Shanghai’s Mingshi IM recruits for Australian office

Mingshi Investment Management, a staff-owned Shanghai-based China ‘A’ shares specialist, has opened an Australian office with the recruitment of experienced marketer Michael Negline.

Mingshi is unusual in several respects. It was founded by two academics, professors Yu Yuan and Robert Stambaugh, who met at the Wharton School at the University of Pennsylvania. It is a pioneer in quantitative investing among mainland Chinese firms. It is a pioneer and leader in the single-stock short-selling market. And, it has both onshore (mainland China) and offshore (Hong Kong and Cayman Islands) funds.

Negline said last week (June 23) that the firm had applied for an ASIC license and was hopeful to launch one or more Australian-domiciled funds in the near future.

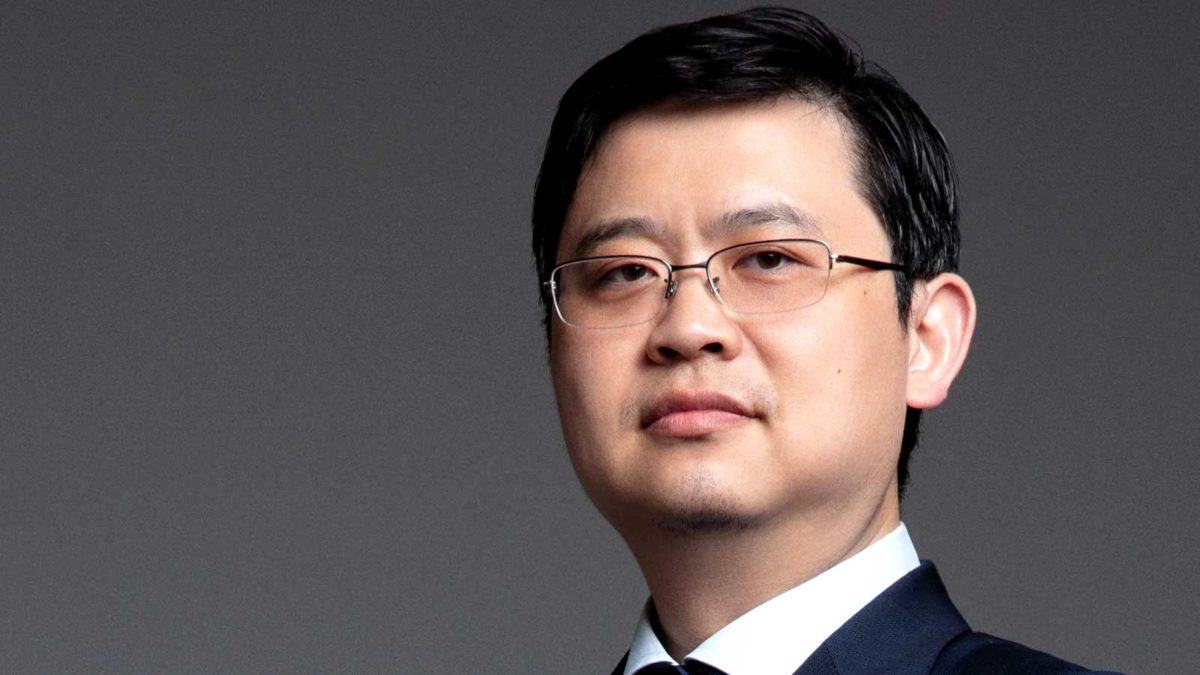

In an interview which included Lewis Prescott, the head of international business, and Stephan Zhou, the COO and CFO, both in Shanghai, Negline said the Mingshi flagship offshore funds, which were seeded by the firm’s partners, were likely to be at the forefront of the offering in Australia and New Zealand.

The Caymans-domiciled funds are a long-only and market-neutral strategies, both for China ‘A’ shares (trading on the Shanghai exchange). In a comprehensive range, they are the purest long-only and market-neutral representations of Mingshi’s core quantitative approach using investment signals and research.

Professor Yuan completed masters degrees in both economics and statistics in the US before obtaining his Masters in Finance at Wharton in 2007, followed by a PhD at the business school. He is head of strategy for Mingshi.

Professor Stambaugh, who was Professor Yuan’s adviser for his doctorate, is currently Miller Anderson & Sherrerd Professor of Finance at Wharton. He studied under renowned academic Eugene Fama for his doctorate and acts as chief adviser to Mingshi for research and business strategy.

They started the firm, which has about US$2.l billion (A$2.8 billion) under management and 115 staff, in 2010.

Prescott, an Australian, and Zhou, a Chinese national who is married to an Australian (currently in Sydney with their Australian daughter due to covid-19), were the main drivers behind the Australian expansion. The other offices are Hong Kong and New York.

Prescott, who is also a member of the investment committee of Mingshi, said that most international investors availed themselves of the Hong Kong-managed and regulated Caymans funds, which are administered by alternatives specialist Citco Fund Services.

He said Mingshi understood that the Australian market was not one where you looked to raise money quickly and the firm had a long-term business horizon for the region. Mingshi launched its offshore funds in 2019, through Hong Kong-based manager OP Investment Management, and started discussing the Australian initiative early in 2020.

Zhou described the opportunities in China ‘A’ shares as “exceptional”, with about 80 per cent of shares in the hands of retail or individual investors, an opportunity for institutional and other long-term investors which did not exist in any other major market.

“Everyone believes that the composition of the China market will change, and it will become more institutional,” he said. “We should be lucky enough to enjoy the retail [ownership] for another three to five years. Progress is rather slow. It’s gone from about 90 per cent 10 years ago to the low 80s now, but the trend is there.”

As an aside, Zhou observed that the high activity level of individual, new and younger investors evident during covid-19’s impact this year and last, especially in the US, meant that “the US market seems to be turning Chinese”. He added, however, that that would probably be only temporary.

Mingshi’s management and staff were “highly invested” in the firm’s funds, with a cap placed on their investment level according to length of service at the firm.