Retail superannuation funds are back in town

Retail super funds, which have $789 billion in funds under management and six million accounts, have posted their first year of positive net transfers in a decade, according to the Australian Prudential Regulation Authority (APRA).

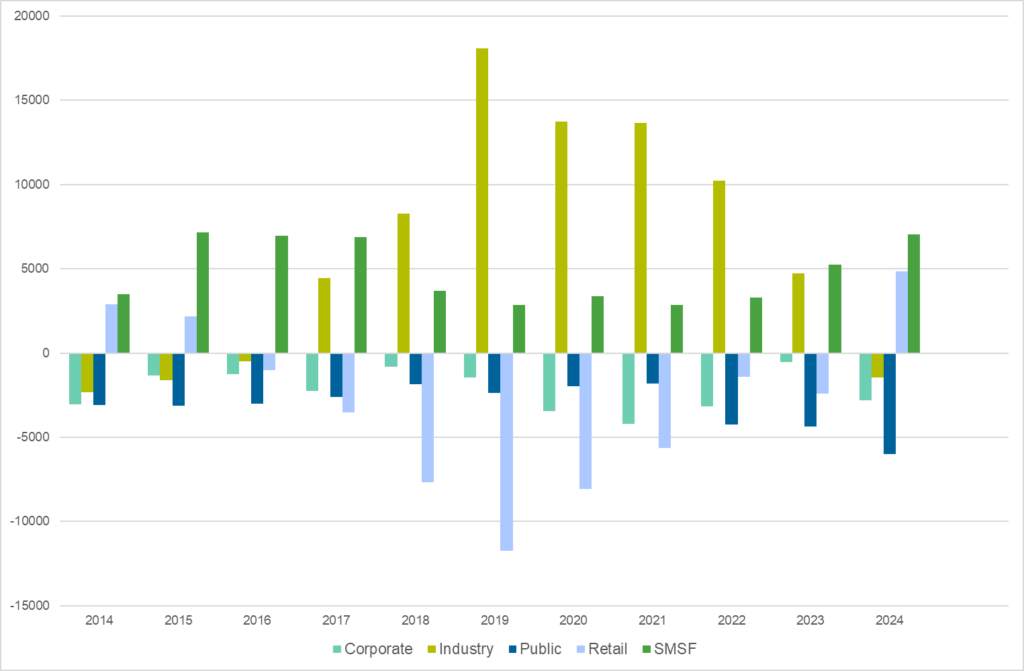

The funds have bounced back from an annual outflow of nearly $12 billion in 2019 – the direct consequence of the fallout from the damning findings of the Hayne Royal Commission (it was tabled in Parliament in February 2019) – to a $5 billion inflow last year, the analysis shows.

By contrast, industry funds, which have nearly $1.5 trillion in funds under management and more than 14 million accounts, posted net inflows of $18 billion in 2019 after emerging virtually unscathed from the Royal Commission, but outflows of around $1.4 billion last year.

In a $4.1 trillion superannuation industry, it’s only a pinprick. But industry experts say if it’s beginning of a trend, then it might suggest growing consumer complaints about industry funds’ lack of services, especially for members in or near retirement, are beginning to bite.

“The large (industry) super funds have not developed the full set of options for retirees – many are still a work in progress,” says Aaron Minney, head of retirement income research at Challenger, a listed investment manager.

“We’re back, baby,” says Ben Hillier (pictured), director of retirement for AMP, another listed financial services company, about the growth of retail funds.

Retail providers claim the turnaround has been triggered by record numbers of retiring baby boomers seeking cutting-edge retirement products, sophisticated administrative services and support such as help with advice to Centrelink benefits that help supplement income.

For example, more than 60 per cent of people aged 65 and over receive income support payments, predominantly the age pension.

The growing use of financial advisers for high-net-worth retirees has also boosted the use of investment platforms offering retail investment products, bulk trading, model portfolios and managed accounts.

Senior industry fund executives are downplaying the result, claiming the March and December quarters were net positive for its sector and that the net transfer differences are “quite small and insignificant” for the $4 trillion super sector.

They also claim average long-term risk-adjusted returns for industry fund member funds’ retirement phase products are consistently above those of retail funds “at all levels”.

But other industry experts warn that many major super funds are not ready for the accelerating transition from a predominantly accumulation, or investment phase, to retirement, when members draw-down their assets as income or a lump sum.

A record number of retiring baby boomers, the generation born between 1946 and 1954, is expected to peak in the middle of the 2020s and then slow through to the 2040s.

Nearly 700 people a day will be ending full-time work over the next ten years, which totals about 2.5 million, according to APRA, which monitors super funds.

David Bell, executive director of The Conexus Institute, a retirement thinktank, says: “The retirement phase will be more complex, may involve multiple product types, will need to be service-led, and is likely to be more personalised.”

Earlier this month AustralianSuper, the nation’s largest super fund with more than 3.3 million members, was sued by the Australian Securities and Investments Commission (ASIC) for death benefit delays in around 7,000 cases between 2019 and 2024.

“If operational systems are struggling to support accumulation, then we fear for the ability of many funds to service retirees,” says Bell.

Marie Briere, head of Amundi Investment Institute’s investors’ intelligence academic partnership, adds that its analysis shows “people don’t know how to allocate their assets for retirement”. (The institute is a division of Amundi, a French asset management company with more than $US3 trillion under management.)

Challenger’s Minney says: “A key driver of the switch to retail funds is the approach to retirement. People approaching retirement are using advisers to develop appropriate solutions, often using retail platforms to provide a range of choice that suits them.”