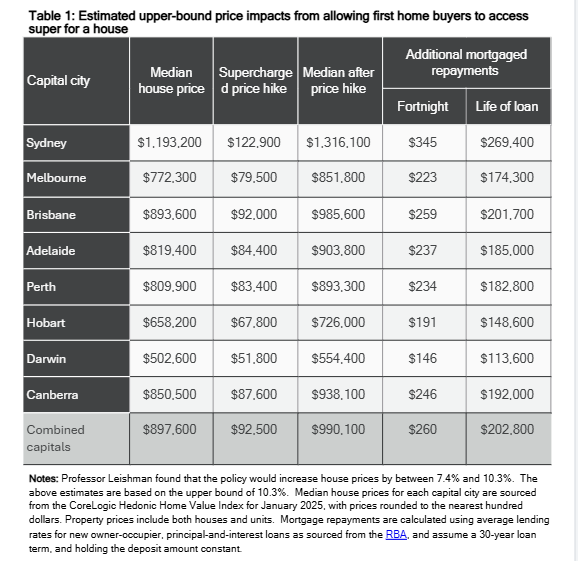

The SMC is urging the Coalition to jettison the policy, arguing that it will just pour more fuel on the fire of Australia’s housing affordability crisis, hiking prices by up to 10 per cent and pushing the dream of home ownership even further out of reach for everyday Australians.

“A vast body of expert evidence is crystal clear that early withdrawals of super for house deposits will just push up house prices further and faster – pricing more Australians out of owning their own home,” says SMC chief executive officer Misha Schubert.

“It will mean future home buyers will have to pay higher repayments on bigger mortgages for longer, worsening housing affordability and cost-of-living pressures on younger Australians.”

She says the international literature is clear, the lived experience in New Zealand is clear and detailed and rigorous econometric models are clear – taking super out for house deposits compounds, not solves, the issue.

A SMC-commissioned study by a leading housing economist, University of South Australia’s Chris Leishman, found the Coalition policy to allow first home buyers to withdraw super for house deposits could see house prices rise by up to 10.3 per cent.

The SMC also cited a report it commissioned from independent economist Saul Eslake who argued a long list of demand-side housing policies over several decades had simply made homes more expensive – and super for housing would be the worst of all.

In a comprehensive report published in 2024, he wrote: “Australia has had 60 years of (housing) history, which unambiguously tells us that allowing Australians to pay more for housing than they otherwise could leads to more expensive housing and not more homeowners.

“Of all the demand-fuelling housing policies, the Coalition’s super for housing policy would be the biggest – it can only lead to higher prices. If super for house was introduced, it would be one of the worst public policy decisions in the past six decades.”

Eslake wrote that the decline in home ownership rates could undermine a key assumption in Australia’s retirement system – that most retirees would own their own home – and noted the need to expand housing supply.

The peak accounting body, CPA Australia, also warns against allowing first home buyers to access $50,000 from their supe.

“This first home buyer measure will not resolve structural housing affordability issues,” says CPA Australia chief executive officer Chris Freeland. “This is more likely to worsen the problem than solve it.”

New South Wales Liberal Senator Andrew Bragg has been the driving force behind the policy initiative in opposition, arguing that by allowing young Australians to withdraw super it would improve their access to the housing market.

When he reiterated this policy in an address to the Sydney Institute in 2024, the Association of Superannuation Funds of Australia (ASFA) felt compelled to issue a press release stating this policy was being “erroneously sold as a silver bullet solution” to the housing crisis.

“After having this proposal soundly rejected at the last federal election, Senator Bragg has brought back the same policy that will leave young people behind and entrench inter generational inequality,” said ASFA chief executive officer Mary Delahunty.

She cited ASFA research that found allowing early access to superannuation for housing would not make home ownership more attainable for most aspiring first-home buyers and those with low superannuation balances.

“The analysis of more than 300,000 ATO superannuation records cross-referenced with capital city property prices showed the people it would help most are those who already have a larger super balance and income and are more likely to be able to afford a home.

“Australians can see clearly that this type of measure would likely push up house prices by increasing demand-side pressures on the housing market, putting home ownership even more out of reach for most aspiring first-home buyers.”