ASX surges on energy weakness, travel sector bounces, Sydney cash delivered

It was another strong day for the S&P/ASX200 (ASX: XJO) with the market looking through challenging headlines and volatility towards what will otherwise be a resurgent economy.

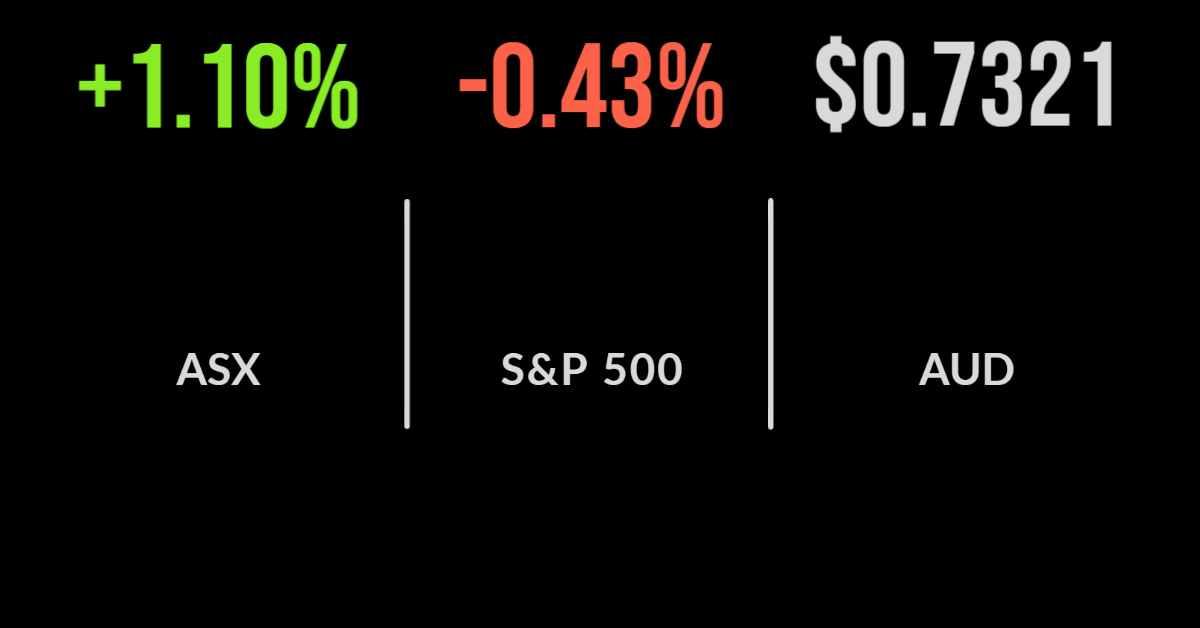

The market finished 1.1 per cent higher with 6 of the eleven sectors gaining more than 2 per cent.

Technology and property were the standouts, gaining 3.3 and 2.5 per cent, with the potential of a ceasefire buoying Unibail-Rodamco-Westfield (ASX: URW) by 5.8 per cent.

But all eyes were on the travel sector which is showing a significant correlation to the oil price, with Flight Centre (ASX: FLT), Webjet (ASX: WEB) and Qantas (ASX: QAN) among the top performers gaining 6.6, 5.8 and 5.8 per cent.

The detractors were the energy and materials sectors after the oil price tanked by 12 per cent overnight, with Woodside (ASX: WPL) falling 4.7 per cent.

Shares in investment platform Selfwealth (ASX: SWF) fell 4.9 per cent after restarting trading following a trading halt in which it denied a rumour about a takeover from Open Markets Group (OMG).

Worley, Rio pull out of Russia, Myer bounces on online sales, Fortescue poaches from RBA

Shares in Worley (ASX: WOR) overcame a broad energy market selloff to gain 1 per cent after the company announced they would be pulling out of Russia.

They provide engineering and related support to a number of projects and will not be signing any new deals.

Rio Tinto (ASX: RIO) fell 7.7 per cent after announcing similar intentions, which are complicated by their joint ownership of Queensland Alumina with Rusal.

Myer Holdings (ASX: MYR) is looking at a significant recovery with shares rallying 24 per cent despite the company reporting a 24 per cent fall in profit; the previous result benefitted from Job Keeper payments.

Sales increased 8.5 per cent in the prior year until January, with online sales growing 48 per cent and resulting in a net profit of $32 million.

Among the most interesting news was the announcement that Deputy Governor of the Reserve Bank, Guy Debelle, would be joining global iron ore and potential green energy giant Fortescue (ASX: FMG) as its new Chief Financial Officer after several decades at the central bank.

Markets weaker as no progress on ceasefire, inflation remains high, Amazon’s stock split

The three US benchmarks showed signs of resilience during the session, finishing off the day’s lows but still falling across the board.

The Nasdaq was off 1 per cent. The S&P500 0.4 and the Dow Jones 0.3 with the transportation sector a rare winner as companies like Union Pacific Railroads (NYSE: UNC) and engine maker Kirby Corp (NYSE: KEX) benefitted from another rally in the oil price.

No progress was made on a Ukraine-Russia ceasefire suggesting the invasion will continue for another week.

But all eyes were on inflation, which reported another 7.9 per cent annual increase, well ahead of last month’s 7.5 per cent increase and above expectations.

Even excluding fuel and food prices were 6.4 per cent higher, the worst in 40 years.

It remains difficult to identify how much of the broader price rises are also driven by higher fuel costs.

Shares in Amazon (NYSE: AMZN) gained more than 5 per cent after the company announced another US$10 billion buyback and a 20 for 1 stock split.

Cybersecurity firm Crowdstrike (NYSE: CRWD) gained more than 10 per cent after delivering strong quarterly sales results whilst Chinese e-commerce group JD.com fell 15 per cent despite reporting a 23 per cent increase in sales.