-

Sort By

-

Newest

-

Newest

-

Oldest

Riding the equity market rally and significant diversification in its alternatives portfolio has delivered Australian Retirement Trust a 10 per cent return as it keeps both eyes on the end of the rate cycle.

The collapse of a built-in bull market has put more pressure on asset managers according to a new report, which will need to make “transformational changes” to enjoy the profitability and growth of years past.

A BlackRock survey of institutional investors has found the growing appetite for private markets is dampened only by liquidity concerns. Meanwhile, its strategists warn that the efficacy of the classic 60/40 portfolio is waning.

Australian institutional investors are plotting increased allocations to alternatives and rethinking geopolitical risk, according to Nuveen.

Institutional investors love private equity but it’s bringing them down. They’re sweating everything from valuations to overcrowding and “private equity bubble risk”.

Asset owners haven’t been challenged with a sustained crisis in nearly 20 years, and it’s possible they’ll get one just as they make the jump into markets they’re unfamiliar with. Governance will be key. As inflation climbs and market volatility increases, Rich Nuzum, president of Mercer’s investments and retirements business, says that asset owners need…

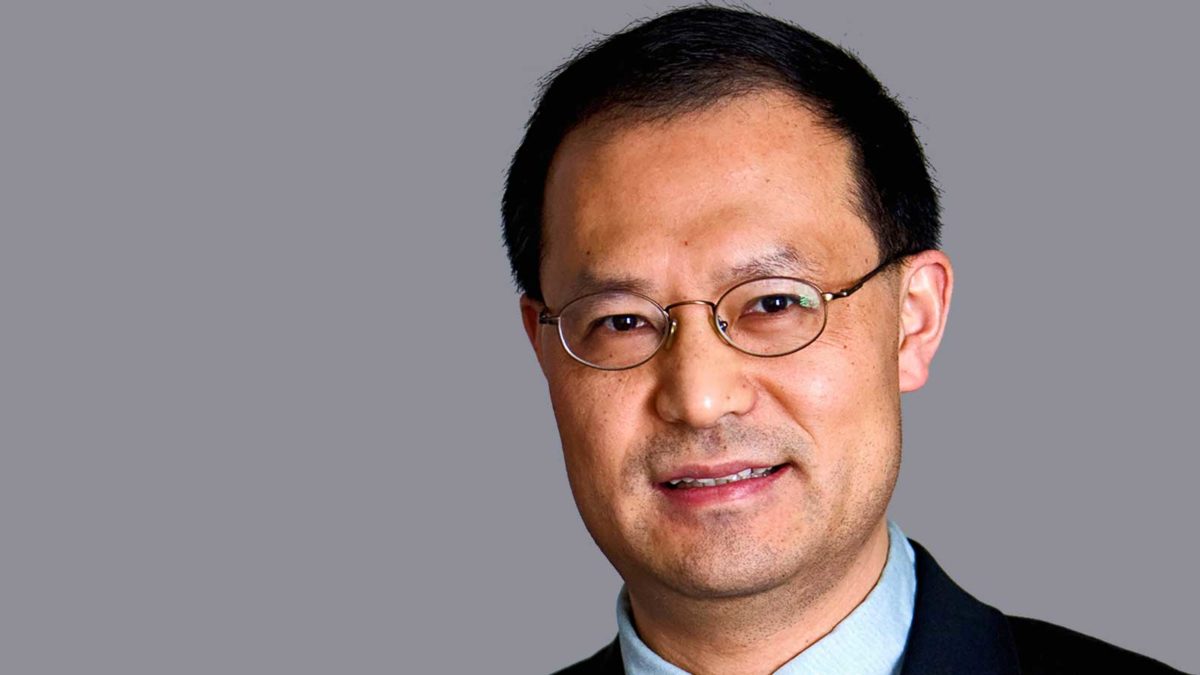

Uncertainty has returned to the market after a bumper 2020, fuelled by persistent inflation and a pandemic that never really went away. But in its latest alternatives outlook, JPMorgan warns that investors aren’t seeing the forest for the trees. “Up close, the “trees” in the 2022 outlook are clear,” writes Anton Pil, global head of…

Every cloud has a silver lining. Alternatives may benefit from both the trend to ESG strategies and the extra inflationary pressures which ensue, according to the mid-year outlook from Franklin Templeton. Two of Franklin Templeton’s affiliate managers, Clarion Partners and ClearBridge Investors, say in the outlook report that accelerating growth and reflationary environment will benefit…

Australia remains tiny on a world scale for alternative investments, with just 1-2 per cent of the global market, despite having consistently good performance, particularly among private equity players. This is the view of Mark O’Hare, the founder and chief executive of Preqin. Speaking to more than 450 investors and managers in Australia and New…