-

Sort By

-

Newest

-

Newest

-

Oldest

The Australian market managed to finish the quarter 0.7 per cent high in price terms, but down just over 1 per cent on an accumulation basis. This was despite the market finishing near its lows on Thursday, down 0.2 per cent. The only positive contributions came from the rare earth and commodities sector with materials…

Markets are poised for more damage after a remarkable bull run, and Orbis Australia believes now is the time when contrarianism will prove its worth. “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness,” writes Charles Dickens in “A Tale…

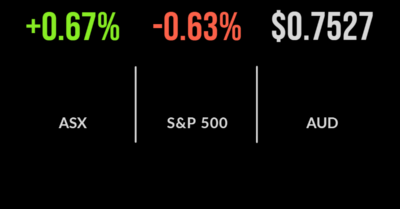

In what can only be described as a remarkable turnaround, the domestic sharemarket is closing in on breakeven for 2022, with the S&P/ASX200 gaining another 0.7 per cent on Wednesday. A positive lead from the US and signs of a ceasefire in Ukraine saw every sector barring energy and materials rally, with technology the standout,…

There was little in the way of positive news on Monday, with the market ultimately capitulated to a lack of direction, gaining just six points to start the week. Just four of the 11 sectors finished higher but among them were the markets two biggest, being materials and financials, which gained 1.3 and 0.6 per…

The Australian market remains resilient to the threat of higher energy prices with the S&P/ASX200 gaining another 0.3 per cent to finish the week. The result was driven by a rally in the energy, materials and utilities sectors, which gained 0.9, 1.3 and 1 per cent respectively. Investors are clearly flocking to perceived inflation hedges…

The local market managed to eke out another small gain on Thursday finishing 0.1 per cent higher powered by the utilities sector which gained 2.6 per cent. The sector is benefitting from growing demand for energy and improving gas prices with Origin (ASX: ORG) a major contributor gaining 3.0 per cent. The energy sector also…

The run of positive days continues to defy expert predictions of market chaos as bond yields increase, with the S&P/ASX200 gaining another 0.5 per cent despite another bump in the 10-year government bond yield. The technology sector tracked the gains of the Nasdaq adding 3.5 per cent as sector leader Block (ASX: SQ2) jumped 7.5…

It was another strong day for the local market with the S&P/ASX200 gaining 1.1 per cent primarily due to a strong global lead. The Chinese Hang Seng continued its strong recovery gaining close to 6 per cent in a single session, further boosting the domestic technology sector which gained 3.6 per cent. Industrials were next best up…

The tanking oil price has offered relief to the share market but will likely take some time to spread into the price of fuel, with the S&P/ASX200 gaining 1.1 per cent on Wednesday. The rally was widespread with every sector finishing higher but energy naturally the worst, gaining just 0.2 per cent. Hopes that interest rates will…

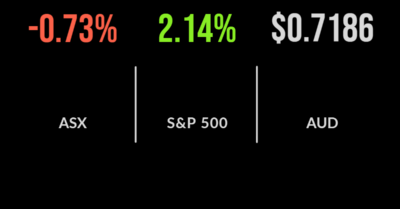

It was another difficult day for the domestic market with the Nasdaq entering a bear market and Chinese technology continuing to selloff putting further pressure on sentiment and the ASX’s position as a ‘risk on’ market. Ultimately the S&P/ASX200 fell another 0.7 per cent on Tuesday with energy and materials the biggest detractors, down 2.9 and 3.7…