-

Sort By

-

Newest

-

Newest

-

Oldest

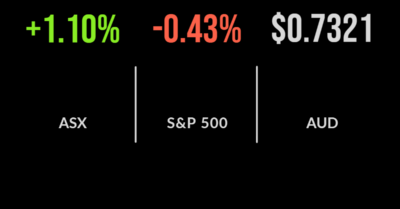

It was another strong day for the S&P/ASX200 (ASX: XJO) with the market looking through challenging headlines and volatility towards what will otherwise be a resurgent economy. The market finished 1.1 per cent higher with 6 of the eleven sectors gaining more than 2 per cent. Technology and property were the standouts, gaining 3.3 and 2.5 per…

The S&P/ASX200 (ASX: XJO) has delivered another positive day despite the incredibly negative backdrop with issues ranging from inflation to commodity price uncertainty and the Ukraine invasion. The market finished 1 per cent higher with the technology and communication sectors central to the performance, up 3.2 and 2.4 per cent respectively. The highlights of today were mainly…

The selling pressure continued on Wednesday with the S&P/ASX200 falling 0.8 per cent as uncertainty around the world continues to grow. Recent winners in energy and materials led the selloff down 3.6 and 3.3 per cent respectively with BHP (ASX: BHP) and Rio Tinto (ASX: RIO) among the hardest hit, falling 3.7 and 4.3 per cent. Among the strangest moves in recent…

The trends of the last two weeks look to set to accelerate for the rest of March with the S&P/ASX200 following the lead of US futures to fall another 1 per cent to open the week. As has been the case since the invasion of Ukraine began, the energy sector remains the biggest beneficiary gaining 5.3 per cent with Woodside (ASX:…

News that the Russian invasion of Ukraine had resulted in a fire at one of the country’s many nuclear reactors sent shockwaves through global markets, with Fukushima returning to front of mind. Shares in Paladin (ASX: PDN) bore the brunt, falling 14 per cent but trading as much as 25 per cent lower, as investors once again…

The Government bond market is now experiencing more volatility than the equity market, with the Australian 10-year yield increasing 10 basis points today, whilst the S&P/ASX200 gained 0.5 per cent once again. Just four of the 11 key sectors were lower, led by Consumer Staples, which fell 2.3 per cent, primarily due to Coles (ASX: COL) moving to ex-dividend and…

President Biden delivered his annual State of the Union address during the session, with strong commentary around Ukraine and targeted investment into domestic manufacturing capacity supporting US futures and ultimately pushing the S&P/ASX200 up another 0.3 per cent. Despite the positive day, seven of the 11 major sectors were down with cyclical companies in the property and the…

The Australian share market continued the post-invasion recovery, with the S&P/ASX200 gaining 0.7 per cent to begin the month of March; this comes after finishing February just 1.1 per cent higher. The technology sector was the biggest contributor with Block (ASX: SQ2) gaining 12.7 per cent, sending the sector 5.7 per cent higher despite a 6 per cent fall in…

Rumours that Russia and Ukraine were being encouraged to come to the table for peace discussions supported the market on Monday, with the S&P/ASX200 gaining 0.7 per cent. Mining, materials and energy remain the biggest contributors as the conflict raises questions around supply chains, with the former adding 3.0 per cent and the latter 1.4 per cent….

The Australian sharemarket followed a strong global lead, finishing 0.1 per cent higher taking the weekly loss to just 4.3 per cent despite the war in Ukraine. On Friday, it was the technology sector that outperformed, gaining over 8 per cent, almost entirely due to a 32 per cent surge in Afterpay’s new owner Block (ASX: SQ2) which was a…