-

Sort By

-

Newest

-

Newest

-

Oldest

A number of industry funds have invested in Nuveen’s US Cities Workplace Strategy as they diversify away from traditional real estate and harness thematics related to changing work and life patterns.

Super funds are double-checking their marketing materials and coming to grips with an evolving regulatory regime as greenwashing risk looms large.

As the pace of superannuation consolidation slows, Cbus CEO Justin Arter will step down and the fund he’s run since 2020 will embark on a new growth plan.

Big super funds are getting even bigger. But as consolidation continues – and stapling kicks in – they’ve got a new problem that can’t easily be overcome: they’re more alike than different.

It’s not quite over, but the dislocation in equity markets and forced selling is leaving plenty of bargains on the floor. Super fund CIOs will be particularly glad for “the strongest tool in their kitbag”.

As homegrown competition intensifies and offshore players eye Australia’s retirement savings, the industry funds are now “frenemies”. Reinvigorating the collaborative model will be the key to their survival.

The last nine years of government have been characterised by a deep-seated suspicion of the country’s largest investors. But with Labor back in power, the super wars are almost certainly over.

Institutions have another reason to resist the siren song of cryptocurrencies, with new research from PGIM refuting many of the arguments in favour of holding the highly volatile asset class.

Big super seems to be experiencing an identity crisis. But former federal treasurer Wayne Swan has provided a unifying vision for Australia’s gargantuan pool of retirement savings. Former federal treasurer Wayne Swan’s speech at ASFA’s 2022 conference comes as super experiences something of an identity crisis. Executives are fretting over how to maintain their culture…

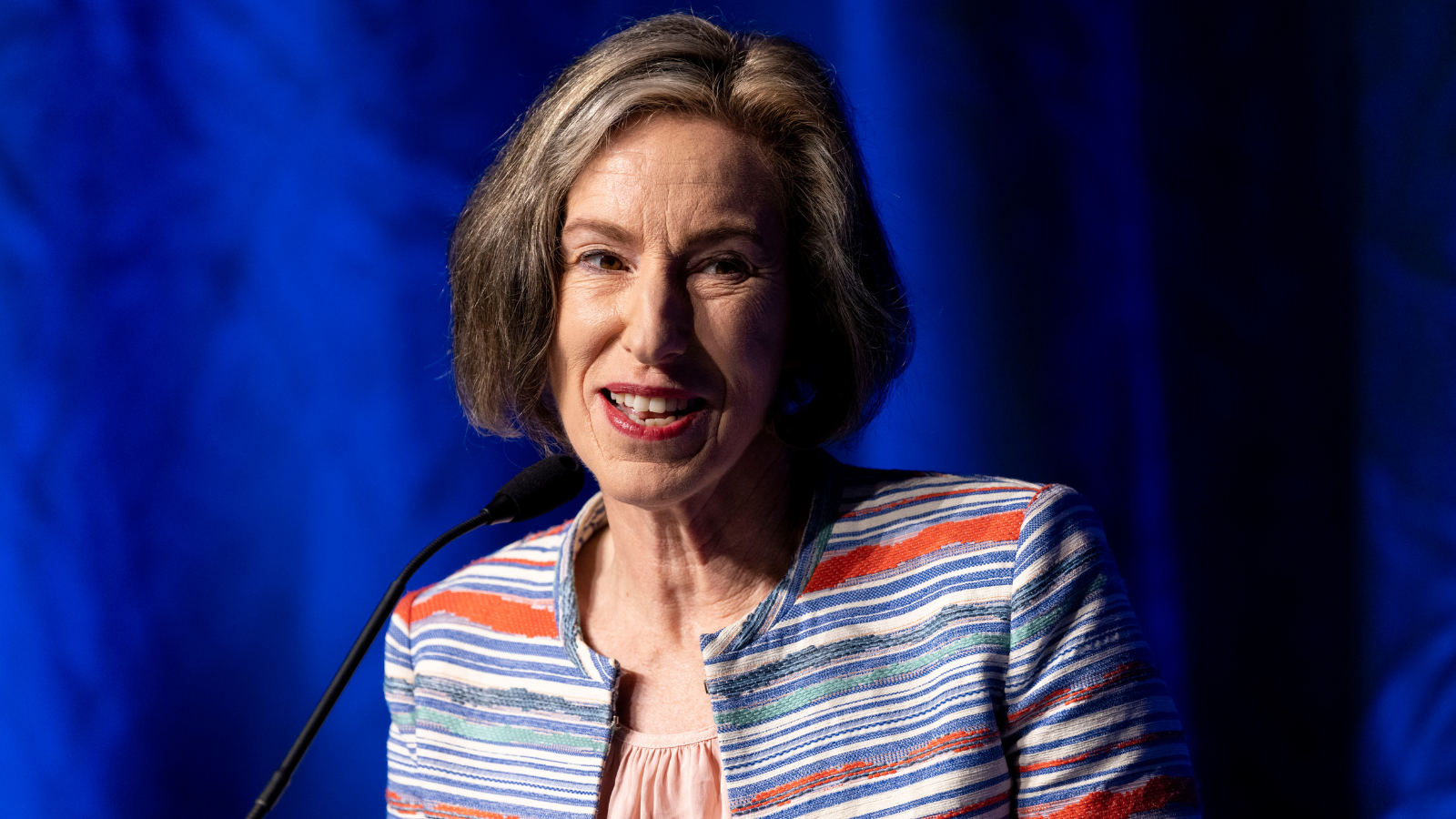

The Your Future, Your Super (YFYS) test is here to stay – but CIOs are still adapting to the idiosyncrasies of their new benchmarks. “The performance test gives you an additional target,” Anna Shelley, CIO of AMP, told the ASFA Conference on Wednesday (27 April). “And you can be the best archer in the world,…